Sponsored by Covisum

Tax Day is rapidly approaching, and it’s no secret that CPAs are dealing with packed schedules. Many Americans are unsure of how to navigate the new tax legislation and what impact the changes will have on them. People are inundating CPAs with questions. But most CPAs make their living off businesses and business owners with complex and time-consuming concerns, not middle-income retirees calling with questions.

Financial advisors can capitalize on this era of new tax laws by forming mutually beneficial relationships with CPAs.

CPAs can add value to your practice, both by providing tax advice and by referring clients who need financial plans. When you work together, you both can add to your books of business. Use our free CPA introduction letter template to forge the relationships that will result in better retirement plans for your clients. Show the CPA how referring their clients to you will benefit them and how you will make their work easier.

The upcoming deadline to file taxes is also a good excuse to touch base with your clients. Use this opportunity and consider scheduling annual reviews for your clients who are still working. You can use Tax Clarity® to identify opportunities where IRA contributions can be used to reduce their amount of taxable capital gains. Here’s an example:

Case Study: Max and Erika Mustermann

Your clients, Max and Erika Mustermann, are a married couple filing jointly; Max is 68 years old and Erika is 66 years old. Erika is still working part time. They have $65,000 in IRA withdrawals, $15,000 of work income, and $50,000 of realized capital gain.

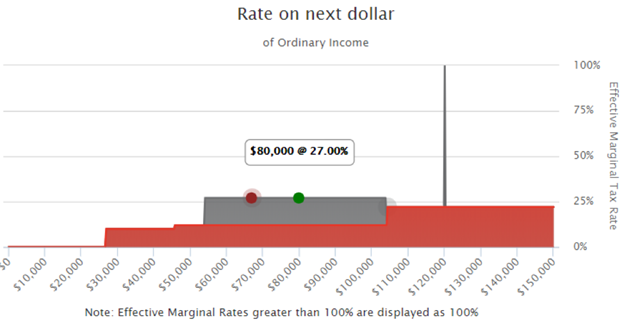

After entering the information into Tax Clarity, this Tax Map is displayed.

The gray section on top of the red section highlights an interaction. In this case, it is between ordinary income and capital gains. So, if you take an extra dollar of the $80,000 of ordinary income out of the Mustermann’s IRA, they’re actually going to lose 27 cents to federal income tax. That extra dollar of IRA income will be taxed at a 12% rate, and it also creates 15 cents of tax on a capital gain dollar that would’ve otherwise fallen into the zero percent tax bracket.

In other words, if a client has long-term capital gains that are not entirely taxable, you have an opportunity to double dip with an IRA contribution. Since the Mustermanns are between 65 and 70 years old, there is an opportunity for both of them, even though only one is working. Therefore, when you make a $13,000 IRA contribution, you’re not just saving the 12%.

To talk taxes with clients, you don’t have to know all of the complicated interactions between different tax provisions and different types of income. Use the software to showcase your value as a financial advisor and carefully plan your clients' retirement income, manage withdrawals, and minimize income taxes while gaining insight into unseen opportunity to add dollars to a retirement plan.

Subscribe to Tax Clarity and identify other sub-optimal situations to help you show your clients how to make retirement decisions in the most tax-efficient way, prior to April 15.

Covisum® creates software, like Tax Clarity, to visually illustrate the value of a good decision. Advisors can quickly recognize and identify opportunities to save their clients from leaving significant money on the table and offer help to the CPA with the less-complicated questions, freeing up their time when resources are stretched thin.

Looking for more? When you subscribe to Tax Clarity software, you also get marketing materials, like a white paper that explains the financial advisor’s role giving tax-efficient retirement strategies and a client-facing seminar and brochure. Grow your business. Use Covisum tools and resources to help you.