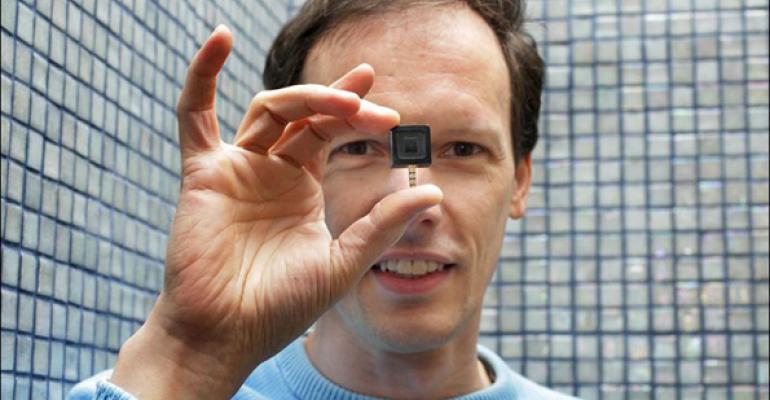

You may not know Jim McKelvey, but you certainly know Square — the company he founded which created a postage stamp-sized device that allows you to swipe a card for a cup of coffee or ice cream cone. McKelvey has now turned his attention to the financial service technology arena which may change how advisors run their firms. His launch, SixThirty, is named for the height and span of the St. Louis Gateway Arch, where McKelvey is based, and offers funding plus mentoring to start-ups looking to change the way consumers and advisors engage with financial services. We asked the co-founder and managing director what appealed to him about this sector and what he believes he can improve.

“Financial services companies have a different set of requirements than normal technology startups. If you have great team, a good idea, a solution to a real problem and enough money to make it all happen, you’re pretty much guaranteed a success. It doesn’t work that way with financial services technology. You may need capital, a banking alliance, a money transfer alliance or an insurance alliance. There are a bunch of things that are needed for financial technology startups above and beyond what basic start ups could require. I know full well having gone through this with Square. We had the basic technology working in three weeks. We had the hardware built in three weeks. It took us 18 months to get the right partners in the banks, credit cards ecosystem and the government.

A lot of time what you’re doing with technology is giving the human the power to do what they do well. Most of the interesting and sophisticated stuff is not what you want to replace people with. In most cases the more interesting is where technology augments human potential. An example is customer service. I need a question answered and technology is very good. I can go to a web site or interactive voice system. I can get an answer without a human, if that’s what I want. Where tech is abysmal is like most phone systems which companies inflict on us where I have a simple question but the technology is terrible and I go through 20 prompts in order to finally get to a human to solve a problem. It goes both ways.

We give [startups] $100,000. It’s an investment. We only have four slots per semester. Eight companies a year. It’s a pretty limited group. They’ll move to St. Louis for at least four months. The sponsoring companies are pretty sizeable firms and they all agreed to review the final presentation, which will have a direct line into the larger firms. We’re not looking at B2B or B2C as a determinant. We’re looking at the value of the technology. Does it solve a problem. The overall trend in technology is general ease of use in communication and transparency in the ecosystem which is what I think we’ll see mirrored here. What you don’t expect to see is the fun part.”