There is a common perception in the investment world that active managers have an advantage over passive managers during times of increased volatility, since active managers can go on the defensive, whereas passive managers have strict mandates to mimic an index.

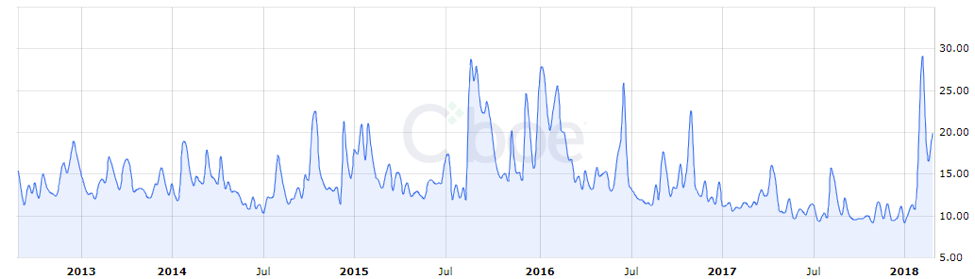

Until recently, we have had to go back to 2016 to test this notion, as volatility, measured by the CBOE VIX Index, has been muted over the past 18 months or so (figure 1). February finally provided us with a period of spiked volatility, which we can examine to see if active managers do indeed, capitalize during periods of volatility.

February marked the worst monthly decline in U.S. equities since 2016, resulting in a volatility spike, as the VIX eclipsed 15 on February 2, and averaged 22.5 for the entire month. According to EPFR Global, investors fled equities during the month, with ETFs absorbing most of the outflows, as investors pulled $20 billion out of ETFs and nearly $14 billion out of non-ETFs .

This spike in volatility provides us with a period to test the notion that active managers benefit during volatile times. Typically, one would rather look for trends over longer time periods, however, with the lack of market volatility, the month of February provides a decent litmus test.

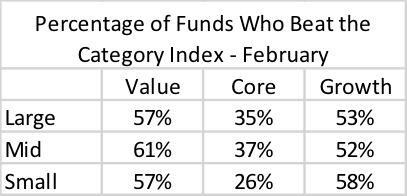

Figure 2 shows us the percentage of mutual funds that outperformed their respective category index during the month of February. As you can see, a high percentage of value funds, regardless of market-cap size, outperformed their category index. The story is different on the opposite side of the style spectrum, as the indexes for the three growth categories fared a little better, all ranking just outside the 50th percentile. Active managers with a “core” style fared worse, as only 26 percent of small-cap core managers outperformed the Russell 2000 Index. Large- and mid-cap core managers didn’t fare much better, as only 35 percent of large core funds and 37 percent of mid core funds outperformed their category benchmark.

Figure 2 - Source: Zephyr StyleADVISOR, Indexes: Russell 1000 Value (large value), Russell 1000 (large core), Russell 1000 Growth (large growth), Russell Midcap Value (mid value), Russell Midcap (mid core), Russell Midcap Growth (mid growth), Russell 2000 Value (small value), Russell 2000 (small core), Russell 2000 Growth (small growth).

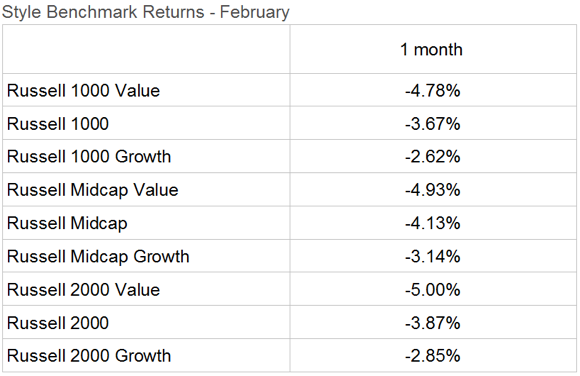

Looking at the performance of the different category indexes sheds some light on the above results. Figure 3 shows that the value indexes, regardless of where they fall on the market-cap spectrum, all underperformed the growth and core indexes by a wide margin. This underperformance may have contributed to the high number of value funds outperforming the benchmark.

Figure 3 - Source: Zephyr StyleADVISOR

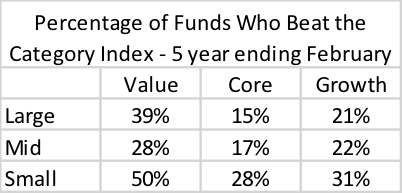

If we expand the time frame to five years, the commentary changes. The CBOE VIX five-year average of 14.48 was much lower compared to the month of February, providing an advantage to passive managers. Figure 4 illustrates that the pool of active managers who outperformed their respective category index during this five-year time period of muted volatility was much lower compared to February.

Figure 4 - Source: Zephyr StyleADVISOR - Indexes: Russell 1000 Value (large value), Russell 1000 (large core), Russell 1000 Growth (large growth), Russell Midcap Value (mid value), Russell Midcap (mid core), Russell Midcap Growth (mid growth), Russell 2000 Value (small value), Russell 2000 (small core), Russell 2000 Growth (small growth).

Despite the brief time period, the month of February confirmed the notion that increased volatility provides opportunities for active managers. Look for active managers to build off the momentum of 2017, which comparatively speaking, was a successful year compared to years prior, and capitalize on the heightened volatility and outperform.

Ryan Nauman is a vice president and market strategist with Informa Financial Intelligence.