CI Financial to Acquire $23B Segall Bryant & HamillCI Financial to Acquire $23B Segall Bryant & Hamill

CI's deal to acquire Segall Bryant & Hamill, a Chicago-based investment and wealth manager, would be its largest yet.

Canadian-based asset and wealth manager CI Financial announced plans Monday to acquire a majority stake in Chicago-based Segall Bryant & Hamill, an investment and wealth management firm with $23 billion in assets under management, representing CI’s largest deal yet.

The acquisition is CI Financial’s 14th deal since January 2020, bringing its total U.S.-based assets to $46 billion and North American assets to $82 billion.

“Acquiring Segall Bryant & Hamill is a major step forward as we continue our U.S. expansion,” CI Financial CEO Kurt MacAlpine said in a statement. “SBH has built an incredible business and formed a committed team that embodies the characteristics we look for in our acquisitions. SBH has also displayed a proven ability to adapt to changing market dynamics to deliver a consistently superior level of client service and investment performance through deep fundamental research. I am pleased to announce that the SBH team will remain intact and be a key driver of CI’s growth in the U.S.”

In addition to SBH’s wealth management business, it also has an institutional investment management business, including traditional and alternative investments.

Terms of the deal, expected to close in the second quarter, were not disclosed.

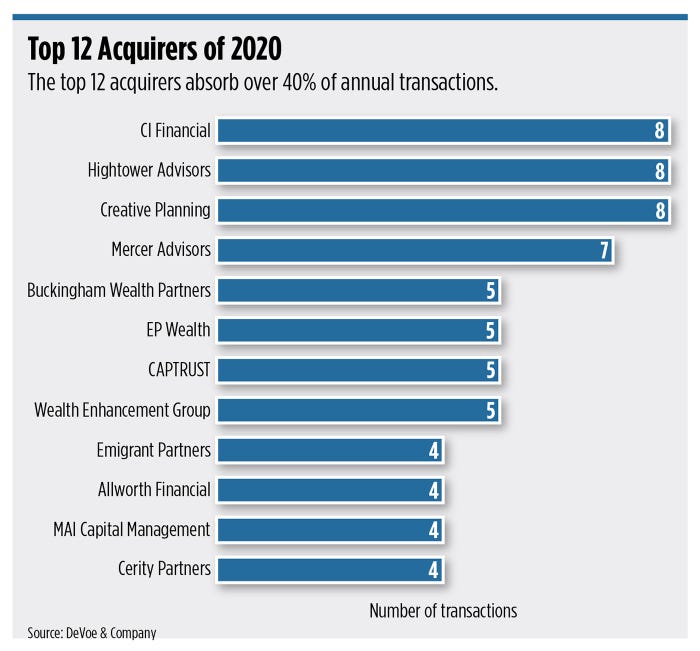

CI Financial is using the U.S. RIA market to carry out its plans to globalize. According to Echelon Partners, CI Financial was the most active strategic acquirer in the RIA space in 2020, having completed nine transactions during the year.

“When I joined, we had no business in the U.S., really no investors in the U.S.,” MacAlpine said in a recent interview with WealthManagement.com. “So by entering the U.S. and expanding south of the border, we had zero brand recognition. I think if you fast forward from the first day to today, we’re not a household brand yet, but I would say we’ve become a household name in the RIA industry. I think we’re expanding our brand in the asset management industry.”

In November 2020, CI began trading on the New York Stock Exchange under the ticker CIXX. The firm issued its first bond in the U.S. in December of last year.

“We have more debt investors in the U.S. than in Canada,” MacAlpine said. “A pretty quick pivot; we’ve gone from Canadian only to balanced across Canada and the US.”