By Dani Burger

(Bloomberg) --Internet stocks, the Nifty Fifty, Crocs -- Wall Street’s littered with examples of what can go wrong when market fads run amok.

Is the same fate awaiting the increasingly popular investment style known as smart beta?

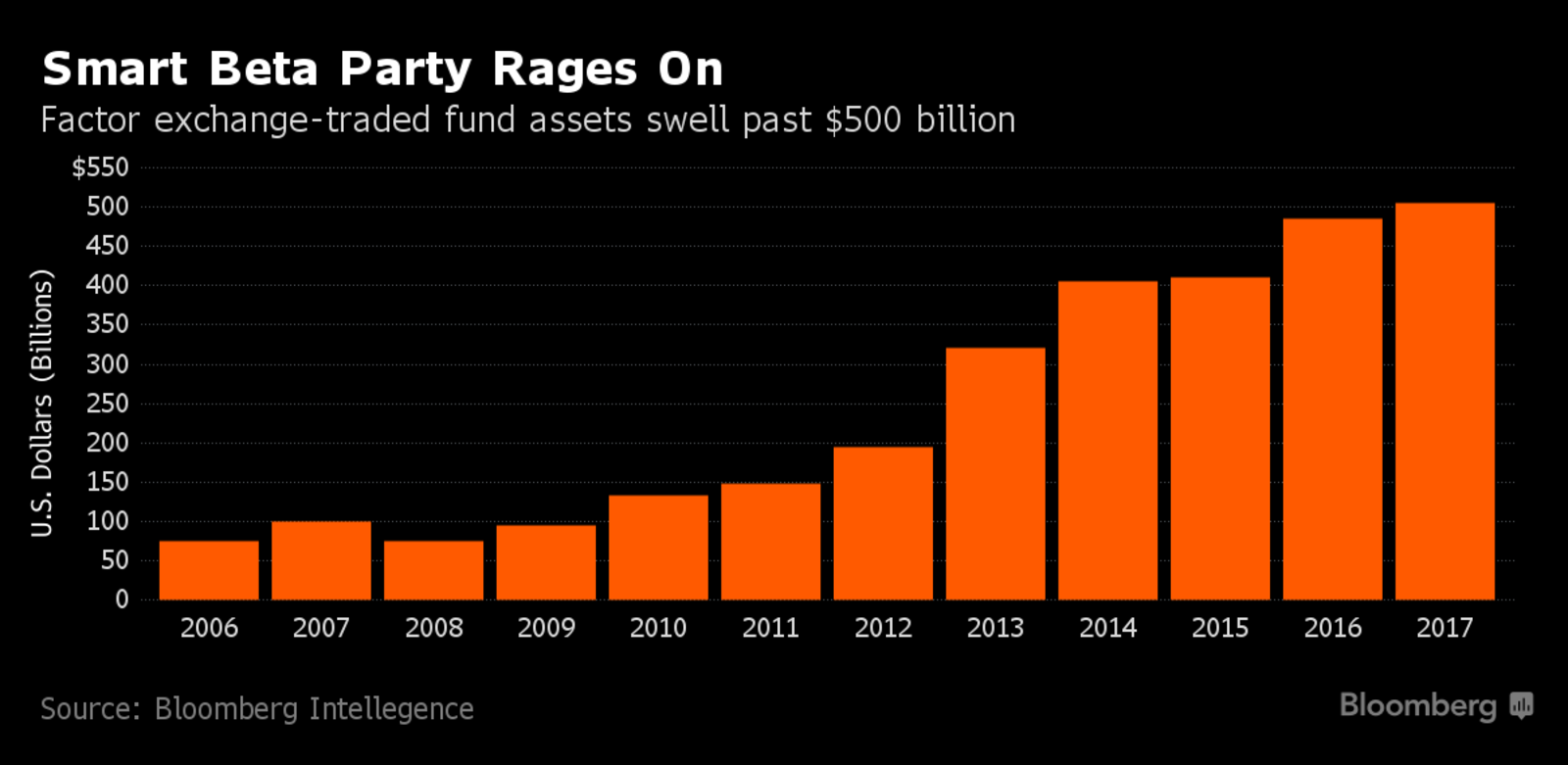

Among securities industry professionals, the threat level is rising. Concern stems from a surge in money chasing strategies that slice and dice the market based on various stock traits, factors like cheapness or volatility. Assets in these smart beta exchange-traded funds, which use methods that are similar to actively managed portfolios but are in a passive instrument, just topped $500 billion for the first time.

