The Department of Labor (DOL) released its second of three planned collections of frequently asked questions regarding the forthcoming fiduciary rule, which is scheduled to go into effect on April 10.

While the first batch was directed more at financial services impacted by the rule, covering compliance dates and details around the Best Interest Contract Exemption, the second FAQ is directed more towards retirement investors and the rights and protections they receive under the law.

The FAQ defines terms that most advisors already know, like “conflict of interest,” and “fiduciary.”

“This includes advisers who are paid directly by you or paid indirectly through commissions or other payments they may receive from third parties,” the FAQ states. “As fiduciaries, they must protect their customers from harmful conflicts of interest.”

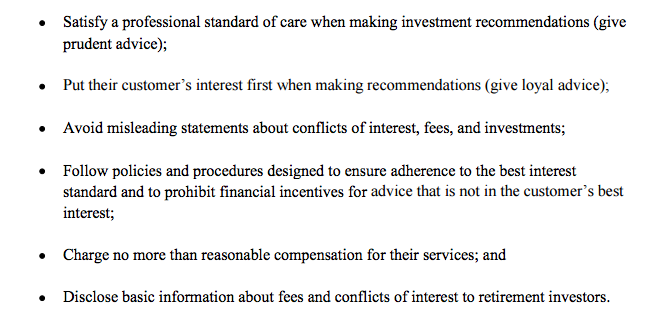

The DOL also notes six requirements that it calls “basic standards of fair dealing and fiduciary contract” that will become law.

The FAQ covers plenty of background information on why it adopted the fiduciary rule, how it changes the financial services industry (including new compensation practices and client disclosures), which advisors are covered by the rule and which loopholes are being closed. The DOL also distinguished between fiduciary recommendations and general investment education, that advisors don’t have to always find the absolute best product for every client, and that advisors aren’t automatically liable if a client’s retirement account loses money.

“Sound investments can lose money. Prudent and loyal advisors can make recommendations that don’t pan out through no fault of their own. … If the investment was prudent and based on your interests at the time of the recommendation, the advisor is not liable merely because it now appears, with the benefit of hindsight, that the investment did not turn out as well as other investments might have turned out.”

The DOL also disputes claims made by detractors of the fiduciary rule such as clients being forced to pay an asset-based fee for advice, executing orders will be more expensive for brokers, or that the rule will restrict access to advice or the type of investments they can hold in an IRA.