The M&A Trends Set to Shape Wealth Management in 2021The M&A Trends Set to Shape Wealth Management in 2021

After a white-hot 2020, M&A experts believe we still haven’t reached a peak; many expect deal structures to evolve and new buyers to find the market in the coming months.

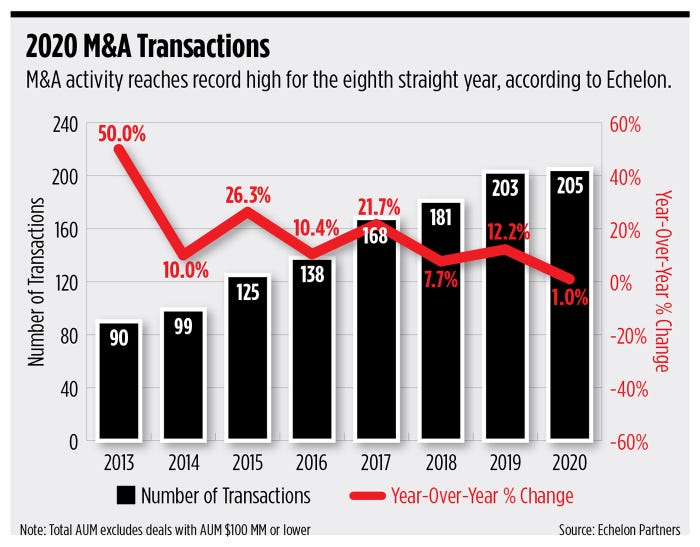

2020 was a record year for merger and acquisition activity in the wealth management industry, despite a significant slowdown in the second quarter driven by COVID-19, which caused many advisors to pause, delay, change directions or stop deals altogether.

But as the industry looks forward, experts point to several trends set to shape wealth management M&A this year, including the continued expansion of options for advisors looking to buy or sell, the rise of internal succession funding platforms, and an increased use of partial monetization strategies.

What transactions count as a deal differs slightly depending on which firm is doing the counting, but all agree that 2020 was a record. Echelon Partners recorded 205 transactions during the year, up from 203 in 2019, an eight-year record high. DeVoe & Company, another firm that reports M&A activity in the RIA space, counted 159 deals in 2020, up from 132 in 2019, the highest in seven years and four times the number of deals in 2014. Fidelity also said 2020 broke records set in 2019 for the most transactions among RIAs, at 130 deals, up 4%, and highest AUM volume, up 22% year over year.

Another Record Year Ahead

David DeVoe, founder and CEO of DeVoe & Company, said 2021 is currently on track to deliver another record year, at around 200 transactions. He’s not concerned that the M&A space is getting frothy.

“For a hyper-fragmented industry with 5,000 firms over a hundred million (in assets), a couple hundred transactions is reasonable,” DeVoe said. “It's even low for what we can expect given the dynamics in the market.”

That said, if M&A activity spikes another 30% to 40% year over year, that would be unhealthy, he said.

“As long as we have a steady climb up toward that point, I think we'll experience healthy M&A, but if we had a huge spike, let's say 2021 we went from 160 deals in 2020 to 320 deals in 2021, that I think starts to become a strain. Buyers are already working around the clock, they're working weekends. And to have that many more sellers come out in the marketplace in a short period of time, I think it could overtax the system.”

In particular, DeVoe expects us to see a surge in the sub–$1 billion deals, which took longer to get to market in 2020.

The fundamentals driving M&A activity are still there. Access to capital is at an all-time high with interest rates at historic lows. There’s a need to consolidate to stay competitive, keep up with compliance and technology developments, and build scale, said Carolyn Armitage, managing director at Echelon Partners. Many advisors also are getting older and in need of a succession plan, and have used COVID-19 as the catalyst to take action.

“We have this beautiful intersection of demographics of advisors needing a succession plan and of course, as they age, their clients are aging and they're in need of financial planning more than ever before,” Armitage said.

Jeremy Holly, LPL Financial senior vice president and head of Advisor Financial Solutions, said the broker/dealer is currently working on 100 deals within LPL. And while there was a lull in deals in the second quarter of last year, there was also a wave of innovation in the second half of the year, where buyers shifted a lot of the risk to the sellers and changed deal structures to get these transactions done.

Sellers were amenable to those changes, but now that there’s less uncertainty, deal structures are shifting back.

“The shift back to buyers taking on more risk has definitely occurred,” Holly said. “What it tells me is that the M&A deal model has got resiliency, and folks will find a way to get a deal done. And they have some levers they can pull when things like this happen.”

More Options

Experts agree that 2021 will bring more choices to advisors looking to buy or sell their practice, as more capital comes into the space.

Scott Slater, M&A specialist and Fidelity Institutional vice president of practice management and consulting, said the fundamental operating nature of RIAs is attractive to buyers, but buying more assets under management is not the only motivator.

“Over time, I think you’ll see some really interesting models," Slater said. "It’s not just about consolidating firms; it’s about building better enterprises that in the end should provide better solutions for clients of these wealth management firms.”

Slater expects to see many of the same well-prepared and well-capitalized buyers as we did this year, including the consolidators and aggregators, but also for new players to come onto the scene as well.

