Gold hit record highs Friday, as February COMEX futures punched through $900 intraday before finally settling near $898. Gold bugs swarmed around the media outlets making sure they got quoted as the first—the very first—to call this takeout of the old record price, set in 1980.

I say: “Big deal!” At $900 an ounce, gold is still cheap.

How can that be?

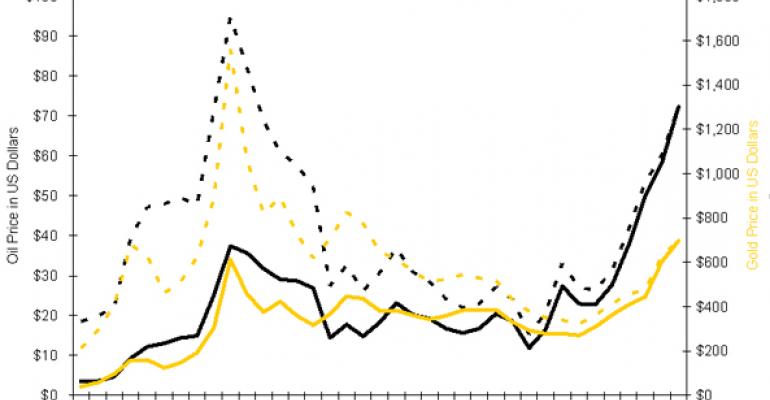

Inflation, that’s how. The basket of goods and services that 1980 gold could have bought you simply costs more now. Inflate the average monthly price of gold in 1980 to 2007 in dollars and you get a $1,563 threshold that the yellow metal must cross to rightly claim its mantle as a store of value.

Taken from this perspective, crude oil has done a much better job as an inflation hedge. At current levels, crude’s average price is much closer to its inflation-adjusted peak, also set in 1980.

Crude averaged an inflation-adjusted price near $95 in 1980. We’ve been living in a $90-$100 oil world for months now. Even if prices stabilize at current levels, crude oil can cruise through 2008 to take out its historic high average price.

So, what’s a better herald of inflation now: black or yellow gold? You tell me.

A picture’s worth a thousand words: