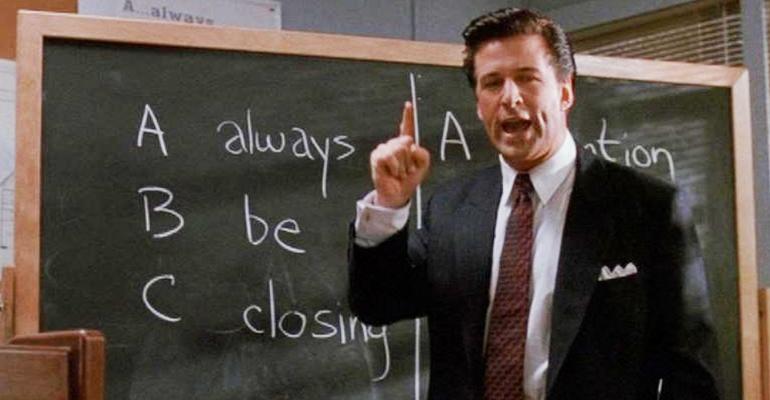

In Alec Baldwin’s cameo appearance in "Glengarry Glen Ross," he addresses an office full of New York City real estate salesmen with this message: “We’re having a little sales contest this week. First prize, a Cadillac Seville. Second prize, a set of steak knives. Third prize, you’re fired!” The scene is a classic. And it’s most likely tainted an entire generation’s perception of the sales profession.

His F-bomb-laced ABC ("Always be closing") rant, followed by dangling the carrot of “leads,” created a level of intensity that continued throughout the movie. If you’ve yet to see it—treat yourself. I’ve seen it more times than I can recall. That said, many thanks to Alec for reinforcing the negative associations with the process of acquiring leads.

Today’s world is a more enlightened era, or at least we should hope so. Millennials aren’t afraid of salespeople, and many have opted for a career in sales. They are also acutely aware of social media’s role in the overall sales process. They use it as consumers, and those in a sales career embrace it as a marketing tool. One of the many benefits these early adopters have tapped into is lead generation.

So let’s leave "Glengarry Glen Ross" and segue into today’s reality. What are leads? Are they really for losers? Here’s a working definition of “lead generation” as defined by social media gorilla Facebook: “Lead generation is the process of building interest in a business’s products or services. On Facebook, you can create campaigns using a lead-generation objective that allows consumers to fill out a form with their contact information.”

Obviously, this definition is promoting Facebook ads, but that aside, it provides a good characterization of the realities of lead generation. As social media has quickly become mainstream in our society, it is becoming the new frontier for marketing campaigns. Financial advisors, especially younger, growth-oriented early adopters, have ventured into this new frontier. They understand the possibilities, and they’re getting results.

However, it’s important to have realistic expectations regarding the possibilities. A prime example is obvious: “Interest in a business’s products or services” doesn’t necessarily equate to “qualified prospect.” And in the heat of a social media marketing campaign, the obvious is easy for an advisor to overlook. You know the problem of "I’m doing all of this work, and hardly any of these leads qualify!"

Welcome to the real world of lead generation and sales. Unlike word-of-mouth-influence, which is the major force behind affluent prospects initially meeting and ultimately hiring a financial advisor, social media lead generation is a digital version of a direct-mail campaign. The more niched your target audience, the higher the probability of a qualified prospect.

Unlike direct-marketing campaigns of the past, Facebook has the data that will enable you to actually target your niche market. The more niched your target audience, the higher the probability of a qualified prospect. The more interesting and useful your offering (giveaway to collect contact information) to a specific niche, the more qualified leads you will collect. However, you do need to know Facebook’s Power Editor to get this specific. Advantage: big data!

Herein lies your next set of challenges. First, you have to get face to face with each qualified lead. Next, it’s essential that you make a strong first impression regarding your professionalism and competency. This is no different than an affluent prospect being personally introduced to you by one of your clients. Regardless of how you get face to face, if you pique any interest, a Google search is likely. Which means your digital brand is extremely important.

So for each qualified lead, you have to make an old-fashioned telephone call. It’s important to make this call as soon as you get the lead’s contact information. Your conversation will dictate your next move—with the goal always to secure a meeting. Sales is a numbers game, and you won’t be able to schedule meetings with every call. However, you'll still want to stay in contact through variations of content marketing; newsletter, research reports, questionnaires, etc. And, if you're allowed, continue dripping on them for six months. At that point, you’ve earned the right to give them another call.