In a recent opinion piece on LinkedIn.com, Sallie Krawcheck argues that Donald Trump may, in fact, be the best thing to ever happen to women in business. Yes, you heard that right. The CEO of Ellevest and chair of Ellevate Network outlines several reasons, the first being that the issues around gender equality are all out in the open now, given the news stories about Trump’s treatment of women. And we can’t move forward without understanding the problems. His election also shows that women can’t rely on others to fight the battle, “so we must redouble our efforts,” she writes. In addition, women have a lot of power, with control of $5 trillion of investable assets. “So it’s becoming clear that, if we care about this, we have to do something different—and more—tomorrow than we did yesterday.” What can women do to use their power? Mentor other women; sponsor other women; talk up other women at work; buy from companies that promote women—BuyUp Index being one way to do so; encourage other women to run for office; or run for office yourself. These are just a few ideas.

How Trump May Help Donor-Advised Funds

Donor-advised funds are growing, and the boom should only continue, writes Ashlea Ebeling for Forbes. In each of the last six years, these funds, which exist at the national and community level, have seen double-digit growth in number, donations and dollars granted out. If president-elect Donald Trump successfully implements his tax plan that includes a $100,000 cap on itemized deductions for individuals and a $200,000 cap for joint returns, then it makes sense that donor-advised funds, which provide immediate tax benefits, should see even more activity. Neil Kawashima, an estate lawyer with McDermott Will & Emery, said to Forbes that the Trump presidency makes it tax-savvy for many investors to give to charity in the 2016 tax year.

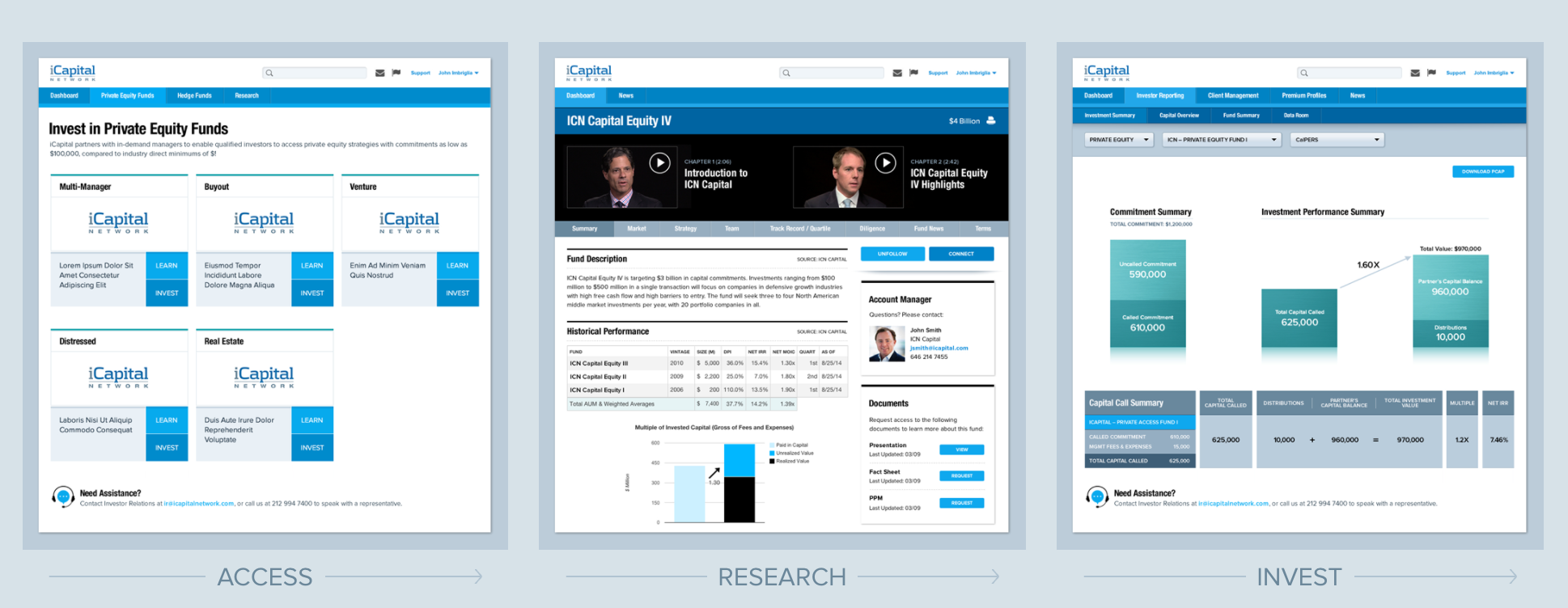

iCapital Network Reaches $2 Billion Milestone

Two years after it launched, iCapital Network reported Monday that it now has $2 billion in assets on its online alternative investment platform. The network has attracted 1,300 users to connect them with private investment opportunities that are traditionally the domain of institutional investors. iCapital has also joined the Fidelity Institutional alternative investment platform as a strategic partner, and was selected by Dynasty Financial to power the Dynasty Select platform for independent advisors. “Our top priority is to offer our investors, registered investment advisors, broker/dealers, private banks and family offices access to the highest caliber of alternative investing opportunities,” said Lawrence Calcano, CEO of iCapital. “In order to meet that goal, we are sharply focused on bringing together the right combination of industry leaders and experts to ensure we have the necessary skills and bench strength across every function.”