By Matthew Chisholm

Consumers expect a personalized marketplace. But why is it that retail and service businesses are comfortable categorizing their grocery stores and hotels, while we in the financial-advice industry shy away from making similar categorical offerings to our clients? The future of retail, technology and marketing is personalized—and your firm's service offering should be too.

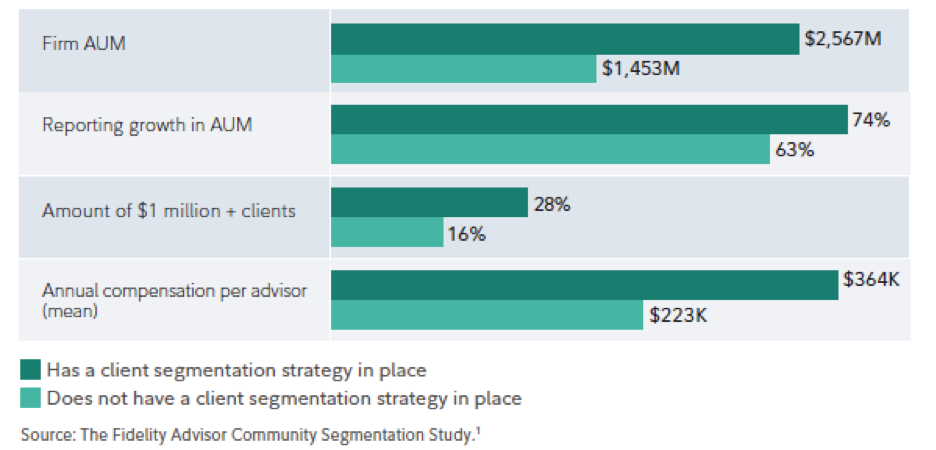

The case for segmentation is clear. In our research, Fidelity found that firms that segment their client base surpassed those who do not in assets under management (AUM), growth in AUM, number of clients with $1 million or more, and annual compensation to advisors. Not only can segmentation benefit your business, but more importantly, it can deliver an exceptional and differentiated client experience.

So how do you get there? Following are four steps to consider to help set up a client-segmentation strategy for your firm.

Step 1: Thoughtfully define your goals

Before you start this process, take the time to clearly define what you want to achieve through segmentation. Are you looking to bring on new clients, or dedicate more resources to your current high-value customers? Once your goals have been defined, begin allocating your firm’s resources for more efficient growth. If you have smaller clients who are not a major source of revenue for your firm, consider bringing in a more junior advisor to manage those clients. Focus on dedicating more time to clients fitting the ideal profile—those who will help you achieve your goals. And finally, it’s important to match your services with your client needs. Remember that not every investor needs or wants the same level of service. The effort and expense required to support a client needs to align to the value they provide to your firm.

Step 2: Create segmentation that supports the client experience

Firms may want to consider building tiered service levels using a scored stack rank. This takes other factors like wealth trajectory, client location and likelihood of referrals into consideration at weights you can decide upon. These tiers can help you set the priority for requests as well as manage your advisors’ time allocations to each client, depending on their tier. When matching advisors to client tiers, look for other opportunities to help create a strong relationship between the advisor and investor. Consider demographic information like gender, but dig deeper than that to match behavioral traits like technology use and even hobbies. Pairing those with a mutual interest in golf or charitable giving can help clients feel their service has been personalized.

Step 3: Effectively collect, manage and analyze client data

Quality data is what will help you effectively segment your clients. Data will come in a range of forms—through personal relationships, emails, paperwork, etc. For new clients, try using the sales and discovery process to collect the bulk of this data. Drill down into the specifics, even going as far as client food and vacation preferences. It’s all in the details. A dynamic data-management system to track all of this can be critical here. Quality data is no good if it’s in varied forms and documents throughout your firm. Ensure associates are trained on how to enter data into a customer relationship management system (CRM), or better yet, bring on a dedicated resource to manage the system and continually update and mine information.

Step 4: Strategically transition clients

When the time comes to move your clients into your personalized segments, be sure to do so carefully for both clients and advisors. Some clients may feel as if a valuable relationship is ending, while advisors may feel their book of business has been short-changed. It’s important to educate both on how he or she will benefit from the change. This may include incentive programs for your advisors and thoroughly explaining the start of expanded service for clients. For both parties, they should walk away feeling like they have gained in a meaningful way from the transition.

Ultimately, getting to know your clients and creating tiered and tailored programs for them is the future of the advisor industry. Not only can clients walk away with improved service, but your advisors can be given the opportunity to focus on their key value drivers and enhance their overall productivity. And that is what we like to call a win-win.

Matthew Chisholm is senior vice president, Practice Management and Consulting, for Fidelity Clearing & Custody Solutions.