A huge portion of the Biden administration’s trillion-dollar infrastructure proposal is dedicated to clean energy investments, including hundreds of billions specifically for accelerating clean energy and sustainability. If it passes Congress, the plan will be among the largest actions ever taken by the federal government to address the climate crisis.

This seismic shift has the potential to immediately and substantially reduce carbon emissions. It also carries the promise of a nationwide job boom, while significantly expanding the investment opportunity set for the impact investing community. In other words, socially responsible investors may very well have a unique opportunity to profitably shape the future of a greener economy.

Funding Immediate Carbon Reduction—a Long-Term and Near-Term Winner

As a candidate, President Joe Biden set an ambitious goal of national carbon neutrality by 2050—an objective which clearly informs much of the administration’s infrastructure proposal. In addition to the long-term investments being discussed in Washington, however, local lawmakers who want to make the 2050 target a reality are also prioritizing projects that provide an immediate reduction in carbon emissions.

Regardless of the success of the current infrastructure proposal, many state-level energy regulations already require utilities to use and develop lower and zero-emission generation solutions. As a result, there has been an explosion of opportunities to fund shovel-ready clean energy infrastructure projects in recent years, which we expect to continue.

As more states advance carbon regulations, including clean energy standards, transportation electrification and emission reduction mandates, the demand for sustainable infrastructure will continue its upward trajectory. For investors, these trends have converged to create an ideal moment to work with developers who have proven track records in reducing emissions and delivering state-of-the-art solar, wind, power storage and hybrid projects.

Broaden the Definition of Value

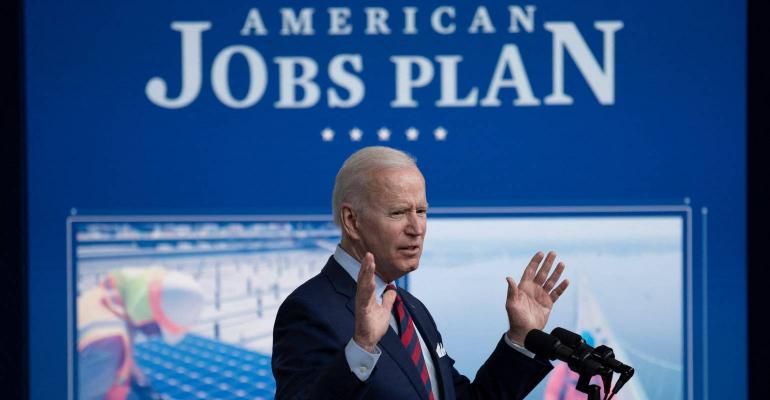

One benefit of the proposed infrastructure plan will be its tremendous impact on employment. In fact, the administration has dubbed it “The American Jobs” plan, and for good reason, especially from the perspective of clean energy infrastructure.

According to the U.S. Bureau of Labor Statistics, two of the country’s three fastest growing occupations are in the renewable energy industry. Both wind turbine technicians and solar photovoltaic installers have seen growth rates upwards of 50% over the past few years. With starting wages well above national averages, these positions can help reenergize local communities while expanding consumer access to safer, cheaper power generation.

Boosting employment and improving energy infrastructure has a direct impact on local budgets and municipal programs, as well. We have seen time and again that regions that welcome clean energy infrastructure reap short- and long-term financial benefits. For example, all but three counties in the state of Wyoming ran deficits last year; the three counties that welcomed wind generation projects saw budget surpluses.

Sustainable infrastructure investments can also help alleviate, or even prevent, crises like the power outages in Texas this winter and in California over the past several fire seasons. Along with the immeasurable human toll of the lives lost during these events, they also levy significant commercial costs. A Stanford University study estimated that economic activity decreased by $2.5 billion due to the public safety power shutoffs across Northern California in 2019. (Researchers have been unable to put a price tag on the complete economic impact of the winter storm in Texas.)

These risks can be mitigated by strategic investment in green energy today. And sustainability investors don’t need to sacrifice their bottom line to help seed critical next generation infrastructure. Standalone renewable power facilities that supply power to utilities and other offtakers—including communities, municipalities, and corporations—carry the potential to generate attractive built-in cash flow, and capitalize on tax incentives, while at the same time improving the world we leave for our children.

Investors Can Drive a Greener Future

The sustained growth we’ve seen in clean power generation and sustainable infrastructure projects across the country offers increasing potential to deliver both significant returns and nearly assured environmental benefits over the long-term. Investors that tap into this have the chance to drive a legacy of social and financial responsibility, without surrendering portfolio performance to accomplish it.

Over the past 10 years, clean energy has moved from a specialty ESG consideration to a mainstream multi-trillion-dollar sector with the potential to reshape our economy, and our world, for the better. Today, financial advisors and discerning investors have the power to support economic growth and environmental benefits that contribute profoundly to a sustainable future, while driving meaningful returns for client portfolios today.

David Sher is the Co-CEO of Greenbacker Capital, an owner and operator of sustainable infrastructure and energy efficiency projects.