Each year, the Internal Revenue Service adjusts tax brackets and other tax benefits. The Tax Cuts and Jobs Act of 2017 (the Act) enacted changes to the tax law that override some of the original figures issued by the IRS in the revenue procedures, and these changes can have an impact on charitable giving. For 2018, there have been many inflation-adjusted increases, with some amounts remaining the same. (See Revenue Procedure 2017-58 (Nov. 6, 2017) and Rev. Proc. 2018-18 (March 5, 2018).)

Tax Brackets

For 2018 through 2025, pursuant to the Act, the regular individual income tax rate schedules are: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The top bracket is 37 percent (reduced from the earlier 39.6 percent).

- Joint filers and surviving spouses: Up to $19,050 taxed at 10 percent; $19,050 to $77,400 taxed at 12 percent; $77,400 to $165,000 taxed at 22 percent; $165,000 to $315,000 taxed at 24 percent; $315,000 to $400,000 taxed at 32 percent; $400,000 to $600,000, taxed at 35 percent; over $600,000 taxed at 37 percent.

- Heads of household: Up to $13,600 taxed at 10 percent; $13,600 to $51,800 at 12 percent; $51,800 to $82,500 at 22 percent; $82,500 to $157,500 at 24 percent; $157,500 to $200,000 at 32 percent; $200,000 to $500,000 at 35 percent; over $500,000 at 37 percent.

- All other single taxpayers: Up to $9,525 taxed at 10 percent; $9,525 to $38,700 at 12 percent; $38,700 to $82,500 at 22 percent; $82,500 to $157,500 at 24 percent; $157,500 to $200,000 at 32 percent; $200,000 to $500,000 at 35 percent; over $500,000 at 37 percent.

- Married individuals filing separately: Up to $9,525 taxed at 10 percent; $9,525 to $38,700 at 12 percent; $38,700 to $82,500 at 22 percent; $82,500 to $157,500 at 24 percent; $157,500 to $200,000 at 32 percent; $200,000 to $300,000 at 35 percent; over $300,000 at 37 percent.

Capital Gains

The Act retains the long-term capital gains rates of 0, 15 and 20 percent, but each level is based on a “breakpoint,” which isn’t necessarily aligned with the new tax brackets. The breakpoints are from 0 to 15 percent, and the 15 percent and 20 percent rates. The 15 percent breakpoint is $77,200 for joint returns and surviving spouses (Half that amount for married taxpayers filing separately), $51,700 for heads of households and $38,600 for unmarried taxpayers. The 20 percent breakpoint is $479,000 for joint returns and surviving spouses (Half that amount for married taxpayers filing separately), $452,400 for heads of households and $425,800 for unmarried taxpayers. For estates, the 15 percent breakpoint is $2,600, and the 20 percent breakpoint is $12,700. The 0 percent rate applies to individuals and estates with an income not exceeding the 15 percent breakpoint.

Exception: Gains on sales of artworks (and other collectibles) held long term remain taxable at the 28 percent maximum rate. Unrecaptured gain on a sale of real property continues to be subject to a 25 percent maximum rate.

The gain on sales of capital assets held short term (one year or less) is taxed in the regular tax brackets.

3.8 Percent Medicare Surtax

Treasury regulations on the 3.8 percent Medicare tax give guidance under Internal Revenue Code Section 1411. The regulations can affect individuals, trusts and estates.

- For an individual. In 2018, in addition to any other tax, a 3.8 percent tax is imposed on the lesser of: (1) the individual’s net investment income (NII) for the taxable year, or (2) the excess (if any) of the individual’s modified adjusted gross income (AGI) for the taxable year over the threshold amount. The threshold amount(s) are: (1) for a taxpayer filing a joint return or as a surviving spouse, $250,000; (2) for a married taxpayer filing a separate return, $125,000; and (3) in any other case, $200,000. For most taxpayers, modified AGI is their AGI. “Modified” applies only to taxpayers living abroad and using the foreign earned income exclusion. These threshold amounts aren’t indexed for inflation.

- For an estate or trust. A tax, in addition to any other tax for each taxable year, in 2018, is imposed equal to 3.8 percent of the lesser of: (1) the estate’s or trust’s undistributed NII, or (2) the excess (if any) of the estate’s or trust’s AGI for the taxable year over the dollar amount at which the highest tax bracket in IRC Section 1(e) begins for the taxable year. Translation. That threshold amount for 2018 is $12,500 (indexed for inflation).

- Charitable remainder trusts. Although charitable remainder unitrusts and charitable remainder annuity trusts aren’t subject to the 3.8 percent Medicare surtax (Section 1411), annuity and unitrust distributions may be NII to the non-charitable recipient beneficiary. Treasury Regulations Section 1.1411-3(d)(2) provides that NII is categorized and distributed based on the IRC Section 664 category and class system.

