As the price of Bitcoin has surged along with its growing integration with established financial markets, so are the scams surrounding the digital currency. Security firm ZeroFox has reported a surge of Bitcoin-related crimes in March, with 3,618 URLs linked to scams, shared over 8,742 social media posts, The Verge is reporting. The scams ranged from basic phishing attempts to elaborate pyramid schemes, all using the Bitcoin logo to lure unsuspecting victims. They're pretty basic, according to ZeroFox, either tricking users into installing malicious apps or promising free money in exchange for an initial payment. The rise in scams coincides with Bitcoin reaching all-time highs in price, including being worth more than an ounce of gold for the first time. “In the end Bitcoin, just like social media, depends on community-based trust,” ZeroFox data scientist Phil Tully said. “When certain members of these communities violate that trust, it can ruin a good thing for everyone.”

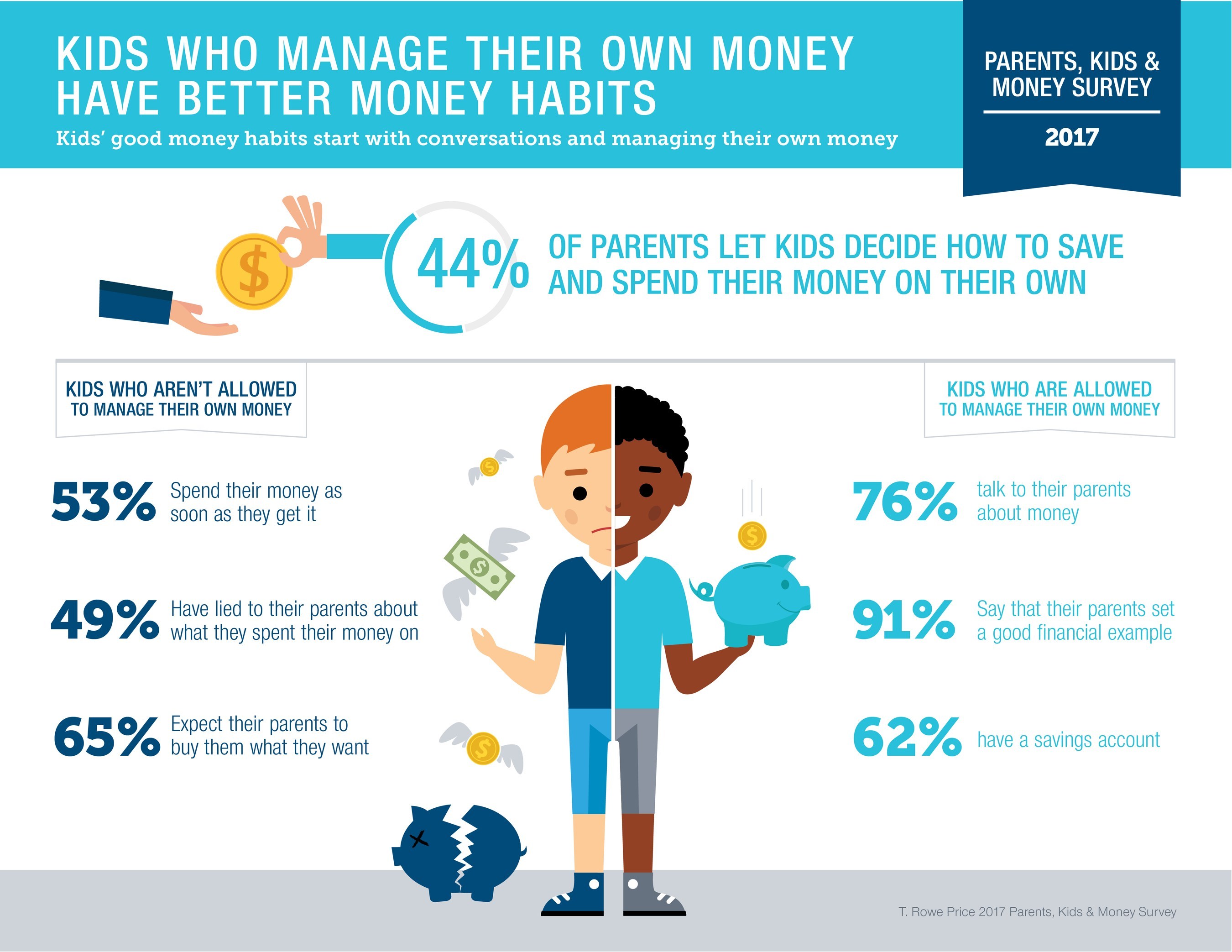

Helicopter Parents Hurt Children's Financial Aptitude

It can be tempting for parents to over-focus on their kids and go with the so-called “helicopter parenting” style. But that style of parenting can have a negative impact on children’s financial habits, according to T. Rowe Price’s 2017 Parents, Kids & Money Survey. Rather, kids who have the freedom to manage their own money have better money habits, found T. Rowe Price, which surveyed 1,015 parents of 8- to 14-year-olds and their kids. The 44 percent of parents who let their kids manage their own money were less likely to: have kids who spend their money as soon as they get it (40 percent versus 53 percent for parents who don’t let kids control); have kids who lie about what they spend their money on (29 percent versus 49 percent); have kids who expect their parents to buy them what they want (52 percent versus 65 percent); and have their children feel ashamed because they have less than other kids (30 percent versus half). Kids who control their own finances are also more likely to say that they talk to their parents about money, at 76 percent, and that they have learned about money from their grandparents (55 percent), teachers (45 percent), or other family members (32 percent). “Giving them real life money experiences brings finances out of the conceptual and puts it into practice,” said Roger Young, a senior financial planner at T. Rowe Price and father of three.

Sizable Morgan Stanley Team Leaves for Merrill Lynch

A Morgan Stanley team with $343 million in client assets under management has left to join Merrill Lynch. Michael Greenstone, John Araneo, Margie Manning and Anita Srivastava will be part of the thundering herd in the Glen Rock, N.J. office. All of the advisors moving have many years of experience, led by Greenstone, who became an advisor in 1980.