By Yasmin Zarabi

Facebook Live can be great for businesses. It’s easy video content to stay top of mind and demonstrate subject matter expertise to clients and prospects. But, it also can expose financial services companies to risk.

If you haven’t seen it in your news feed, Facebook Live is a video streaming feature that lets anyone broadcast live videos for up to four hours. As is the case with any new social media feature, financial services firms should provide guidance on the proper use of Facebook Live, including the type of content that is allowed and disallowed on live videos.

Regulations for Live Video

If Facebook Live is analogized to a public appearance (for example, a scripted business presentation for prospective retail investors), then under FINRA’s communications with the public Rule 2210(f), the firm the representative is associated with is responsible for approving the video’s content prior to recording. Additionally, if the content touches on mutual funds, that potentially raises additional disclosures and filing requirements with FINRA.

In the absence of FINRA stating affirmatively that a video streaming live on Facebook is a public appearance, the other consideration under FINRA Rule 2210 is that it is an interactive electronic forum post. In this case, advisors can post a live video that has non-financial content, like commentary about the Super Bowl or an invitation to a seminar, without needing pre-approval from the firm’s principal.

In addition, advisors can post a live video with general market commentary or economic discussions that neither promotes any of the firm’s products or services, nor makes any financial or investment recommendation without pre-approval from the firm’s principal.

Firms should review the video after it is published (also known as “post-review”) and archive it as part of their business communications recordkeeping.

How to Treat Real-time Viewer Responses

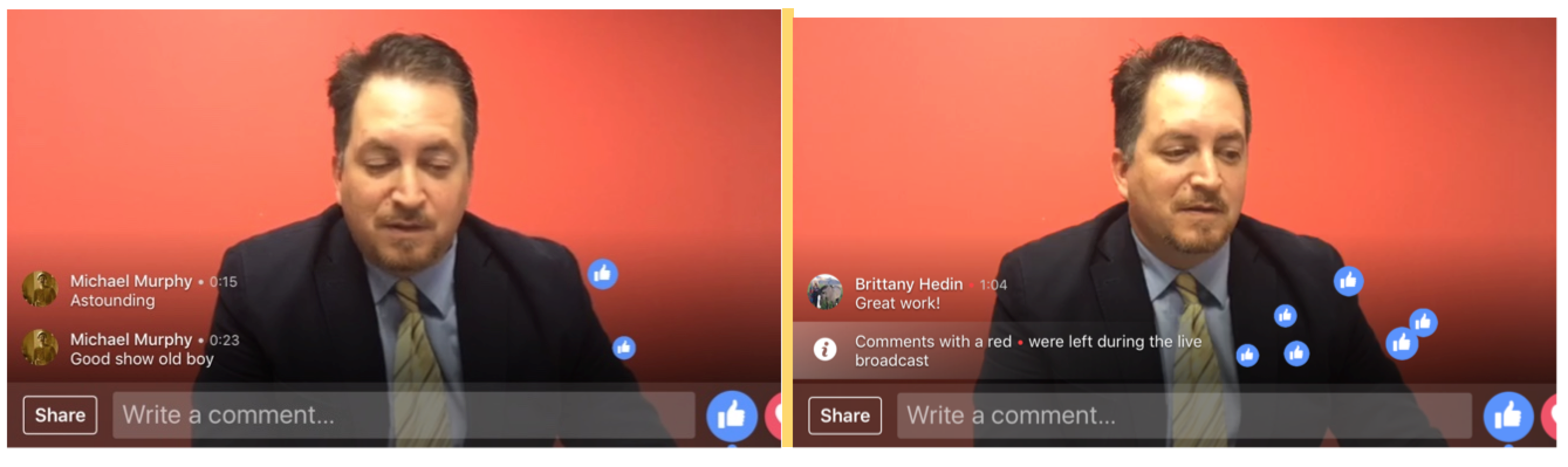

An attractive feature of Facebook Live videos is that they encourage viewers to engage with the content by commenting, liking or posting emojis. This interaction also helps the video ranking in others' news feeds. The publisher can interact with viewers by speaking directly to them in the video and/or by responding to comments personally or through a team member.

These interactions could become problematic for financial advisors depending on the context of the content. For example, if the commentary is specific to products or services, then a client’s comments, likes, or emojis may be interpreted as an indication of a client's experience with the firm and construed as a testimonial.

However, engagement with content that is clearly not related to business (e.g., an advisor’s live streaming of a Fourth of July celebration) will not be construed as part of a client’s experience with the firm.

How to Protect Your Firm and Your Advisors

Our recommendation is that your firm’s social media policy limits the Facebook Live functionality to non-financial services-related content and provides clear guidelines on how advisors should handle and respond to comments.

Moreover, financial services firms should consider how advisors might be watching and engaging with live videos produced by their clients or other third parties. Because a "like" by an advisor could be construed as an endorsement of a product, person or service, companies should revise their policies to ensure advisors are not engaging or commenting on third parties’ business-related live videos in violation of regulations.

It’s also important to remember that a firm’s exposure doesn’t end when live streaming stops. After a video is streamed live on Facebook, it remains attached to the page as a video file so that others can watch or re-watch it. Like any form of digital communication, firms should make sure they have technology in place to capture and archive videos that are published with Facebook Live.

Financial services firms should update social media policies to include a description of how and when it is appropriate for regulated employees to use Facebook Live as representatives of the company. The policy should include what content is appropriate for this channel, and how companies will treat engagement with the videos. Employees should be adequately trained on the policy updates and how to handle this new medium. Finally, it’s imperative to keep a record of all live videos through appropriate archive channels for regulatory compliance.

Yasmin Zarabi is vice president of legal and compliance at Hearsay.