In the wake of any tragedy, charitable efforts to help victims often come with a sense of urgency and in the form of crowdfunding campaigns via online websites. Despite the substantial sums of money raised annually by these crowdfunding sites, there seems to be little law, and even less guidance, for the donors using them.

A better understanding of the legal, tax and structural issues of these efforts will help donors better match their money to their intentions. Let’s take a look at where things stand.

Whose Funds Are They?

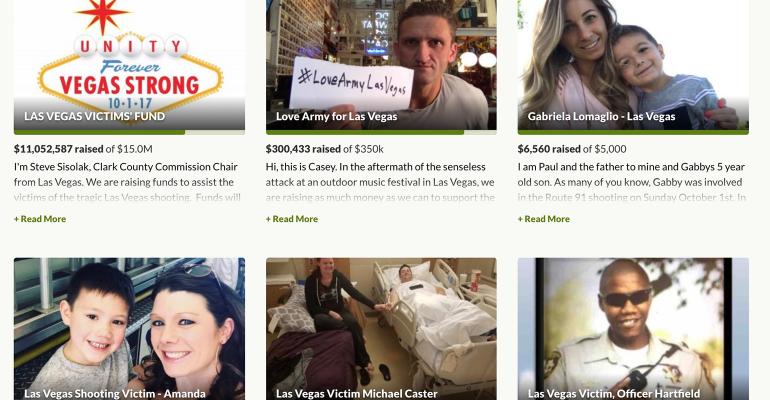

Funds held in a campaign to benefit the public (for example, all the victims of the Las Vegas shooting) pending a distribution to a public charity may reap the income tax charitable contribution, but it depends who owns, or controls, the money.

The terms of service agreement on the hosting crowdfunding platform should govern. There may be other agreements in place, but they’re likely oral arrangements and perhaps only vaguely understood. That might include an oral agreement between the campaign organizer and the donors or between the campaign organizer and the recipient. In either case, a court may have to interpret the language on the campaign page if a dispute arises.

The Difference in Funding for a Group of Victims Vs. an Individual Victim

Funding to benefit a group, like the general crowdfunding site for the Las Vegas victims on GoFundMe, faces different challenges than those for a specific individual.

The group is called a “charitable class.” It must be large enough that the community as a whole, rather than a pre-selected group of people, benefits. For example, a charitable class could consist of all the individuals in a city, county or state. For group efforts that meet that requirement, the following consequences are likely:

- Income tax deduction to donor—These campaigns may be able to partner with an existing charity to meet the requirements necessary for an income tax deduction. For the charitable contribution deduction to be available, the existing qualified charity generally must be given full control and authority over the use of donated funds.

- Income tax inclusion to the recipient—Payments that individuals receive under the charitable organization’s program are considered gifts and may be excluded from the gross income of the recipient, but advisors should review that qualification. Special tax treatment is also provided for qualified disaster relief payments made to victims, regardless of the source.

- Gift tax—For a group campaign, there’s no specific individual beneficiary, so the donation doesn’t necessarily constitute a present interest gift. However, even if the campaign is structured to qualify for the income tax charitable deduction, it may not qualify for a gift tax charitable contribution deduction. Under current law, these “donations” may still subject the donor to a gift-tax filing obligation. Perhaps permitting gifts to crowdfunding campaigns to qualify as a gift of a present interest would suffice without creating much room for abuse. Partnering with an existing qualified charity could help.

- Protection—If the funds are turned over to an existing charity, the infrastructure and procedures of that organization can provide significant assurance that the goals of the campaign will be achieved.

Funding for a particular individual, such as a crowdfunding site for a specific Las Vegas victim, faces different issues from a crowdfunding effort for the general public.

The Internal Revenue Service has stated: “Individuals can also help victims of disaster or hardship by making gifts directly to victims. This type of assistance does not qualify as a tax-deductible contribution since a qualified charitable organization is not the recipient. However, individual recipients of gifts are generally not subject to federal income tax on the value of the gift. If you make a gift directly to an individual, you are not subject to federal gift tax unless the total gifts made in a year exceed the annual exclusion amount.”

For individual efforts, the consequences seem to be:

- Income tax—There can be no income tax deduction.

- Gift tax—There is potential for gift tax issues because the gift can’t meet the gift tax charitable contribution requirements and, in many instances, won’t qualify as a gift of a present interest to avoid gift tax reporting by the donor.

- Protection of funds raised—The potential for partnering with an existing charity in respect to the disbursement of funds in which the accounting may not be viable, other options will have to be considered to provide accountability. Further, for an individual (or family), the use of a trust to safeguard the funds may be advisable. For instance, if the recipient requires medical care, as do may survivors of the Las Vegas shooting, funds could be applied in that matter, although that could risk dissipating the funds. Alternatively, it may be beneficial if funds could be held in a vehicle that doesn’t disqualify the person from means-tested government benefits, such as Medicaid, so that Medicaid pays for the medical care, and the funds raised are preserved for purposes that Medicaid won’t cover. For non-medical campaigns, a trust that permits discretionary distributions for the various purposes of the campaign may be beneficial.