Going into the U.S. Federal Reserve's September meeting last week U.S. Equity Funds again failed to post consecutive weekly inflows for the first time since mid-March, with Large Cap Value Funds experienced the biggest net redemptions while Small Cap Blend Funds fared best in both cash and flows as a percentage of AUM terms. Retail investors kept their distance for the 37th time in the 38 weeks year-to-date despite the latest record highs recorded by benchmark U.S. equity indexes.

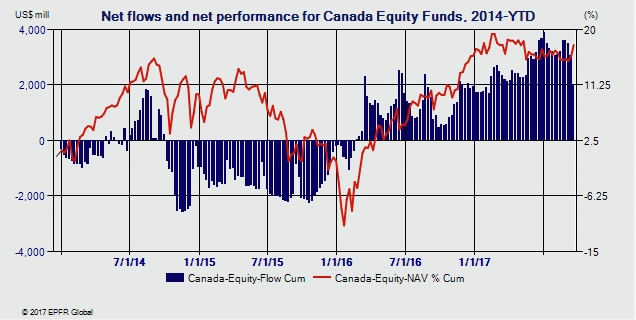

While the Fed concluded its meeting by indicating the future interest rate hikes remain in the table, the Bank of Canada has raised its key rate twice since July to prevent an economy growing at more than 4 percent from overheating and keep. It also wants to keep a lid on potential housing bubbles. Investors redeemed money from Canada Equity Funds for the fourth week running, with the latest outflows the largest since early September, 2014, when sliding oil prices began to put the brakes on the country's booming energy sector.

Flows to Europe Equity Funds, meanwhile, rebounded ahead of an election in Germany that is expected to extend current chancellor Angela Merkel's term in office. That, allied to the emergence of new French President Emmanuel Macron as a pro-Europe reformer and the Eurozone's stronger growth, is prompting investors to reassess their outlooks for key markets and Europe as a whole. Commitments to all Europe Equity Funds hit an eight-week high and France Equity Funds recorded their biggest inflow in nearly three months as they took in fresh money for the 12th time in the past 14 weeks.

With investors warming to the Eurozone and European Union, funds dedicated to markets on the outside struggled. Switzerland Equity Funds experienced their biggest outflow since late June and U.K. Equity Funds posted consecutive weekly outflows for the first time since mid-July.

Japan Equity Funds also experienced a spike in redemptions, with outflows hitting a 15-week high, ahead of the Bank of Japan's September policy meeting. Redemptions were broadly based, with 28 funds seeing over $20 million flow out. Foreign currency-denominated flows to this fund group climbed to levels last seen in mid-June but were offset by the biggest yen-denominated redemptions since early May.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company.