When I hear the term “hedge funds,” I can’t help but think of an ice cream parlor. The place that advertises its “31 Flavors.” Why? Because of all the choices available.

Accredited and institutional investors are also faced with a myriad of choices when they consider private placements. Instead of strawberry, lemon custard and orange sherbert, of course, investors have to choose from long/short equity, market-neutral, merger arbitrage and event-driven funds—and more. For those who have trouble deciding, there’s the multi-strategy fund—a sort of “tutti frutti” of investment approaches.

Multi-strategy was, in fact, the hedge fund flavor of choice last year as investors, hungering for performance and diversification, switched out of long-only equity strategies. Multi-strategy hedge funds are supposed to be absolute return investments, capable of cranking out positive returns no matter what the equity markets do. Their hallmark is a low correlation to stocks.

Not everyone can pay the rather stiff cover charge required to step into the hedge fund parlor, though. For those left outside, there’s still a way to get hedge fund returns on the cheap—through exchange traded funds (ETFs). Three ETFs provide multi-strategy hedge fund replication:

The IQ Hedge Multi-Strategy Tracker ETF (NYSE Arca: QAI) portfolio is an amalgam of sub-portfolios, each emulating the returns of a specific hedge fund strategy. Mostly composed of ETFs, these sub-portfolios are built by quantitative analysis, actively managed and, when aggregated, are supposed to replicate the returns of a hedge fund of funds. QAI, launched in 2010, is the granddaddy of multi-strategy hedge ETFs.

At last look, the QAI portfolio included more than 60 ETF positions, both long and short, and an equal number of ETF swaps. Fixed-income ETFs, held long, take up the largest portion of the fund’s portfolio.

Then there’s the PowerShares Multi-Strategy Alternative Portfolio Fund (Nasdaq: LALT). An actively managed portfolio like QAI, this fund holds individual stocks among other non-ETF assets. The stocks held long are deemed undervalued and hedged against market beta with equity index futures. LALT also follows a long/short strategy with currency forwards while maintaining a sizeable long exposure in interest rate futures. LALT debuted in 2015.

The ProShares Hedge Replication ETF (NYSE Arca: HDG) takes a passive approach by tracking an index of long and short positions in individual stocks, equity ETF swaps, currency futures and Treasury securities. HDG premiered in 2012.

HDG’s index algorithm currently calls for a large allocation to short-dated Treasury bills as well as an extensive array of equities. All told, the portfolio holds nearly 2,500 stock positions. And, despite a substantial offsetting short position through S&P 500 swaps, HDG remains tightly correlated to the U.S. equity market.

Taking stock

The trouble with these ETFs is their ingredient lists. While the ETFs are certainly transparent—each holding is disclosed daily—investors don’t get attributions. They don’t know how much exposure they are actually getting to market-neutral, event-driven or any of the other strategies at any given time.

How does one choose a fund without that information? After all, it’s the strategy allocations that determine returns.

Speaking of returns, how’s the multi-strategy approach fared over the past year? Has the switch from long-only equities paid off for investors?

