Take a look at the chart below. It illustrates the growth of a $10,000 investment in gold over the past three years. So, why are there three lines in the chart instead of just one? Because there’s more than one way to purchase gold. In America we typically buy gold in U.S. dollars; folks elsewhere don’t. On the Continent, euros are swapped for bullion. In Japan, yen is the medium of exchange. Whenever you buy gold, the gain or loss ultimately realized upon its sale is predicated on the metal’s shift in value relative to your purchase currency.

In the chart, the price of bullion (“GOLD”) is tracked very closely by the SPDR Gold Shares Trust (NYSE Arca: GLD), a favorite vehicle for U.S.-based investors seeking a liquid exposure to gold’s price movement. Here, GOLD is dollar-denominated, as is GLD. As you can see, long-term investors in either GOLD or GLD have had a rather unpleasant ride since 2014. Not so, however, for traders who bought the AdvisorShares Gartman Gold/Euro ETF (NYSE Arca: GEUR).

GEUR provides a mechanism for investors to hold gold in euros rather than dollars. It does so by selling euro currency futures or forward contracts as it buys gold futures. GEUR thus captures any buoyancy in the metal’s price while neutralizing dollar risk vis-à-vis the euro.

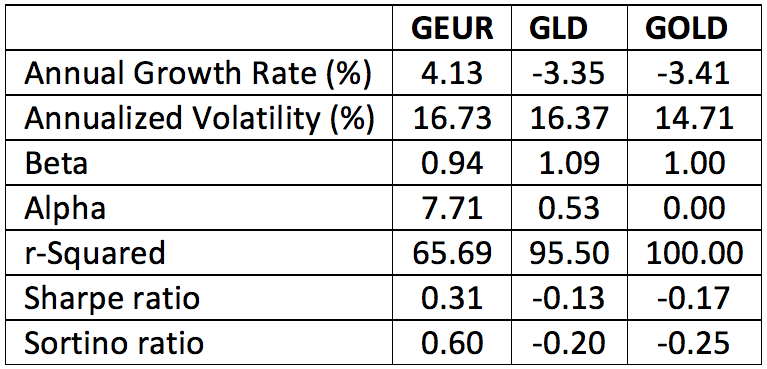

Holding gold in euros has certainly been a smarter way to capture gold’s traditional diversification benefit. Since 2014, GEUR’s appreciated at a compound annual rate of 4.1 percent. That doesn’t sound very exciting until you consider that GLD’s price has been simultaneously eroding at a 3.4 percent clip. GLD earns a -.15 correlation coefficient versus the broad stock market while GEUR clocked in with a -.26 figure.

GEUR’s February 2014 debut was well-timed. Since the ETF's launch, the wheels soon started coming of the euro, as you can see in the chart below. Good news for anyone short of the EU currency, especially GEUR holders.

Since its introduction, GEUR has capitalized more upon the weakness in the euro than in any inherent strength in gold. No matter, though. It’s been a winning approach. The numbers tell the tale: