The Financial Industry Regulatory Authority has completed the merger of two teams within its Department of Enforcement and named an in-house executive to lead it.

As part of the FINRA360 initiative of self-evaluation and improvement, the regulator consolidated what were two distinct teams: one that handles disciplinary actions related to trading-based matters found by the Market Regulation division and another handling cases from the other oversight divisions, such as Corporate Financing and the Office of Fraud Detection and Market Intelligence.

The goal is to create “more consistent decision-making and outcomes,” FINRA said in a statement about the merger.

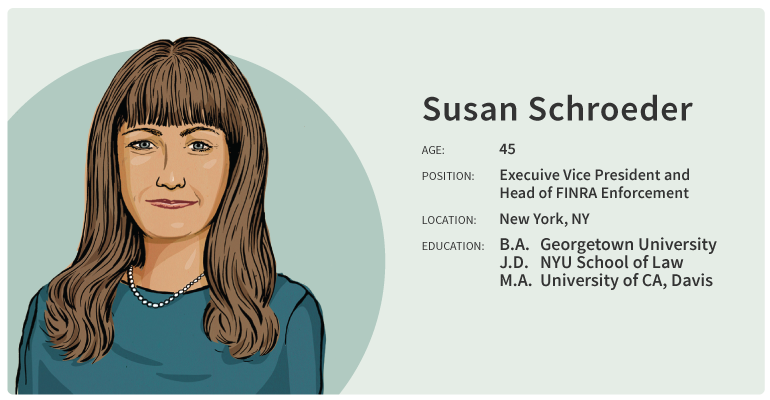

The evaluation and restructuring began when Susan Schroeder, who has been with FINRA since 2011, was named executive vice president and head of enforcement last summer. The motorcycle enthusiast oversaw the department’s evaluation and was charged with effectively merging the two teams. The department has a staff of more than 150 attorneys organized in the new centralized structure.

The evaluation and restructuring began when Susan Schroeder, who has been with FINRA since 2011, was named executive vice president and head of enforcement last summer. The motorcycle enthusiast oversaw the department’s evaluation and was charged with effectively merging the two teams. The department has a staff of more than 150 attorneys organized in the new centralized structure.

“The consolidation of our enforcement functions enables us to better target developing issues that can harm investors and market integrity, and ensure a uniform approach to charging and sanctions,” Schroeder said in a statement.