Liquid alternatives are broadly defined as strategies that are available in registered funds (mutual funds, ETFs and UCITs) that seek to provide investors with diversification benefits and downside protection. Following the crisis, liquid alternative funds grew rapidly as more allocators sought to introduce sophisticated portfolio construction methodologies across retail and other portfolios. In recent years however, growth has slowed as many early adopters expressed frustration that performance had failed to match expectations. In the first part of this two-part series, we will diagnose the failure of “Generation One” liquid alternative products to deliver the promised diversification benefits before exploring the ways in which “Generation Two” products can meet the needs of allocators. This series is derived from a lengthier article available here.

Problems with Generation One Liquid Alternatives

Generation One products came in two general flavors: multimanager products designed to be “one-stop” solutions for the bucket, and single manager products akin to individual hedge funds. There have been three primary issues with these products.

1. Structural Underperformance of Some Liquid Alts Relative to Hedge Funds

Multimanager vehicles were built to appeal to asset allocators as a one-stop solution designed to match or outperform the “bucket.” While multimanager funds offered potential diversification akin to a portfolio of hedge funds, they suffered from two issues: poor net-of-fee performance and particularly high fees. Over the past five years multimanager mutual funds returned 1.9 percent per annum, or slightly more than half the 3.4 percent delivered by funds of hedge funds.1 Consequently, the funds underperformed despite a modest advantage on fees.

Another example is the managed futures space, where you can compare the performance of CTA mutual funds with CTA hedge funds. The SocGen CTA mutual fund index has underperformed the hedge fund counterpart by approximately 270 bps per annum since inception of the former in January 2013. Here, most attribute the underperformance to limitations on leverage. Whatever the reason, over the past three years, a persistent drag of two to three percent eliminated almost all cumulative performance. Difficult to justify, to say the least.

2. Fees That Are “Low Relative to Hedge Funds” Can Still Be Prohibitively Expensive

Hedge funds fees have taken center stage recently.2 Many Generation One products were designed with the pitch that, “if it’s cheaper than hedge funds at 2/20, it’s a great deal.” Multimanager mutual fund marketing material often highlighted the fact that fees and expenses were “half” those of funds of hedge funds.

But half of five percent is untenably high for fee-sensitive investors. The average expense ratio of the multimanager mutual funds described above is around 2.6 percent today. For a target date fund with an expense ratio of 40 bps, a 10 percent allocation would increase the expense ratio by roughly half. Given regulatory oversight and competitive pressures, suffice it to say that this is almost certainly a dealbreaker.

When the average multimanager mutual fund has returned 1.9 percent, a 2.6 percent expense ratio means that nearly six of every 10 dollars made by the fund were paid away in fees — a worse ratio than for most hedge funds.

3. Dispersion of Single Manager Funds

The final issue is the dispersion of performance among hedge fund strategies. Among equity hedge funds that reported to the HFR database between 2000-2016, the average annual dispersion between the top and bottom decile performers was 40 percent, and has been as high as 80 percent in a single year. This dispersion introduces fund selection risk that is an order of magnitude higher than in most traditional strategies. The same holds true for liquid alt funds.

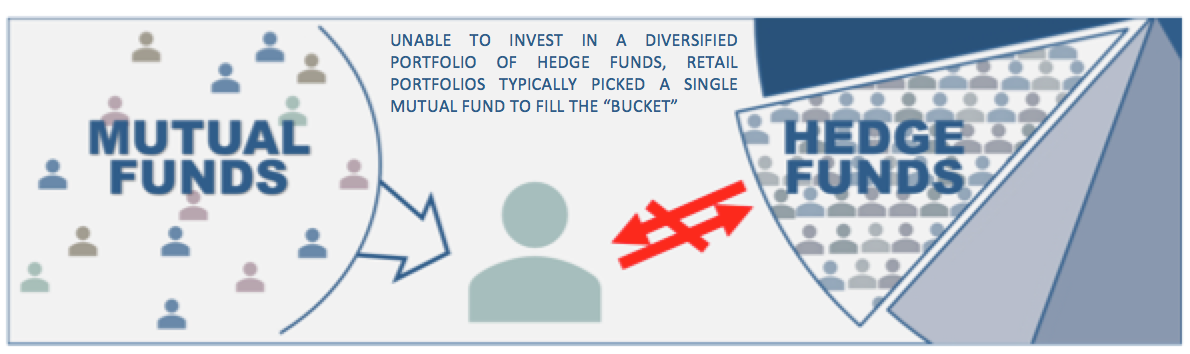

The first generation of liquid alternatives products solved the “access and liquidity” issues. However, there were far fewer options than among hedge funds themselves, and the fund selection team would typically select a single liquid alternative fund to fill the bucket as shown below.

Selection of a single fund failed to address the dispersion issue in hedge fund strategies. In a performance comparison of 36 equity long/short mutual funds over the past five years, the spread between the top and bottom performer was 154 percent.

Conclusion

Given the issues with Generation One products, Generation Two should satisfy three criteria for allocators:

1. Performance: Match or outperform a hedge fund index — especially no structural underperformance.

2. Cost: Have a low all-in fee structure that is comparable to traditional funds and attractive to fiduciaries.

3. Consistency: Deliver consistent results akin to those of a highly diversified portfolio of alternative managers.

In the second part of this series, we’ll discuss the asset allocation process and where Generation Two fits into this process. Furthermore, we’ll establish why a replication-based approach is especially well-suited to satisfy the needs of allocators within the Generation Two framework.

End Notes

1 The performance of the multimanager mutual funds is an equal-weighted composite and assumes monthly rebalancing.

2 Financial Times: The Hedge Fund Fee Structure Consumes 80% of Alpha

Andrew Beer is Managing Partner and Co-Portfolio Manager, Dynamic Beta at Beachhead Capital Management, a hedge fund replication strategist with more than $500 million under management.