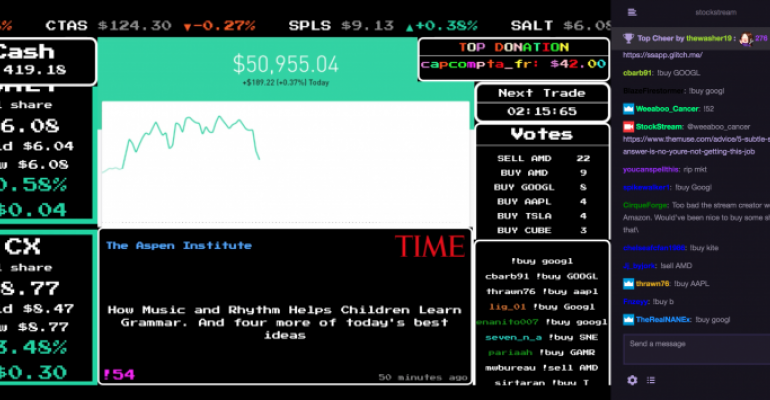

People are now comfortable with algorithms managing their money, but what about the collective intelligence of thousands of internet strangers? That’s what Mike Roberts, a 26-year-old software engineer for Amazon, is trying to figure out with StockStream, a game broadcast on Twitch that lets anonymous people vote on how Roberts should invest his personal $50,000 brokerage account. Roberts coded the game himself; every five minutes it takes votes (which literally anyone can cast) and either buys or sells a stock. Everything happens automatically using the online brokerage, Robinhood. After its first week and hundreds of thousands of votes, including some trolls intentionally trying to derail the project, Roberts’ account added more than $700 in value, the Wall Street Journal reported.

More Companies Are Considering Financial Wellness Programs

More companies are considering including financial wellness programs in their benefits packages to encourage higher utilization of employer-sponsored savings and investment programs and productivity gains from a reduction of financial-related stress. Out of companies surveyed, only 38 percent already offer financial wellness education (compared to more than 90 percent that offered a 401(K) program). But 14 percent of companies are considering financial wellness programs, according to a recent Charles Schwab white paper.

Umpqua Bank Hires Wealth Management Chief

Portland, Ore.-based Umpqua Bank has named Kent Grubaugh head of its wealth management division, Bank Investment Consultant reports. Grubaugh, who comes from City National Bank, will be in charge of overseeing and expanding Umpqua's private banking and investment management services to high-net-worth clients, professional services firms and nonprofits. He follows Kelly Jonson, who set up Umpqua's wealth management division in 2009 and left in 2014 after the acquisition of Sterling Financial. Umpqua has 350 locations in Idaho, Washington, Oregon, California and Northern Nevada.