Clients have been hearing about the impending retirement “crisis” for so long that many are ignoring the other side of the coin, the risk of running out of retirement funds due to unexpected longevity. Primary among the various “longevity risks” is the potentially astronomical cost of long-term care.

Just how deep the problem runs is explored in a recent survey of 150 advisors’ experiences with planning for LTC, performed by Key Private Bank.

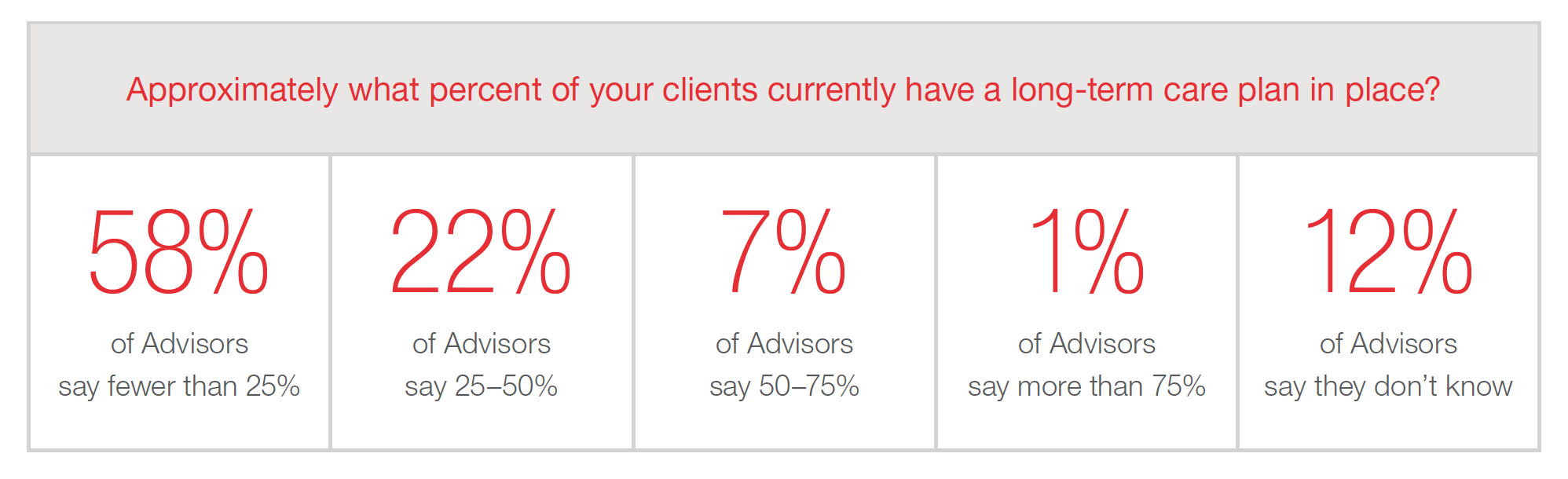

According to the study, nearly 60 percent of respondents reported that less than one-fourth of their clients currently had an LTC plan in place. On the other hand, only 1 percent of advisors replied that more than three-quarters of their clients had such planning in place. Most distressingly, 12 percent of advisors simply don’t know.

As for the reasons why there is such a paucity of preparation in this area, advisors offered a litany of potential complexities and pitfalls. The most common difficulty cited by (52 percent) of respondents is convincing clients to put an LTC plan in place in advance of needing one. Helping clients increase savings for LTC costs without substantially affecting their other financial goals (44 percent) and forecasting caregiving needs and addressing coordination of care (38 percent) were the next two most common responses.

These difficulties, if taken at face value, imply that an education and communication gap lies near the heart of the problem. And the surveyed advisors largely bore this sentiment out. Even though 96 percent of clients would prefer to stay at home and remain independent in their old age, 77 percent of respondents report that either “some” or “hardly any” of their clients are actively communicating their LTC wishes to their families.

As for what is being done to remedy the issue, not all advisors are simply sitting on their hands like the aforementioned 12 percent. On June 14, an alliance of 24 financial services companies, including AIG, Jackson, Lincoln Financial, Prudential and TIAA, announced that they are coming together to create a nonprofit, The Alliance for Lifetime Income, to educate consumers (and provide resources to advisors) about retirement risks and to “refocus the national retirement discussion on lifetime income planning vs. accumulation.”

First conceived roughly a year ago during an impromptu meeting of CEOs at an industry conference, the alliance grew from the shared reality that these institutions all had their own campaigns to raise awareness in this space, but none were really satisfied with the progress they were seeing, so they got together and decided that, according to Colin Devine, the nonprofit’s educational advisor, “24 heads are probably better than one.”

“I’m amazed by how many people in the industry don’t fully appreciate the risks presented by longevity,” says Devine. “The whole financial services industry is centered around accumulation. ... It has not been focused on savings or income and having some form of protected monthly income after you stop working.”

It’s important to note, however, that the alliance isn’t trying to point fingers. The members acknowledge that they too have been part of the problem. Devine explains: “The alliance members wanted to acknowledge that the products that are out there today are far too complicated—nobody can understand what they were actually selling from the literature, let alone could clients understand what they were buying.” To illustrate, he confessed: “I own 8 variable annuities, and when I bought them, I think I looked at 15 companies’ products; I could only figure out in one company what the products actually did [and I’m in the industry]. For the rest I had to call the wholesalers, so they could walk me through it.” This is the sort of issue the alliance is looking to solve.

Though the alliance focuses largely on insurance-based solutions, it doesn’t consider them a monolith. “There is no one solution to planning for retirement income,” says Devine, “but having a comprehensive plan in place is an important first step.”