Finny and the Great AdvisorTech AccelerationFinny and the Great AdvisorTech Acceleration

Our columnist sees the future of wealthtech in a small band of young entrepreneurs solving the “lead generation” problem.

Victoria Toli, one of the three co-founders of Finny, describes her startup as “Hinge for financial advisors,” drawing a parallel to the popular dating app. The comparison makes sense in a few ways. Yes, Finny helps with the age-old goal of matching advisors to likely prospects but boosts the speed and success rate with a ruthless efficiency enabled by algorithms, data and personalization.

It’s at the forefront of a movement I’m calling the "Great AdvisorTech Acceleration,” meaning the rapid introduction of new tools for advisors powered by the widespread adoption of artificial intelligence, the growing availability of large datasets, and a new generation of young, innovative engineers who have mastered the art of synthesizing these elements into practical solutions.

Launched in February, Finny has already made an impact, securing revenue-generating business from real financial advisors. A participant in the prestigious Y Combinator startup incubator, Finny recently clinched the top prize at Morningstar’s annual fintech competition.

Morningstar CEO Kunal Kapoor said he was impressed with what Toli and her co-founder, Eden Ovadia, have brought to the wealth management ecosystem. “Eden and Victoria are working on an innovative solution for advisors, and I’m excited to see what the future holds for this impressive team,” he said when I asked him about the startup.

The team raised an undisclosed pre-seed funding round in February, backed by Y Combinator and Crossbeam Venture Partners, and launched what startup types refer to as a “minimum viable product” in May. Five firms participated in a paid pilot program. The founders say within a month, the waitlist grew to 30 firms and now exceeds 70.

The idea for the prospect-discovery tool was born out of Ovadia’s experience at the Boston Consulting Group, where a research project confirmed what advisors already know: The conversion rate from cold outreach was dismal. The group found a conversion rate of less than 1% after an average of 56 hours spent on data collection from platforms like LinkedIn and ZoomInfo and subsequent messaging campaigns.

The Finny team believes they can automate the process by identifying and prioritizing prospects—from a universe of 270 million individuals in the datasets available—within a target niche using thousands of data points per lead, prioritized on the likelihood of converting to an individual advisor.

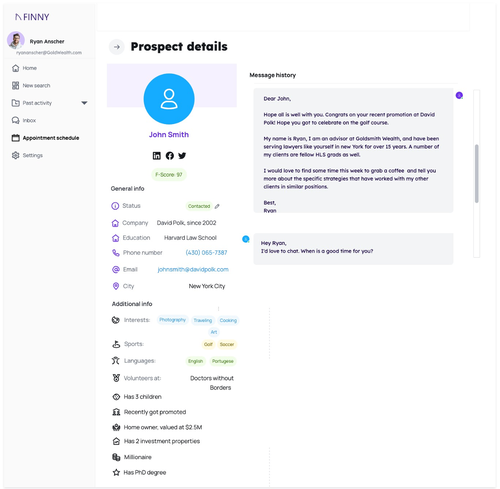

The prioritization score (what the team calls the “F Score”) is unique to each lead and advisor pairing. In other words, a likely prospect for one advisor may not be likely at all for another, based on the advisors’ own data profile and ideal client persona. The platform even automates outreach and scheduling meetings, significantly reducing the workload for advisors.

Toli, a Stanford engineering graduate who joined Finny after four years as a fellow at Kleiner Perkins and two as a growth product manager at Uber, said the key to Finny's rapid development lies in its ability to use open-source code to customize large language models. This allows the small, five-person team to achieve in weeks what would have taken larger teams in the past months or even years to build.

The startup’s CTO and third co-founder, Theodore Janson, developed Finny’s F-Score matching engine and algorithms from scratch. He says the tool is akin to Netflix’s predictive content model, which surfaces likely matches to viewers based on their profiles. Janson, who studied electrical engineering and math at McGill University and holds a master’s degree in artificial intelligence from Ecole Polytechnique in Paris, says the F-Score accuracy continuously improves as it feeds data into the large language model driving the outreach process.

