The best way to address taxes from an investment perspective is to consider them from the beginning: In the financial plan. But what if your client has assets that were not invested in a tax-efficient manner and you want to evaluate the benefit of being more tax-efficient?

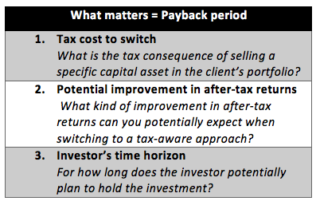

There are three key factors to consider before deciding to make the switch.

Let’s take each of these factors in turn and apply them to a sample scenario:

A couple (married, filing jointly) in the top tax bracket purchased a hypothetical multi-asset balanced mutual fund three years ago. It had a 32% cumulative, pre-tax return (in line with the broad U.S. stock market, as represented by the S&P 500® Index). Under which circumstances would it make sense to sell this investment in favor of a more tax-sensitive one?

1. Tax cost to switch

Consider the following:

- Has the asset’s value appreciated since it was purchased? Is the current market value greater

than the original cost or adjusted basis? - For how long has the client held the asset? Holding periods of 12 months or less may be

subject to a higher tax rate than longer holding periods. - Does the investor have any capital losses or loss carryforwards that could be used to offset

the gain?

Applied to the sample scenario: If the couple chose to sell the mutual fund, taxes would take an 8% bite out of their investment return. (Based on a 23.8% tax on the long-term capital gain of 32%, causing the after-tax cumulative return to drop from 32% to 24% – an 8% difference.

2. Potential improvement in after-tax returns

Consider the following:

- What kind of improvement can you plan for by being smart around taxes? It depends.

Are you looking at only U.S. equity, international equity, U.S. bonds, or a fully diversified multi-asset portfolio? Every asset class is different.

Applied to the sample scenario: Based on returns of the couple’s multi-asset balanced portfolio for the past 10 years, the advisor assumes a 2% improvement in after-tax returns is possible from a diversified portfolio that is explicitly tax-managed. The advisor recognizes that historical returns are no prediction of future results and that diversification does not protect against all loss or guarantee a profit.

3. Investor’s time horizon

Consider the following:

- The investor’s expected time horizon for holding the new investment will influence whether the new investment has the potential to make up the cost of making the portfolio switch in the first place. The longer the investor’s time horizon, the more options they likely have.

Applied to the sample scenario: The couple plans to hold the investment for at least five years.

Putting it together

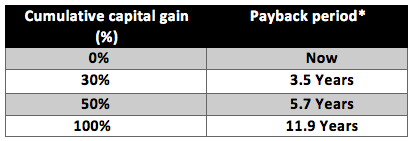

Based on the factors above, the estimated payback periods are:

**Hypothetical example for illustrative purposes only. Market return: Russell 1000® Index. Tax rate assumed = long term rate at highest marginal rate (23.8% = (Max ST Cap Gain 20% + Net Investment Income 3.8%). Payback period assumes 2% per annum compound excess returns after tax of a tax managed solution relative to non-tax managed.

For the couple in the sample scenario, a switch to a tax-managed solution could potentially add value. The tax hit they would sustain for selling their hypothetical mutual fund that enjoyed a 32% long-term investment gain would potentially have a payback period of just over 3.5 years. Given they are expecting to hold the new investment for at least five years, this move could be beneficial.

Some may feel that the 11.9 years’ payback period for portfolios with a 100% cumulative capital gain is a long time, but many investors have time horizons that are longer than this (for instance, accumulators). For instance, a couple in their early 60’s could easily have at least 20 years ahead of them in which to wait out a payback period.

As you consider your clients’ situations, you may find that in many cases it’s in the client’s best interest to pay the investment tax now, with the understanding that improved after-tax returns will benefit their long-term wealth and improve their odds of reaching a successful outcome. One change to consider immediately is to reinvest distributions or income generated from non-tax-managed assets in a tax-smart manner.

The bottom line

Helping clients invest in a tax-smart way can be an excellent way for you to distinguish yourself from competitors, and potentially add value for your clients and build a more valuable practice.

These views are subject to change at any time based upon market or other conditions and are current as of April 27, 2017. The information, analysis, and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual or entity.

This material is not an offer, solicitation or recommendation to purchase any security.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional.

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Strategic asset allocation and diversification do not assure profit or protect against loss in declining markets. The general information contained in this publication should not be acted upon without obtaining specific legal, tax, and investment advice from a licensed professional.

Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

Indexes are unmanaged and cannot be invested in directly.

Russell 1000® Index: Measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. Russell Investments’ ownership is composed of a majority stake held by funds managed by TA Associates with minority stakes held by funds managed by Reverence Capital Partners and Russell Investments’ management.

The S&P 500® Index is a free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. The stocks included in the S&P 500® are those of large publicly held companies that trade on either of the two largest American stock market exchanges: the New York Stock Exchange and the NASDAQ.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

The Russell logo is a trademark and service mark of Russell Investments.

Copyright © Russell Investments Group, LLC 2017. All rights reserved. This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

Russell Investments and Wealth Management are not affiliated.