By Jason Chalmers

In 2016, I wrote an article titled “The Odd Couple: Hedge Funds and the Taxable Investor,” the basic premise being that the after-tax returns on hedge funds make them a less-than-ideal choice for taxable investors.

That already-rocky relationship just got worse. The Tax Cuts and Jobs Act that went into effect on Jan. 1 delivers another setback for hedge funds as investors are now responsible for even more taxes. Rather than being able to deduct management fees and expenses, hedge fund investors are now taxed on a return that includes those fees—in essence, being taxed on income that was never even earned.

To illustrate, assume a hedge fund delivers a 10 percent net return to an investor in the highest tax bracket of a state that carries a top combined marginal rate of 50 percent. The fund generates 100 percent ordinary income tax (short-term capital gains) due to high investment turnover, and it charges a 2 percent management fee along with 1 percent for miscellaneous expenses. Prior to 2018, the investor could have received an after-tax return of 5 percent (50 percent of the 10 percent return).* However, under the new tax rules, the same investor will now be taxed on a 13 percent return that includes management and miscellaneous fees, translating to a 6.5 percent tax obligation. Subtract that from the initial 10 percent gain, and the individual walks away with a disappointing 3.5 percent return.

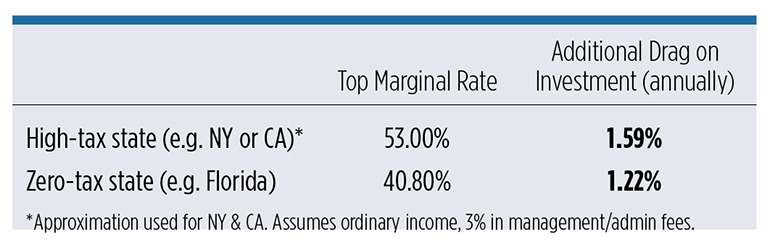

Basically, our investor is now being hit with an extra 1.5 percent of tax drag. While exacerbated in high-tax states, even investors in zero-tax states will still feel the pain (as depicted in the table below).

Particularly concerning 2018, K-1s will not be received until mid-year 2019, so investors may not become aware of the additional tax for over a year. Furthermore, many advisors have not fully digested the impact of the changes and are still operating under the old guidelines.

As advisors begin to understand the tax implications and look to offer solutions, there are potential strategies that can help minimize this unwanted tax burden.

Avoid funds that generate ordinary income tax. Try to find funds that produce long-term capital gains; this can cut the tax-drag by almost 50 percent.

Use tax-advantaged private placement wrappers (PPLI/PPVA) to help to defer/reduce capital gains and potentially eliminate the new tax on management and miscellaneous fees.**

The hedge fund industry has been embattled for several years now; perceived underperformance coupled with tax inefficiency has heightened negative sentiment within the investment community. This latest tax increase only worsens an already difficult situation. Fortunately, for savvy advisors able to identify the issue, there are strategies and structures available to help mitigate its effects.

*Assumes the full deduction of management fees and miscellaneous expenses.

** Individuals must meet the standards of accredited investor and qualified purchaser to invest in hedge funds, private placement life insurance (PPLI) and private placement variable annuities (PPVA).

Jason Chalmers is a director at Cohn Financial Group, a private placement life insurance distributor.