“Ours is an agent that does the work for the advisor and is always running in the background,” said Toli.

Prospect/client details in the Finny interface.

Janson said the discovery and lead-generation process is a bit of a black box to the advisor, who will never be able to fully know the underlying formula behind the proprietary matching algorithm.

The two advisors using the platform provided by Finny that I spoke to do not particularly care about how it works, just that it works. They like that it places warm leads on their calendars without them having to do anything beyond initially providing a detailed description of their firm and their “ideal client” parameters.

Richard Will, a wealth manager and partner at Jackson, Wyoming-based Catalytic Wealth Management (the wealth management arm of venture capital firm General Catalyst, backer of firms like Stripe, Airbnb, HubSpot and Datalogix), said being at a VC firm gives him a front-row seat to many overhyped ambitions of AI startups. However, with Finny, while it may be a challenge to scale the model, he loves what the application is doing for his firm.

For instance, when he goes to a particular city and looks for prospects between 30 and 50 who are either founders or in the C-suite of a biotech firm and from there, identifies, say, an interest in lacrosse, “my goal with it is always to get a meeting or two out of it.”

“It helps me find people that are in the sweet spot and if not the client, then the country clubs where they will be—15 to 20% of the people I hit up are calling me back up,” he said.

“I just connected with a big real estate developer that was based on an email I drafted from a Finny recommendation,” he said. “When I’m searching for a biotech founder or a crypto founder … I’ll change the email a little bit, but it gets the ball down the field,” he said, “and frankly, I’m using Finny because I want to understand the technology.”

Firms pay $500 per month per advisor, plus a one-time success fee equal to 25% of the annual fee from the Finny-sourced client.

Will said he was a Finny fan but questions how the “success fees” will work out with the larger world of advisors. Other lead generation tools have tried charging success fees over the years with mixed results. He said the Finny team is open to feedback.

“I’m on a call with either Eden or Victoria once a week,” he said, with questions or requests for what he would like to see added in the future.

Alex Goldstein, an advisor on the corporate executive services team at Chesapeake Asset Management with previous stints at UBS and Merrill Lynch, praised Finny’s ability to generate high-quality leads at a fraction of the cost of traditional tools like ZoomInfo.

“When I started in the business, I was in the training program at Merrill and it was just straight cold-calling, offering them tax-managed strategies,” he said. Later, he found success using LinkedIn for prospecting. At Chesapeake, he said he could reach out to anyone and has, in turn, grown adept at using CoPilot AI and Salesflow. He heard about Finny from a friend after the startup had been accepted into Y-Combinator.

Goldstein said while the startup is still in its early days, it reminded him a lot of ZoomInfo, but without the cost.

“They use AI to better tailor your search. For example, instead of just targeting execs at Nvidia or Oracle or Snowflake, I target firms that are seeing growth or add political party or religion to the search criteria,” he said. He also likes the outreach Finny automates.

“Meetings just appear on your calendar. It links up via Calendly with the exact people I want to target,” he said, adding that he is paying for the service himself but also questioned the long-term viability of the success fee.

Among the many prospecting and lead generation tools I’ve written about, Finny reminds me most of Aidentified in terms of its methodology, the massive datasets it has access to, and its use of artificial intelligence.

While I call out Finny as a prime example of the new “Great AdvisorTech Acceleration” because it is a small team rapidly developing technology and magnifying its power in short order, I began seeing this trend a year ago without really realizing it.

Startups like SIFA, now named AdvisoryAI, and Jump are examples in the advisory communications space, while the small team at Portrait Analytics has been building an AI-based hedge fund junior analyst.

There are several others I’ve met with and from whom I’ve received demos over the last couple of months that I have yet to write about—these fall into yet other categories that advisors are likely to find helpful.

It is unclear how they will all fit into the fabric of the current advisor tech ecosystem, but the landscape will look very different in the months, and especially years, ahead.

About the Author

You May Also Like