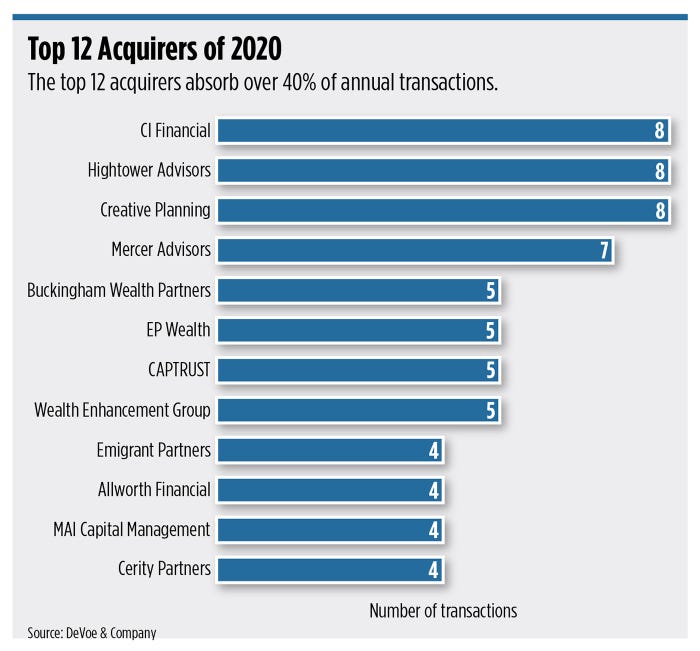

If you look at this year’s list of top acquirers (see table below), firms like Canada-based CI Financial and Creative Planning, Peter Mallouk’s RIA, are relatively new acquirers.

In November, former Cetera CEO Larry Roth launched Kingswood Acquisition Corp., a SPAC sponsored by the major shareholders in British wealth management firm Kingswood Group and a sister company to Kingswood U.S., with plans to use proceeds from the public markets to invest in U.S.-based RIAs and wealth management firms.

Another newcomer, TRIA Capital Partners, which provides minority financing to wealth management firms, recently announced its first investment, taking a minority stake in Modera Wealth Management, an RIA in Westwood, N.J. Modera recently merged with Independence Advisors, a Wayne, Pa,. RIA, creating a $4.4 billion firm.

Armitage said she’s never seen as many private equity firms interested in the industry as she does today. In 2008, prior to the economic crash, there were about 75 private equity firms investing in the space; today there are over 275 of them, according to Echelon.

And while most private equity firms—frequently the investors in many large RIA firms currently—seek an exit strategy in four to seven years, some position themselves as longer-term investors, with a nine- to 10-year hold, which is more tolerable for the seller, Armitage said. "They are thinking ‘Ten years—I’m not going to be here in 10 years, so that’s fine.’”

The Rise of Internal Succession Funding Platforms

Independent broker/dealers are bringing new options to firms, with several launching internal succession funding platforms to help their advisors do transactions. DeVoe expects the trend to continue.

In 2019, LPL Financial launched a deal execution platform to help advisors with all the pieces involved in a given deal and providing them a single point of contact on one platform. LPL will finance deals from its own balance sheet. The firm has shortened the time to complete deals from six to nine months to 60 to 90 days. Holly likens it to an investment bank for their advisors.

Last April, LaSalle St. Securities, a midsize independent b/d, corporate RIA and insurance business in Chicago, started providing loans with zero interest rates to help facilitate its advisors’ mergers and acquisitions.

And more recently, Commonwealth formalized a succession planning and M&A capability, doing internal valuations and providing templates for deal structures. The offering also includes a more stated packaging of financing options, whether that be lending capital, growth capital or some combination of the two.

“The motivation for them creating that is they want to retain those assets inside their organization, and I think they’ve always needed to create some sort of transition opportunity to make that happen and help their existing advisors have a liquidity event,” Slater said.

Partial Monetization

Another trend set to continue into this year is advisors selling minority stakes in their businesses. In fact, players such as Merchant Investment Management and TRIA specialize in taking partial stakes in RIAs.

LPL’s Holly said about 10% to 20% of the deals his firm does internally are partial sales. A lot of sellers want to continue to have the lion’s share of the cash flow and ownership stake, but they want to take some chips off the table and bring in somebody who has financial wherewithal.

Fidelity’s Slater said his firm started tracking these minority investments for the first time this year. There are a lot of generalist private equity firms looking for a way to have a stake in this market, and that’s one way for them to do so.

“From a seller’s standpoint, it’s also that they really want that partnership because maybe the investor they have brings a skillset and strength around M&A themselves, and the firm that’s selling wants to have an inorganic strategy,” Slater said. “And they need that help—somebody who can build source opportunities, help them structure them, provide the capital for it, and frankly just accelerate what they’re doing.”

Echelon’s Armitage also expects such partial monetization deals to accelerate; she agrees that this gives an RIA access to their strategic partner’s deal prowess, while maintaining control and their branding. And if the partner takes a stake of 20% or less, the advisor doesn’t need client approval to take it, and an investment that small doesn’t have to be made public.

“We do expect that there is a hidden market out there of at least three to four times more than what we're seeing because of the private firm nature of our industry,” she said.

About the Author

You May Also Like