And that’s just the tip of the iceberg. Interest in quantitative investing is exploding as traditional managers like Paul Tudor Jones recruit market technologists in droves. Thousands of data scientists are entering investing contests as crowd-sourced funds like Quantopian promise to plow funds into computer programs. Hedge funds have as much as $300 billion in quant strategies, much of it incorporating factor logic.

Quant’s a craze. And it’s starting to evoke memories of trades that got too crowded in the past.

AQR Capital Management’s Cliff Asness, while not in the Cassandra camp, says it isn’t unusual for the volatility of trading methodologies to increase once they seep into the public consciousness. Crashes, to Asness a natural feature of the investing landscape, become a bigger risk.

“I won’t pretend I don’t wish we were the only ones who knew about these,” the 50-year-old founder of Greenwich, Connecticut-based AQR said.

Concerns about market risks arising from stocks lumped together by factors have been around for a while, topping out a year ago when industry pioneer Rob Arnott warned that many strategies had worked because their popularity was puffing up valuations.

While far from unanimously accepted, Arnott’s theory reflected a concern common in trading circles that once a strategy becomes known, its charms diminish. For program traders, the classic example was the August 2007 quant meltdown, in which correlated bets among a swath of hedge funds turned sour and resulted in widespread losses.

Evidence has accrued over the years that it becomes harder to profit from market anomalies once they’re harvested en masse. Take investment ideas outlined in academic papers. Three years after publication, their returns fall by more than half, according to research from David McLean, a finance professor at DePaul University.

At least one smart beta category, small caps, has seen its usefulness in fund diversification fade, according to Michael Iachini, head of ETF and mutual fund research at Charles Schwab Investment Advisory. Correlation between the Russell 2000 and the S&P 500 from 1979 through 2001 was less than 0.7, low enough to achieve meaningful diversification, Schwab’s data show. From 2002 to 2016, correlation rose to more than 0.9.

Some analysts thought they saw a herding effect in low-volatility funds last year as investors plowed money into defensive and dividend-yielding stocks, which made up the majority of the ETFs’ holdings.

For example, total assets in the iShares Edge MSCI Minimum Volatility fund reached $15 billion by late July, more than twice what they were at the start of 2016. Soon, the BlackRock Inc. product began to see historically large price swings. It fell 2.8 percent in October, its worst month in over a year, as investors pulled $2.1 billion in the last three months of 2016.

Iachini says there’s no cause for structural concern just yet. But he believes investors should lower their expectations for future returns from factors. With more money finding its way to the ETFs, don’t be surprised if their performance is less robust in the next decade, he argues. The more well-known, the less edge exists.

“I would set my future expectations lower for smart beta factors,” said Iachini. “When you look at the past 10 years, am I going to expect the same for the next 10 years? I’d expect less because there’s more money there.”

For its part, Goldman Sachs Asset Management disagrees that crowding is an imminent issue.

“In active management, a large percentage of returns are based on factors, and active managers are investing in factors,” Mike Crinieri, the firm’s global head of ETF strategy. “We’ve seen this big movement of flows from active management into passive, and a large part of it is into traditional index products.”

About 20 percent of money moving from active to passive has gone to smart beta products, with the rest chasing market-cap index funds, according to Crinieri.

Asness has occasionally found himself in public debates about the frothiness of factor investing. He issued a vehement rebuttal to Arnott’s contention that swollen valuations present a risk for strategies like momentum and low volatility. Any effort to pop in and out of factor strategies is probably doomed, he wrote.

Still, Asness can’t help but sense the onslaught of newcomers in the space he pioneered decades ago.

“Despite becoming more well-known and popular, these factors are largely still reasonably priced,” he said. “There have been crazy moves in our market. Any known strategy has that, and quantitative ones aren’t immune.”

To contact the reporter on this story: Dani Burger in New York at [email protected] To contact the editors responsible for this story: Jeremy Herron at [email protected] Chris Nagi, Eric J. Weiner