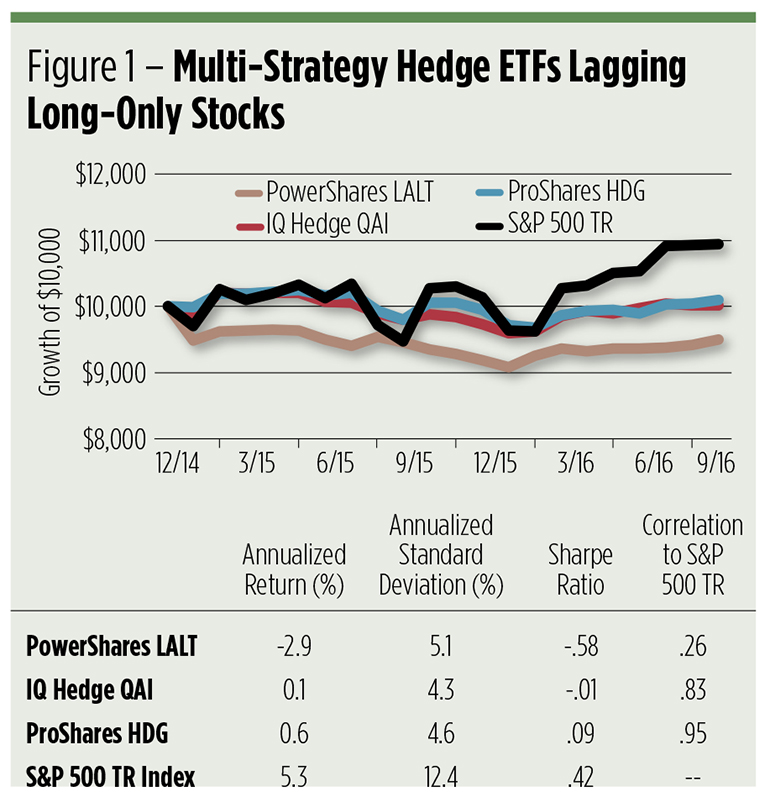

Well, yes and no. From the chart below, we can see that all three of these ETFs have underperformed the S&P 500 on a total return basis. From this, you might think the hedge strategy’s been a bust. Interim gains aren’t the only measure of an investment’s performance, however. There’s risk to be taken into account. Across the board, swapping into a multi-strategy position substantially reduced volatility for investors, by more than half, but the hedge fund ETFs haven’t yet been able to crank out Sharpe ratios better than that of the S&P 500. Keep that word “yet” in mind.

What’s next?

Are we too impatient with the hedge fund strategy? Better yet, is there something we can do to goose up risk-adjusted returns? To answer those questions, we need to dig into the ETF returns to identify their most significant contributory strategies. Once we know those, it may be possible for us to adjust the multi-strategy approach with over- or underweights.

There are a number of single-strategy hedge ETFs we can use as benchmarks in our return attributions.

The IQ Hedge Long/Short Tracker ETF (NYSE Arca: QLS) is an index tracker that takes long and short positions primarily in ETFs and ETF swaps. The fund’s index methodology combines ETFs and derivatives covering the U.S. and foreign equity markets as well as high-grade debt and bank loans. Not surprisingly, QLS is “half way” correlated to the U.S. stock market with a lifetime coefficient of .46; beta, at .43, is also middling.

Large-scale economic trends are exploited by so-called global macro funds such as the IQ Hedge Macro Tracker ETF (NYSE Arca: MCRO). Passively managed, MCRO is geared to emulate the returns of macro and emerging markets hedge funds with a .66 correlation to the U.S. equity market and a .30 beta.

Market-neutral funds attempt to hedge out equity market risk while trying to wrest gains from stock picks and other assets. The IQ Hedge Market Neutral Tracker ETF (NYSE Arca: QMN), with a beta of just .08, does a good job of minimizing market exposure. Its correlation to domestic stocks, at .35, is also modest.

Restructurings and corporate recapitalizations brought about by mergers, spinoffs and bankruptcies are exploited by a number of event-driven hedge strategies. Through a portfolio composed of mostly ETFs, the IQ Hedge Event-Driven Tracker ETF (NYSE Arca: QED) attempts to replicate the returns of these funds. Exposure to equities is necessarily high as reflected in QED’s .95 correlation to U.S. stocks. Beta, at .54, is moderate.

So, how do we identify the strategies that are overperforming and those that are laggards? One way is to look for factors common to the multi-strategy funds and the four single-strategy ETFs. This allows us to see what factors contribute most to the funds’ returns. For example, we can use these three classic risk/return signatures from the Fama-French Model:

- Beta—Estimated to account for up to 70 percent of a security’s return, beta measures the fund’s sensitivity to the overall equities market.

- Size—Small-cap stocks behave differently than large caps. Over the long run, small-cap stocks generate higher returns, but they in turn carry higher risk. The size factor measures the risk premium.

