An advocacy organization for independent broker/dealers warned against legislation poised to limit the independent contractor status of many financial advisors after President Joe Biden urged Congress to move on the bill during his first State of the Union address.

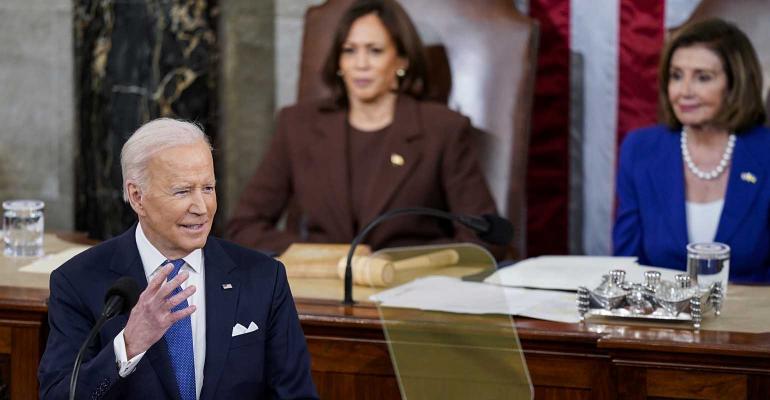

In a speech that touched on Russia’s invasion of Ukraine, the pressures of inflation and the ongoing impact of the COVID-19 pandemic, Biden briefly mentioned support for the Protecting the Right to Organize (PRO) Act, which advocates say would boost protections for workers and allow employees to freely form unions, should they choose.

“And let’s pass the PRO Act,” Biden said during the address to Congress on Tuesday. “When a majority of workers want to form a union, they shouldn’t be stopped.”

The Financial Services Institute, which lobbies Congress on behalf of the broker/dealer industry, fired back in a statement by CEO and President Dale Brown, criticizing the PRO Act’s potential impact on advisors in the IBD channel, many who work as independent contractors. Brown said many members voluntarily switched from an employee advisor position in order to gain more autonomy in their business.

“The PRO Act, as it is currently written, threatens to revoke that choice,” he said. “We call on lawmakers and the administration to recognize the unique nature of the independent financial services model and preserve advisors’ independent contractor classification in the PRO Act and all other worker classification rules.”

The PRO Act originally was passed in the U.S. House of Representatives in early 2020 but has since stalled in the U.S. Senate, and it might be even more difficult to pass in the year ahead due to this fall’s midterm congressional elections. To determine an independent contractor status of an employee, the PRO Act would use the “ABC” factor test employed in similar legislation in California—though that rule included a carveout for financial advisors.

According to the test, a worker was an employee unless they were “free from control and direction with the performance of the service, both under the contract for the performance of service and in fact,” that the service “was performed outside the usual course of business of the employer” and that the worker was “customarily engaged in an independent established trade, occupation, profession or business of the same nature as that involved in the service performed.”

While the act hasn’t moved in the Senate, there was still a possibility it could be coupled with other bills, according to David Bellaire, an executive vice president and general counsel for FSI.

“What we’ve always been concerned about is that some form of must-pass legislation would be moving, and the PRO Act or parts of the PRO Act would be attached to it, making it very difficult to stop the bill from becoming law,” he said. “So we’ve remained very engaged with Capitol Hill on the issue.”

These questions are not solely being asked by legislators; last year, the Department of Labor withdrew a rule announced during the final weeks of the Trump administration that, among other impacts, would have solidified the independent contractor status for IBD advisors.

The DOL argued the rule was inconsistent with the Fair Labor Standards Act, with Labor Secretary Marty Walsh saying employees often lose “important wage and related protections” if an employer classifies them as independent contractors. Critics of the rule also argued gig and contract workers would have a harder time advocating for minimum wage earnings and overtime protections if it was enacted, according to The Washington Post. In response, the FSI joined plaintiffs in a lawsuit filed in Texas federal court claiming the DOL’s withdrawal violated federal law.

To be sure, the outlook for the bill remains uncertain, and passing contentious legislation can be even more remote during a year including midterm congressional elections, which are coming this fall. But Bellaire believed there was broad understanding that FSI members had left employee-based models because they wanted to run their own businesses as they saw fit.

“There’s a lot of sweat equity built into these businesses that independent financial advisors don’t want to lose,” he said. “They understand what they traded away in terms of employee benefits, but they value their independence more."