We get asked “what would you say” type questions every day. Advisors find themselves in perplexing situations and want our thoughts on how to respond. It’s tough when you are put on the spot. It’s not easy to sound confident when your skeptic is across the table reading into your every stutter, stammer, and eye twitch. It’s much easier to reflect on a past situation and craft a perfect response, and be prepared the next time this situation arises.

We’d like to discuss a common (and eerily similar) question for both new and veteran advisors, and provide you with some responses you can put to use (and practice) immediately. Enjoy!

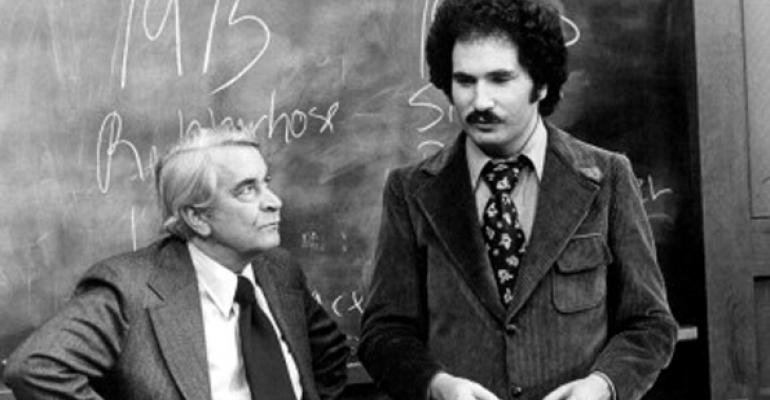

A Question for the Rookie: How long have you been an advisor?

Reason for Question: Your prospect is uneasy with your youth and perceived inexperience. When responding to such a question, it’s important that you do not get defensive. After all, this is a very legitimate concern. Your objective is to first validate your prospect and then redirect their focus by leveraging your firm, prior experience, or team. Your response should be succinct and exude confidence.

Potential Response:

“It might appear as though I am newer to the business; however, I spent the first part of my career as (insert profession here) which gave me an excellent vantage point on the financial services industry.”

Or you might say…

“It might appear as though I’m a little green; however that’s far from the case. I’m simply one component of a team of experts here. We all have our specialties and this is truly a team effort.”

Or you might say…

“It might appear as through I’m new, but I’m a Certified Financial Planner and oversee all the financial planning and investments for our team.”

Or you might say…

“As you can tell I’m pretty young, we need to wrap this meeting up quickly as my mother is waiting out back with a mini-van (haha).” (This barb was thrown at us before a social media presentation!)

A Question for the Veteran: How much longer are you going to be an advisor?

Reason for Question: Your prospect is uneasy with your retirement timeline and would prefer not to commit now and have to make a change in service provider soon. When responding to this question, it’s important that you validate your prospect and clearly articulate your succession plan. Your objective is to ease their minds and let them know your commitment to them and your profession. You also want to convey that your succession plan entails your team building a long-term relationship with them. Lastly, this response should be delivered in an energetic and positive manner.

Potential Response:

“I understand your concern. The great thing about being an advisor is there is no mandatory retirement age. I’ve been blessed with good health (knock on wood), I truly love what I do, and I plan to work for another ten to fifteen years. I find it important that Sue (other advisor on the team) build a relationship with you as I plan for her to play a larger role in the practice in the future.”

Or you might say…

“I am planning to retire in X years, and we put the same thought and attention to the succession plan for our team as we do to overseeing your family’s finances. This is why I am working closely with Carl and Sue who are going to be an integral part of the team going forward.”

There are endless ways to respond to these two questions. The most important element is to make the wording sound like your own. It doesn’t matter if you are six months into the business or thirty years, there are always going to be pointed questions that require prepared responses.

Stephen Boswell and Kevin Nichols are thought-leaders and coaches with The Oechsli Institute, a firm that does ongoing research and coaching for nearly every major financial services firm in the US. To take the first step towards coaching, complete the pre-coaching business profile for a complimentary consultation.