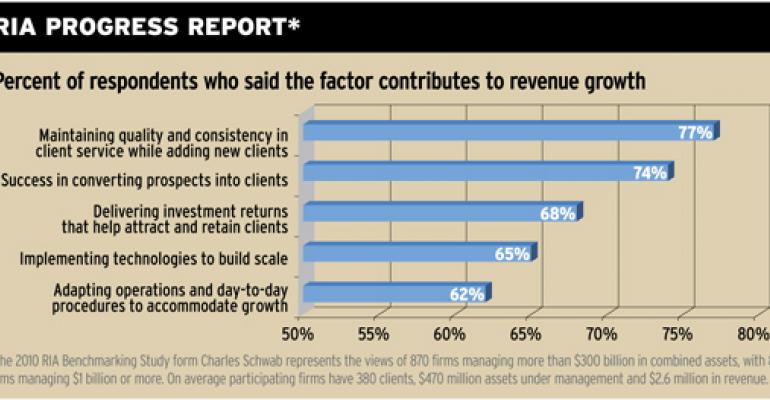

Despite short-term stock market volatility, lower revenues and compressed profit margins, the long-term growth prospects of the independent registered investment advisory industry are strong. In fact, 84 percent of advisors expect their firms to grow moderately to aggressively over the next five years, according to a 2010 RIA Benchmarking Study by Charles Schwab. The advisors surveyed projected an average increase in 2010 revenues of 10 percent, despite an average estimated decline of 11 percent in 2009 revenue.

Referrals continue to be an essential driver of growth for advisors, accounting for 83 percent of advisors' new clients. Roughly half of those referrals come from existing clients and a quarter come from professional partners, says the Schwab study. “We are seeing an increasing number of advisory firms recognize the importance of strategic business planning,” says Bernie Clark, senior vice president and head of Charles Schwab Advisor Services. “Three years ago, it was about ‘how do we grow as fast as possible’ for many firms. Now, advisors are much more focused on ‘how do we really plan for growth and do it in a strategic and deliberate way.’” More specifically, RIAs surveyed said investing in technology will be a strategic priority.