- Value—Like small caps, value stocks offer a risk premium; they tend to generate higher returns than growth stocks over time. Value is generally determined by a stock’s lower price-to-book and price-to earnings ratios.

With our factor analysis, we can build “clones” of each multi-strategy ETF from the single-strategy funds. The greater the factor similarity between a multi-strategy fund and a single-strategy ETF, the larger the singleton’s allocation within the clone.

We’ll skip the math for simplicity’s sake and further restrict our clones to two component ETFs to make it easier to see outperformance when we compare track records. Clones that do better than their multi-strategy fund targets will showcase the most efficient hedge strategies—ones that would have benefitted investors most with overweights.

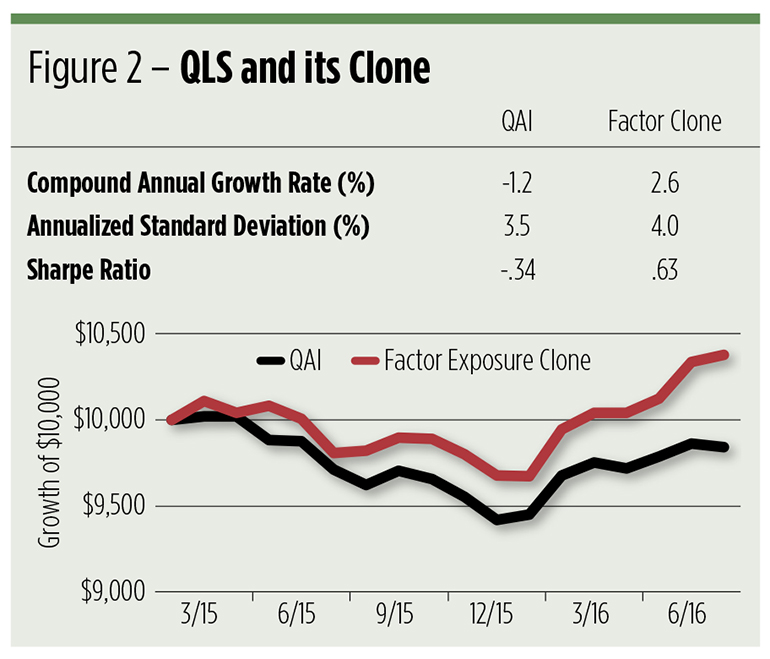

QAI Clone—65 percent QED (event-driven); 35 percent QMN (market-neutral). With a combination of event-driven and market-neutral outperforming QAI, MCRO (global macro) and QLS (equity long/short) would have been drags on performance.

