One of the best ways to reduce the cost of college is to throw a wider net when looking for schools. If your client’s child goes to a little-known college, it’s just about guaranteed that they won’t pay full price.

Here are the average annual merit scholarships at some smaller schools, including Beloit College, my son’s alma mater:

| Hartwick College (N.Y.) | $22,929 |

| Denison University (Ohio) | $22,140 |

| Beloit College (Wis.) | $20,149 |

| Willamette University (Ore.) | $19,925 |

| Trinity University (Texas) | $19,066 |

| Clark University (Mass.) | $18,798 |

There are many reasons why your clients, even when they can’t afford to pay $280,000 for a bachelor’s degree at an elite research university, balk at widening their search parameter.

The bragging rights seem worth the financial sacrifice. Teenagers guilt their parents. Many don’t understand how college pricing works.

Or they may just fear that schools they have never heard of might go belly up.

Here are six ways that you as an advisor can alleviate their fears and help them determine the institution’s stability:

1. Understand the odds.

While colleges do close, it doesn’t happen nearly as often as parents might believe. In the decade ending 2014, public and private colleges averaged five closures a year, according to Moody’s Investors Service. During the same period, there were two to three mergers a year.

It’s important to put those events in context. In the United States, there are more than 2,300 private and public four-year colleges. So those mergers and closures represent a fraction of 1 percent of institutions.

2. Check a college’s bond rating.

If your clients are interested, they can head to Moody's and register for a free account to find a school’s bond rating. Access to some of the more nuanced research is reserved for subscribers, but anyone can access issuer ratings with the free account.

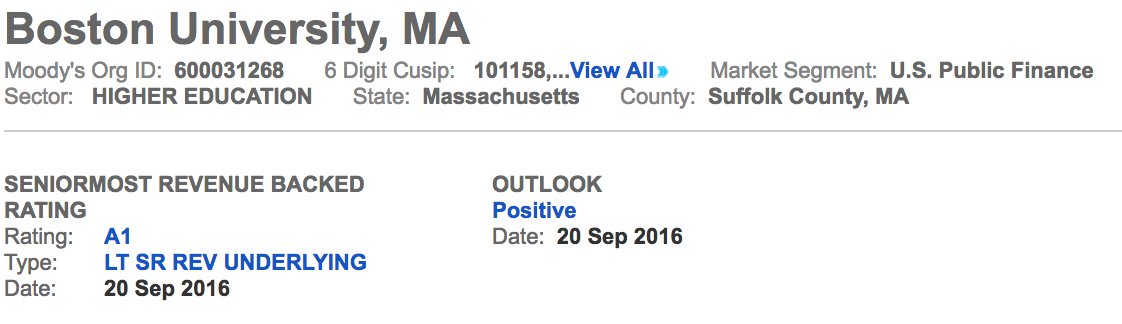

From there, just search the name of the school, and assuming Moody's rates it, you’ll be directed to a page with its rating and outlook like this:

The rating for Boston University, for example, is A1 and the outlook (which signals the direction the rating is likely to move in the short-term) is positive.

3. Look for deferred maintenance.

Colleges strapped for money tend to postpone maintenance projects. Consequently, it’s smart to check for a poorly maintained campus while on a college tour. Is paint peeling? Do the ceilings have water damage? Does the landscape look ignored? Are buildings dirty? Do student complain about the heating and cooling? How robust is the campus Wi-Fi?

4. Check the campus size.

Not attracting enough students is a sign of trouble. You’ll want to pay the closest attention to institutions with fewer than 1,000 students. Colleges with fewer than 1,000 students, according to the National Center of Education Statistics, have less than 2.5 percent of market share.

Also check out the student body trend line. You can see what the size of the student body has been over the years by looking at a college’s annual Common Data Sets. This standardized and voluntary document, which many schools complete yearly, contains a large number of admission, academic and financial statistics about an institution, including its size.

You can often find a school’s CDS by googling the term and the college’s name.

5. Look for bad news.

When a college is experiencing financial difficulties, it usually attracts local news attention. Parents should set up a Google news alert for schools on their child’s list.

The student newspaper can also be an excellent source. See if the student newspaper is online, and when you’re visiting pick up a copy. Even better, pay a visit to the office of the campus newspaper. The student journalists should be eager to talk about potential problems.

6. Pay attention to tuition discounts.

The vast majority of private colleges provide their affluent freshmen with merit scholarships. As mentioned earlier, elite universities are an exception since they don’t need to provide merit awards because rich students will attend at any price.

According to the National Association of College and University Business Officers, the average tuition discount for private colleges is 56 percent, which is an historic high.

While large discounts are great for budget-conscious families, you want to be careful about a school that must offer much greater discounts to attract students. You will have to ask a school’s financial aid or admission office what its discount rate is.

When a school’s tuition discount rate exceeds 80 percent, the institution is facing big problems that can’t be fixed by increasing tuition.