- Pooled income funds. Pooled income funds are subject to the 3.8 percent tax. Treas. Regs. Section1.1411-3. A pooled income fund distributes all its income to the fund’s income beneficiaries. Thus, that income doesn’t subject the fund itself to the 3.8 percent tax. High NII beneficiaries may be subject to the 3.8 percent tax under the rules on an individual’s NII.

Additional 0.9 percent Medicare tax. In 2018, an individual is liable for a 0.9 percent additional Medicare tax if his wages, compensation or self-employment income exceed the threshold amount for the individual’s filing status.

| Filing Status | Threshold Amount |

| Married filing jointly | $250,000 |

| Married filing separately / Single | $125,000 |

| Head of household (with qualifying person) | $200,000 |

| Qualifying widow(er) with dependent child | $200,000 |

These threshold amounts aren’t indexed for inflation.

Personal Exemptions

The Act repealed personal exemption deductions for the taxpayer, spouse and dependents for the years 2018 through 2025.

The Standard Deduction

The Act increased the standard deduction to $24,000 for married individuals filing a joint return, $18,000 for head-of-household filers and $12,000 for all other individuals. The standard deduction is indexed for inflation using the chained CPI indexing methodology for taxable years beginning after Dec. 31, 2018.

Unified Gift and Estate Tax Exemption

The Act doesn’t repeal the estate, gift and generation-skipping transfer (GST) taxes, but the exemptions are doubled. However, in 2026, the exemptions return to 2017 levels (indexed for inflation). The basic exclusion amount provided in IRC Section 2010(c)(3) is doubled from $5 million to $10 million. The $10 million amount is indexed for inflation occurring after 2011. For 2018, the figures are $11.18 million per person, $22.36 million for married couples. The tax rate remains at 40 percent.

GST Tax

The GST tax imposes a flat rate tax on transfers when assets or benefits are shared by individuals who are two generations or more below the transferor’s (for example, grandchildren) and on direct transfers that skip generations. For 2018, the GST tax exemption is the same as the gift and estate tax exemption, and the tax rate is 40 percent.

Annual Gift Tax Exclusion

In 2018, for gifts of present interests, the annual gift tax exclusion is $15,000 per donee. With “gift-splitting,” spouses can transfer a total of $30,000 per donee each year without gift tax. Present interest gifts to a non-citizen spouse qualify for an annual exclusion of $152,000 in 2018.

Health Insurance Costs

Self-employed taxpayers who had a net profit for the year can deduct 100 percent of eligible costs in 2018.

Social Security Benefits

The maximum taxable earnings in 2018 are $128,100. Persons who continue to work after reaching their normal retirement age (66 in 2018, increasing to 67 by 2027) won’t have their Social Security benefits reduced, no matter how much they earn.

An earnings test is imposed for Social Security recipients aged 62 to 66. The maximum amount those recipients may earn without reduction of benefits is $16,040 in 2018. If a recipient earns more than that, $1 in benefits is withheld for every $2 earned over $17,040. In the year an individual reaches full retirement age, $1 in benefits will be deducted for every $3 above $45,360, but only counting earnings before the month the individual reaches full retirement age. Starting with that month, there’s no limit on earnings.

Monthly Social Security benefits increase 2 percent in 2018.

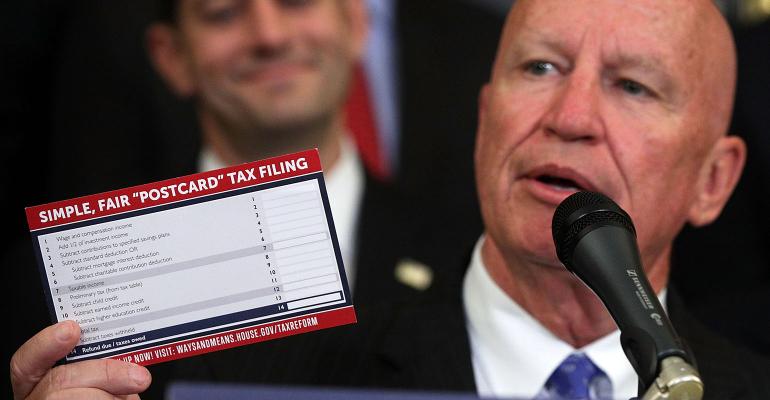

SORRY. I don’t think this will fit on a postcard.

© Conrad Teitell 2018. This is not intended as legal, tax, financial or other advice. So check with your advisor on how the rules apply to you.