By Lu Wang

(Bloomberg) --For all the hoopla about the FANG rally, the impact of megacap technology companies on the internal balance of benchmark stock indexes remains well within the bounds of history.

Yes, enormous firms like Apple, Microsoft, Google, Amazon and Facebook account for roughly 60 percent of the Nasdaq 100’s gain this year, but no, that isn’t resulting in a particularly distorted picture of breadth, at least so far.

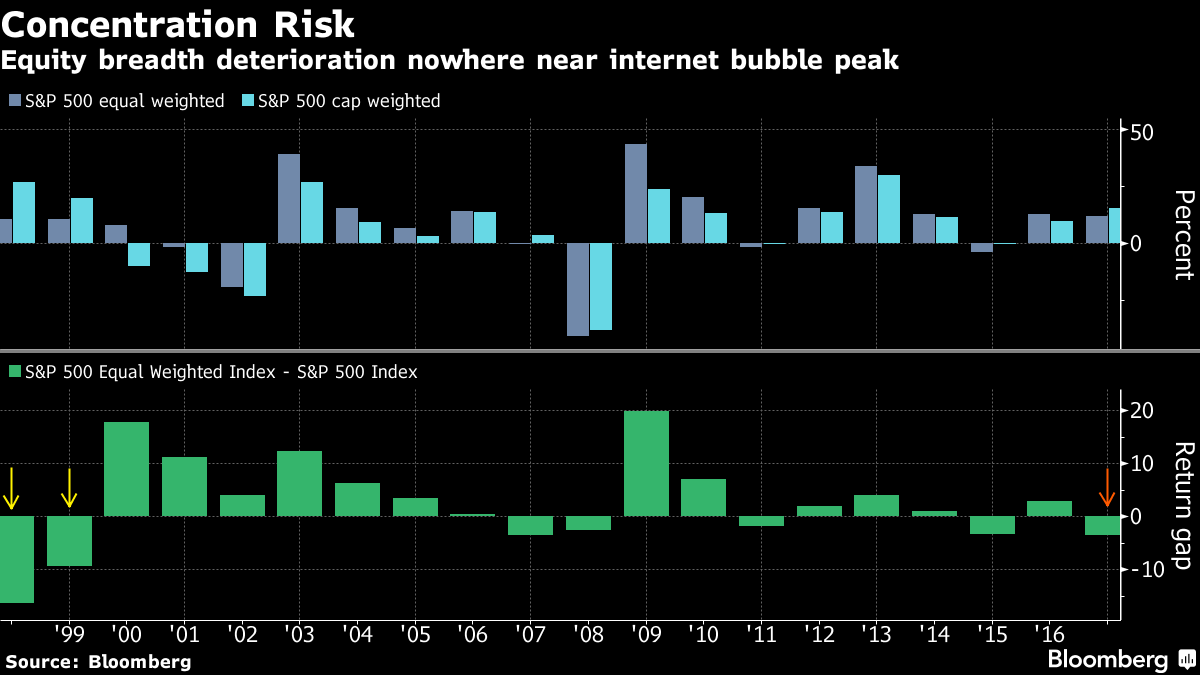

One way of seeing this is to compare an index that reflects market-value biases with one that doesn’t, a so-called equal-weighted gauge. The larger an advantage the cap-weighted gauge commands, the more giant companies are influencing the move.

This year, an equal-weighted measure of the Nasdaq 100 that treats Apple the same as Viacom is trailing the regular version by 6.7 percentage points. While the gap is the widest in two years, it’s only about 1 standard deviation away from the average in data that goes back to 2006. In fact, the spread has been larger three times in the last decade.

Futures on the Nasdaq 100 were little changed as of 8:44 a.m. in New York, as investors digested quarterly reports from a handful of well-known tech stocks including Facebook Inc.

Concern over concentrated gains resurfaced after tech giants last week surged on strong earnings. The top five firms on Friday contributed almost all the market’s gains, leading the Nasdaq 100 to its best performance since 2009 relative to the S&P 500.

Viewed from a wider lens, however, the latest FANG rally is more of a catch-up after tech stocks trailed the market in the previous four months. Taken together, last week’s advance simply brought the industry’s relative return in line with peak levels seen in June.

Data on equal-weight Nasdaq don’t go back to the internet bubble, but the same effect is visible in broader benchmarks. In 1999, the cap-weighted S&P 500 rose 20 percent, or 10 percentage points more than its equal-weighted cousin. This year the spread is 4 points.

That it seems like the FANGs must be doing something unusual says more about investor psychology than statistical truth.

To contact the reporter on this story: Lu Wang in New York at [email protected] To contact the editors responsible for this story: Jeremy Herron at [email protected] Chris Nagi