Investors today increasingly are demanding digital engagement. “The rise of robo-advisors has really forced the hand for financial advisors to maintain a strong tech presence,” says Michael Wilson, President and CEO of AdvisoryWorld, a software developer for financial advisors. “If advisors don’t have a front-end solution that meets client demand for technology, investors might choose an online solution instead.”

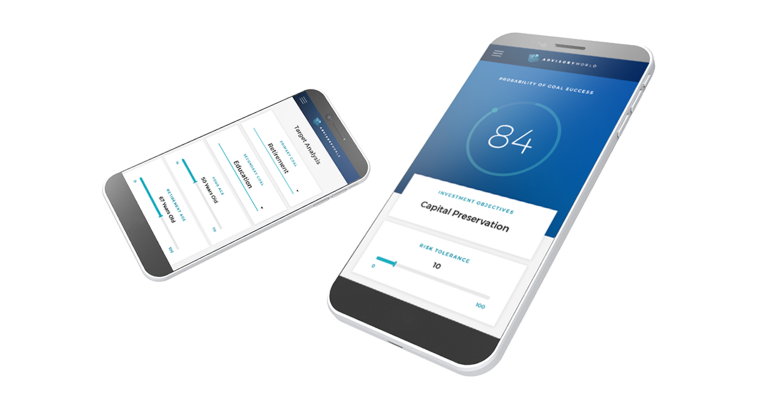

To help advisors meet the evolving appetites of investors, AdvisoryWorld created ACQUIRE, lead generation software that advisors can embed directly in their websites and social media accounts. When investors visit these sites, they fill out a configurable questionnaire and enter information about themselves including their appetite for risk and their goals.

ACQUIRE then immediately suggests an advisor’s model asset allocation which satisfies both risk and goals based objectives. The software allows the advisor to showcase their financial planning, risk management and portfolio construction offering.

At this point, investors can choose to share their information with the advisor or open an investment account directly. Even if they choose to forgo reaching out to the advisor and open an account themselves, that account is still opened under the advisor’s book of business.

ACQUIRE serves as a lead generation tool for advisors and can be integrated with a firm’s CRM such as Redtail. With the information entered by the prospective client, Wilson says, advisors can then share their personal know-how effectively combatting robo-advice. “It’s a really nice conduit between investors and advisors. Advisors can share their expertise, such as suggesting personalized portfolio allocations and adjusting financial goals to match various changes in lifestyle; two of many things that robos simply don’t have in their arsenal,” Wilson says.

As a pioneer in the financial technology space, AdvisoryWorld prides itself on delivering tools to help financial professionals remain competitive. “As the market’s eye has moved towards interactive, investor-facing experiences , we’re able to provide a scalable solution which allows advisors to beat robo-advisors at their own game,” says Wilson.