By Emily Chasan

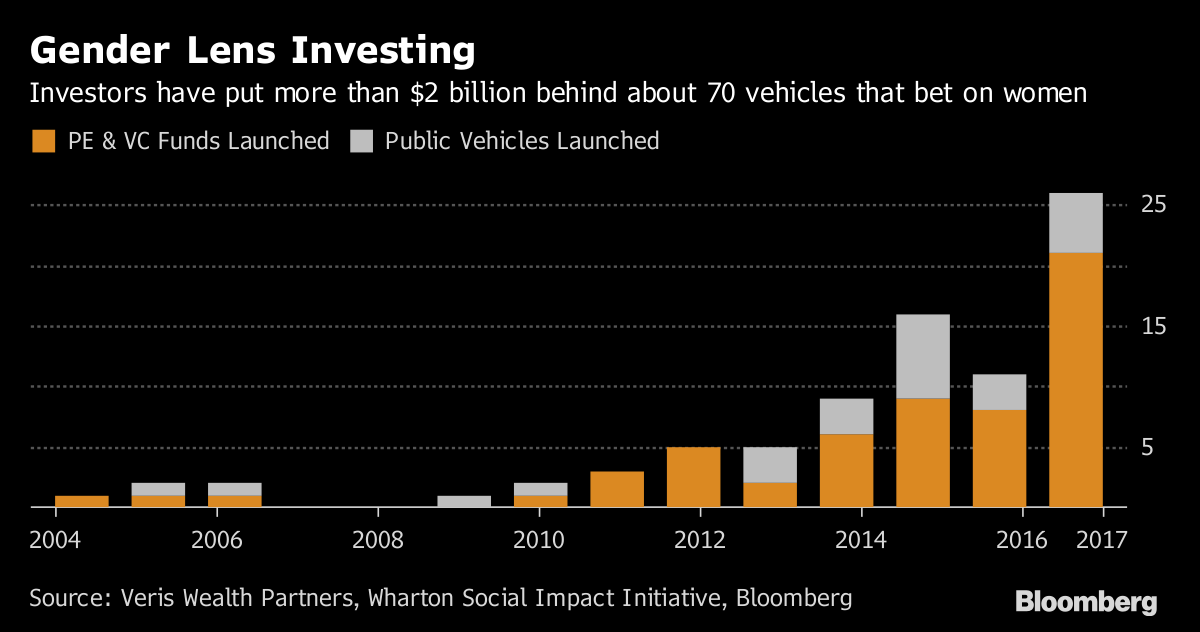

(Bloomberg) --Investment strategies that focus on improving the lives of women and girls, closing the gender pay gap or adding women to corporate boards have attracted more than $2 billion in public and private assets.

Public investment vehicles, including mutual funds and ETFs focused on so-called “gender-lens” investing, oversaw $910 million in assets as of June 30, 2017, according to a study released Wednesday by investment firm Veris Wealth Partners LLC. That’s up from $561 million in the same period a year ago, and just $100 million in 2014.

A separate report from the Wharton Social Impact Initiative last month found that private equity and venture capital had raised more than $1.3 billion at 50 funds it identified with gender-based strategies. They include investing in small businesses owned by women, startups with female founders, or other businesses that improve the lives of women.

This “is a powerful signal that investors want more options to put capital to work for the benefit of women and girls,” Veris Chief Executive Officer Patricia Farrar-Rivas said in a statement.

Gender-lens investing is still a nascent trend, with the majority of public and private funds using the strategy launched in the last three years, according to the studies. Not all of the the funds identified disclosed their capital figures.

The public investment vehicles tracked by Veris, include 12 managed accounts, six mutual funds, one exchange-traded fund, an exchange-traded note, a certificate of deposit and a limited partnership hedge fund. Among them are State Street’s Gender Diversity Index ETF and the Pax Ellevate Global Women’s Index Fund.

To contact the reporter on this story: Emily Chasan in New York at [email protected] To contact the editors responsible for this story: Alicia Ritcey at [email protected] Dan Reichl