I don’t know, but I heard the new Federal Reserve Chairman Jerome Powell’s testimony and I didn’t get much more of a hawkish sense than I had before; December Fed Fund futures only rose about 4 basis points, adding marginally to the odds of three hikes by the end of the year, and gave all that up by week’s end. In context, the odds of 2 percent or more in December are near 68.5 percent from just shy of 64 percent a week earlier. Frankly, I think that pretty much prices in three rate hikes for now and I’m not just trying to talk a bullish position. I just don’t see that it was a more determined hawkish lean than the market already had. I mean, 4 basis points … really?

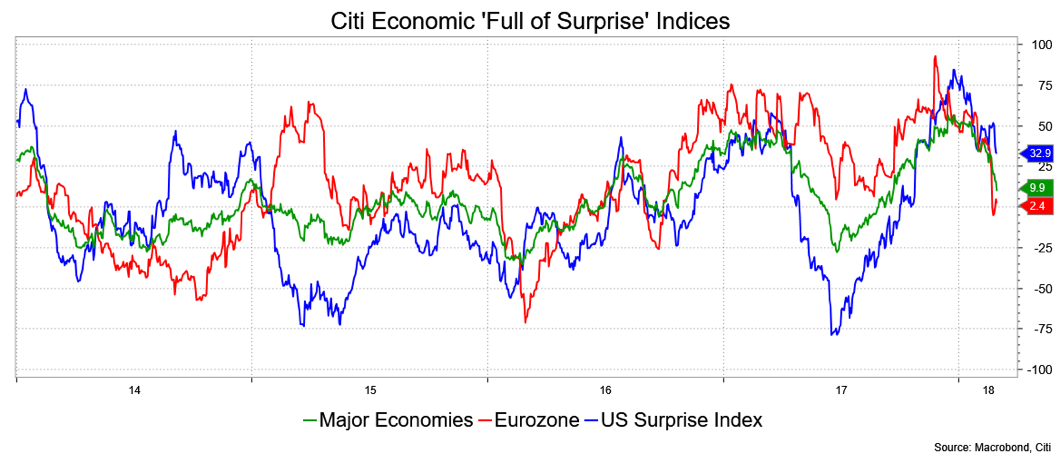

Consider some of the data of late: retail sales, hours worked in January, University of Michigan’s one-year inflation expectations, capital goods orders in December, real average hourly and weekly earnings, January’s industrial production and capacity utilization numbers, existing home sales, new home sales, durable goods, downward revision to the GDP, Chicago Purchasing Manager’s Index, pending home sales and stocks. There is another side to all the optimism that might be more than just bad weather. You see much of that “aggregated” in the Citigroup Economic Surprise Indices:

Again, I’m not saying we have cause to be bullish much. Rather, that we’ve priced in a lot of the bearish news in many ways. Not only is sentiment still very oversold, but the data expectations seem to have adjusted. By these I refer to that Citigroup Surprise Index, which is at the lows for the year, meaning that the data is no longer surprising people—it doesn’t necessarily mean the data is weak, only that it’s not surprising to the upside. And for the Eurozone and other major economies it’s at the lowest level since 2016.

I think the markets are dealing with a lot of anxiety. Leaving the raw influences of empirical economic data aside, there’s turmoil in Washington with ongoing Trump blasts at Sessions, the trade sanctions, seeping extensions it seems of the Russia investigations, resignations of more people in the White House, Kushner’s security clearance and potential conflicts with the family business. Leaving aside his bluster and Trump’s heretofore use of the stock market as his favored popularity poll, the last month tells a different story. I ponder if the approach to the mid-term elections will increase the stress on markets.

Jerome Powell, let’s be frank, didn’t say much that we didn’t already know: the Fed’s got its three more hikes there in the dot-plots; the data the Fed harps on, jobs and inflation, have firmed since December; and odds were already strong for those hikes even before this week. In short, stocks reacted negatively, but what did they react negatively to? The addition of 10 percent odds to an already nicely discounted set of hikes this year. That seems a glib excuse. That Powell, like any Fed chairman and so many FOMC members have opined in recent years, would hike even if it caused equity market volatility, reveals more about the vulnerability of stocks than it does about the risks of one more additional hike than we thought.

I get back to the data. It’s been softer in many cases, enough perhaps to stall the bond market’s slide for a brief while. I get back to the inflation stories, such as Greg Ip’s Thursday piece in the Wall Street Journal outlining all the potential causes for it to rise, “Why an Unpleasant Inflation Surprise Could Be Coming,” but also note the subheading, “There is a plausible, if unlikely, scenario in which inflation marks a new, dangerous trend.” If UNLIKELY indeed. Why an Unpleasant Inflation Surprise Could Be Coming

There is a plausible, if unlikely, scenario in which inflation marks a new, dangerous trend

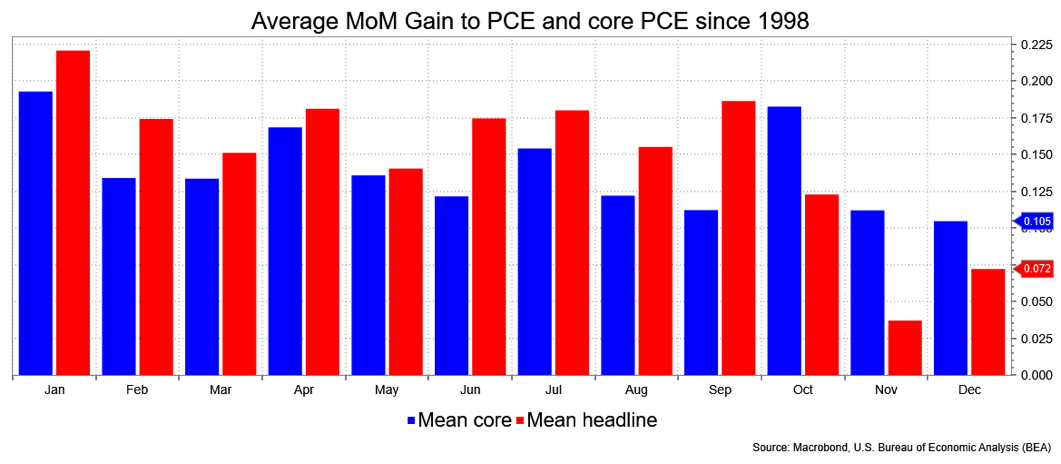

We just saw January Personal Consumption Expeditures year-over-year at 1.7 percent, and core at 1.5 percent. And, FYI, January is traditionally the biggest month for gains in this series.

David Ader is the Chief Macro Strategist for Informa Financial Intelligence. To read more of his musings, click here.