Sponsored by

In today's dynamic financial landscape, finding unique ways to stand out is not just an advantage — it's a necessity. Part of succeeding involves keeping pace with industry trends, understanding your clients’ specific financial needs and knowing the products that can help them reach their goals — and when to suggest them. Another way to help your business stand out is testing some of the core strategies top financial professionals use to attract and retain clients.

Three success secrets stood out

What strategies are top financial professionals using today? Research conducted by Harris Poll on behalf of Athene revealed three popular strategies successful financial professionals1 are using to thrive in today's competitive landscape. Implementing these success secrets may help give you a competitive edge.

1. Know your unique value proposition

Every financial professional has something distinct to offer, and top financial professionals understand leveraging their unique value can help them stand out.

“The most helpful way I found to identify my unique value proposition was asking myself these questions: What are my values and interests? What type of people do I know and understand best?” says Derek Notman, CFP®, Found & CEO, Couplr AI.

“Getting clear on these points helps crystalize an ideal client, which in turn can help define our brand, logo, marketing materials and so on.”

How do you find your unique value? You may think about people you relate to or understand particularly well. Consider specialized knowledge about a particular market segment or expertise on a specific topic you have. Do you use a unique client management approach? Are you reaching out to clients or prospects with impactful marketing strategies that your competitors aren’t?

Knowing and articulating your unique value can help attract clients who are looking for precisely what you have to offer and potentially create avenues for connecting with existing clients in a new way.

2. Engage clients creatively

Engagement goes beyond regular meetings and updates. Creative engagement strategies such as personalized retirement plans, interactive webinars and informative newsletters can help maintain and strengthen client relationships.

“Client engagement strategies that actually engage the client collaboratively have worked the best for me,” says Notman. “I love using clean and simple technology solutions that are visually appealing and promote deeper conversation. I also have found that clients love interactive portals and tools where they can co-pilot with me and interact with the work we're doing together.”

Working interactive tools into your client meetings may be another way to help engage them. According to survey results, 53 percent of financial professionals with $500 million + in Assets Under Management report they’re leveraging content marketing more often than other financial professionals.2 With this strategy, they are attracting new leads while helping reinforce their position with existing clients as a trusted source in financial matters.

Being familiar with creative client engagement methods only goes so far. Knowing which ones attract the most prospects or resonate best with your existing clients is key. Measuring each strategy’s effectiveness is the only way to know which ones are working.

“The best way to measure the tools I use is two-fold,” according to Notman. “First, (the tools) should save me time doing back-office work so I can spend more time engaging with clients,” he says. “Secondly, what my clients are saying plays a role. If they like how we’re working together and the tools we are using, then I know we're doing the right thing.”

3. Understand the value of networking and mentoring

Networking isn't just about growing your client base. It’s also about learning and sharing experiences with peers.

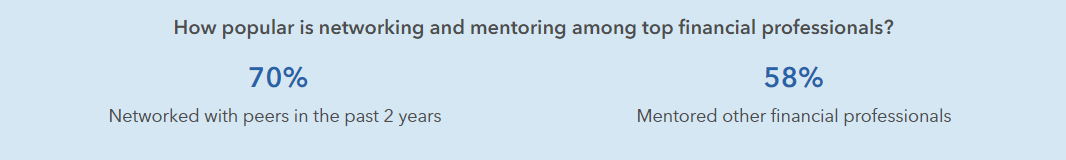

Popularity of networking and mentoring among financial professionals

Networking and mentoring among financial professionals are common practices. According to our recent Harris Poll survey, 70 percent of financial professionals have networked with their peers in the past two years, and about three-fifths have mentored other financial professionals. These interactions can lead to new ideas and strategies that could help improve your own practice and client offerings. “When like minds collaborate, new ideas tend to surface,” says Rod Mims, Senior Vice President and National Sales Manager at Athene. “It’s exciting to see the results networking or a good mentoring relationship can generate.”

Power of strategic relationships

Networking to form strategic relationships with firms or organizations can open new avenues for client referrals and specialized services that could enhance your business model. For example, top financial professionals often collaborate with accountants and lawyers so they can help provide comprehensive solutions to their clients. Fostering professional networks like this can help you build a sustainable practice that’s differentiated from your competitors.

“Embrace the power of mentoring and strategic partnerships. They are cornerstones of a thriving practice in this competitive industry,” says Mims.

The landscape for financial professionals is as challenging as it is rewarding as you pursue your own professional goals while helping your clients achieve their financial dreams. Adopting proven success secrets top financial professionals use can give you more tools to help stand out from your competitors.

5 key strategies top financial professionals use to stand out

In addition to the top three strategies already discussed, survey respondents with $500 million + in assets under management say they’re using other strategies to help attract new clients and retain existing ones more than other financial professionals. Here are their top five:

- Networking

- Developing a strong value proposition

- Implementing a client engagement strategy

- Utilizing technology

- Updating plans with existing clients

For more information on connecting with clients, our e-book Build Confident Clients is filled with other strategies and ideas to help enhance your practice and provide additional value for your clients.

1This online survey was conducted within the United States by The Harris Poll on behalf of Athene from January 30 - February 15, 2024, among 1,001 financial professionals with $50+ million in Assets Under Management.

2The Harris Poll online survey conducted on behalf of Athene, February 2024.

© 2024 Athene. All rights reserved.

For financial professional use only. Not to be used with the offer or sale of annuities.

Annuity contracts and group annuity contracts are issued by Athene Annuity and Life Company (61689), West Des Moines, IA, in all states (except New York), and in D.C. and P.R. Annuity contracts are issued by Athene Annuity & Life Assurance Company of New York (68039), Pearl River, NY, in New York. Group annuity contracts for New York residents and New York contract holders are issued in New York by Athene Annuity & Life Assurance Company of New York, Pearl River, NY. Payment obligations and guarantees are subject to the financial strength and claims-paying ability of the issuing insurance company. Insurance products may not be available in all states. These companies are not undertaking to provide investment advice for any individual or in any individual situation, and therefore nothing in this should be read as investment advice. This material should not be interpreted as a recommendation by Athene Annuity and Life Company, Athene Annuity & Life Assurance Company of New York, or Athene Securities, LLC. Please reach out to your financial professional if you have any questions about insurance products and their features.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, THE BANK OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED