Advisors who choose to build client portfolios know the process can be resource intensive. Building client portfolios can cost advisors a lot of time and money. Advisors can either select assets on their own, devoting many hours to research and analysis, or pay astronomical fees to access expert research and analysis. Even if they rely on expert insight, using that information to build and maintain client portfolios can still be a time-intensive process.

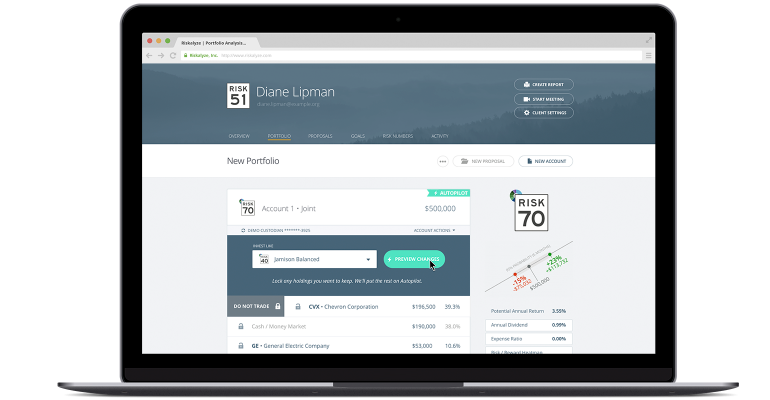

California-based fintech company Riskalyze created the Autopilot Partner Store to provide advisors with low-cost access to investment research and a fast, easy way to implement it. Advisors who use Autopilot gain access to a suite of carefully crafted portfolio models. Advisors can subscribe to various models, using them as-is or modifying them according to specific needs. "With Autopilot, we put a lot of valuable intellectual property at advisors' fingertips," says Riskalyze CEO Aaron Klein.

The speed at which advisors can select and alter models distinguishes Autopilot from its competitors, says Klein. For example, consider an advisor who subscribes to a model and over time applies it to 300 different accounts from multiple brokerage firms. When a Riskalyze asset manager updates that model, the advisor gets an alert and can implement the updates to all 300 accounts with a single click.

With Autopilot, advisors also have the option to customize models at any time. For example, if they want to tilt a model toward fixed income or emerging markets, they can make adjustments accordingly.

"It's clear that advisors want flexibility, freedom and control to make great decisions for their clients," says Klein. Autopilot helps advisors achieve this goal by giving them access to top-of-class research and freeing up their time so that they can focus on other aspects of their jobs, he says. "We're democratizing access to advice and empowering advisors to serve more clients."