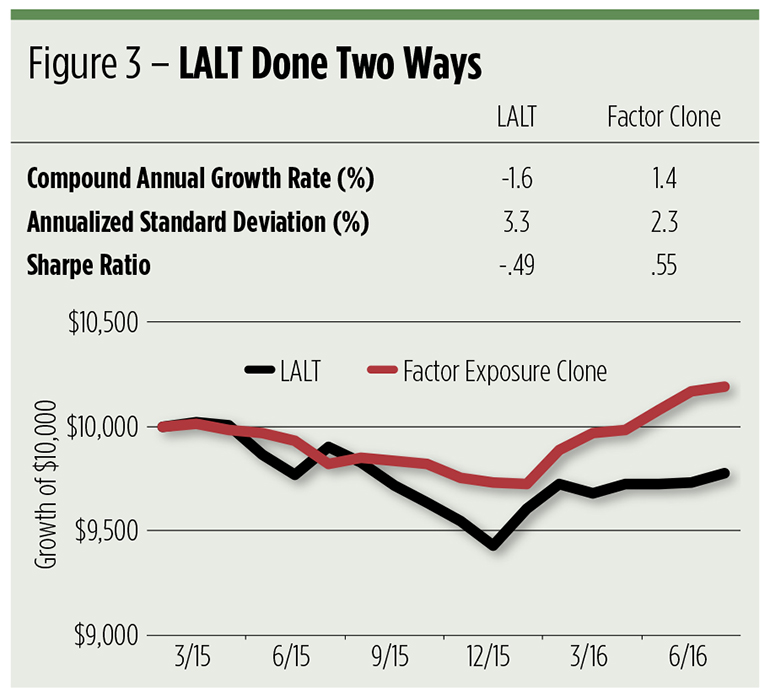

LALT Clone—72 percent QMN (market-neutral); 28 percent QED (event-driven). Again, reducing exposure to market-neutral and event-driven strategies outguns a diverse approach. And that again puts global macro and equity long/short in the doghouse.

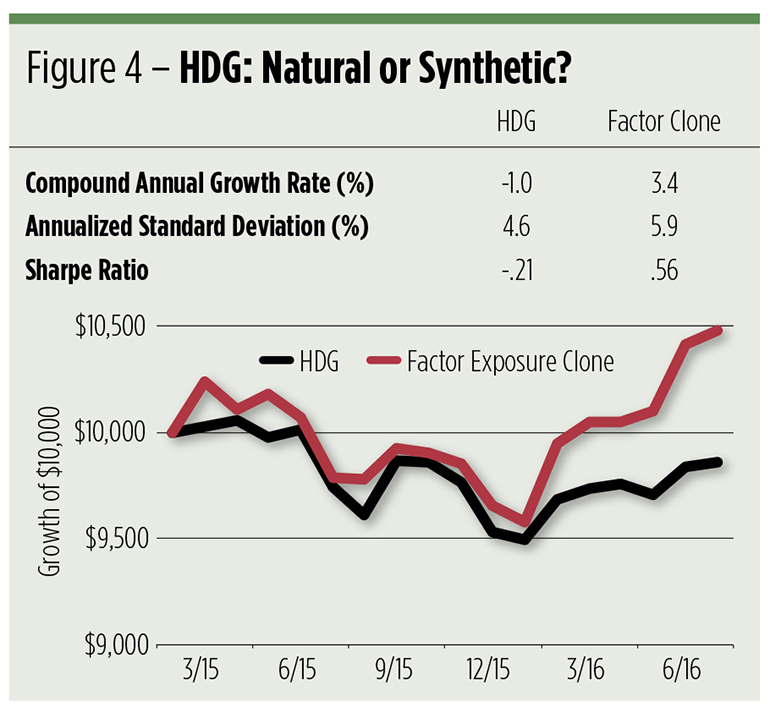

HDG Clone—88 percent QED (event-driven); 12 percent QLS (equity long/short). The passive HDG fund was bettered by limiting exposure to event-driven and equity long/short strategies. Global macro was left behind along with market-neutral.

And, in the end…

Apparently, there’s more to diversifying away from equity market risk than just swapping into a multi-strategy fund. Witness the improvement in risk-adjusted returns in our cloning experiment. Distilling the multi-factor approach down to two exposures swung Sharpe ratios 90 ticks in a positive direction from an average of -.35 to .55.

The exercise also reveals a pecking order of contributory strategies. Event-driven is featured in all three clones, with an average allocation of 60 percent; market-neutral, at a 54 percent average share, appears in two clones, while equity long/short shows up only once at 12 percent. Global macro was shut out entirely.

So what does this tell us? Two things. First, there’s more than one way to build a multi-strategy hedge fund replicant. The event-driven strategy seems common to all, but varies in its influence. Attributions to the other strategies show even more variance. Second, and perhaps most importantly, the performance contributed by each of the strategies is ethereal. Event-driven stands out now as the best of the four, but who’s to say that global macro won’t be on top 12 months from now? That’s, of course, the beauty of multi-strategy funds: You’ve got all of the arrows in your quiver. You just never know when you’re going to need one or the other.

But we do know this from our analysis: Over the past year or so, the “31 Flavors” approach has been bested by a double-cone serving of event-driven. Anybody care to guess the flavor of choice for 2017?

Brad Zigler is REP./WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.