For more than six years, retail investors have been lending money to strangers over the internet to consolidate credit card debt, pay medical bills and buy cars. Every year more lenders are saying “yes,” one click at a time. While this may seem more like internet gambling than investing, this version of crowd sourcing is actually more akin to what goes on inside Citicorp than Caesar’s Palace.

Peer-to-Peer lending has exploded thanks to the ease borrowers can connect with lenders online through the platforms facilitating these transactions. The two largest, Lending Club and Prosper, are on pace to originate over $2.5 billion in loans this year, compared to $870 million last year and $537 million as recently as 2011. Depending on the quality of the loans, net yields – that is after defaults - can range anywhere from 4% to 10%.

High profile investors have already placed bets with these platforms including Google. More recently, DST Global, an early investor in Facebook and Twitter, took a stake in Lending Club. Major investors in Prosper include Sequoia Capital and BlackRock.

How it works

To best understand Peer-to-Peer lending, it is helpful to understand what it’s not. It’s not “payday” lending or subprime lending. The average borrower has a credit score over 700, makes over $50,000 a year, owns a home and has been at the same job for more than five years. This degree of quality is due in part to the platforms’ own standards resulting in Lending Club and Prosper rejecting almost 90% of borrowers.

Once accepted, a borrower is assigned an interest rate based on credit risk, the loan is posted on the platform’s website, and lenders will either fund the loan or they won’t. Investors can choose to fund only lower risk, lower interest rate loans, or invest in loans perceived to be more risky with higher rates.

Interest rates typically range from less than 7% for lower risk loans to upwards of 24% for higher risk loans. According to Lending Club, the annual default rate averages about 3% per year for all loans originated. The default rate of all loans to maturity is higher given that their average maturity of about 3 years. As a result, the default rate of all loans through maturity is closer to 10%. But again, defaults vary with loan quality. In fact, the interest rates set by the platforms have proven to be good predictors of defaults.

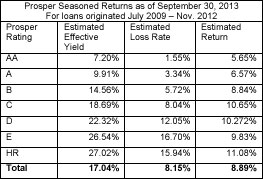

For example, Prosper calculates returns from outstanding loans by level of risk as follows. The net returns are returns after defaults and fees:

Welcomed disruption

When was the last time you went to a travel agency to purchase an airline ticket, or visited a record store to purchase music? Similarly, Peer-to-Peer is disrupting how consumer loans are funded. Borrowers are circumventing banks for personal loans and unlike other established industries that fought technology disruptors, banks are responding to this threat – by ignoring it. The personal loan has been a declining priority of the banking industry for years. Instead, credit cards are where the profits are. Rather than fund a debt consolidation loan, a bank is more likely to offer a new credit card.

Is capacity this new asset class’ Achilles heel?

Peer-to-Peer lending’s extraordinary growth has led some to question the remaining capacity in the space. Lenders sometimes complain that loan opportunities are snapped up too quickly as investor demand swamps supply. With institutional investors entering the space, skeptics wonder if there can be enough borrowers to soak up the funds investors will provide.

We believe the constraints are in the platforms, not in the addressable market. First, consider the $2.5 billion in Peer-to-Peer loans expected to be originated this year. Compare that figure to the Federal Reserve’s estimate of revolving (mostly credit card) debt outstanding of $894 billion. This comparison between Peer-to-Peer lending and credit card debt is meaningful. Credit card/debt consolidation loans accounted for nearly 80% of loans funded over the past six years. Certainly not all of that $894 billion will migrate to the Peer-to-Peer space. But average credit card debt is estimated to be around $5,000 per borrower, and 34% of cardholders made only the minimum payment at least once in 2013. Given these figures, we would not be surprised if the market for debt consolidation alone is in its infancy.

Second, there are other attractive peer-to-peer markets. Small business peer-to-peer loans are growing rapidly with potential major players like OnDeck and Funding Circle. Other new peer-to-peer markets include student loans and real estate. Internationally peer-to-peer lending is growing rapidly with platforms launched in the U.K., Germany, Spain, China, New Zealand and Australia.

Increasing institutional interest

Until recently, retail investors had the Peer-to-Peer asset class to themselves. Increasingly, however, advisors are allocating client funds to the space. Now almost 50% of loans are funded through institutional investors.

There are many challenges facing portfolio managers who manage funds in this new asset class. First, they must have proven technology that can analyze and invest in loans in milliseconds. The speed of this evaluation process often determines an investor’s ability to capitalize on coveted investment opportunities. Second, they must have the infrastructure and internal policies in place to ensure the effective application of the investment process. Through proper management of loan loss reserves, capital management and tax efficiencies, investors could potentially achieve returns in the high single digits or even low double digits.

Our own view is that adequate diversification and careful loan selection can reduce risk and enhance returns. The Ranger Specialty Income Strategy uses a proprietary artificial intelligence algorithm that has been used for almost four years in the peer-to-peer market to maximize the spread between interest rates and default rates in order to generate what the algorithms deem to be the highest possible ROI. This technology, combined with a credit committee and portfolio manager that monitor internal loan performance dashboards, seeks to achieve some of the best returns in the industry.

With above average yields, short durations, monthly distributions and returns uncorrelated with either equities or Treasuries, we expect opportunities for advisors to invest in this new asset class will continue to increase. The keys to healthy growth in the space include continued successful operation of the existing platforms and the emergence of new platforms with the ability to cater to institutional investors.

About Bill Kassul

Mr. Kassul serves as a Principal and Partner of Ranger Alternative Management II, LP (“Ranger”) and focuses on marketing and business development. Mr. Kassul continues to serve as President of Traders Marketing, LLC, a position he has held since 2010. Traders Marketing is a Dallas based marketing firm which caters to the financial services industry. From 2005 to 2010, Mr. Kassul became the Vice President of Marketing and Sales of Wizetrade, the #1 selling stock trading software platform at that time.