By Elizabeth Dexheimer

(Bloomberg) --Wall Street has a lot to lose -- or potentially gain -- in a handful of political races voters will decide next week.

Democrats need to pick up at least four seats to take control of the Senate. Republicans maintaining majorities in both the Senate and House would be the finance industry’s best defense to keep dogged bank antagonists like Elizabeth Warren at bay. A Democratic majority in the Senate could give Warren and other progressives more sway in appointing tough financial regulators and pushing aggressive rules for banks, hedge funds and asset managers.

Adding to banks’ anxiety this election season is Wells Fargo & Co.’s bogus account scandal. It has put lenders on the defensive even more than they already were in Washington and reinvigorated calls on the campaign trail to punish firms and executives for alleged misconduct.

The industry has spent millions of dollars to help re-elect lawmakers who sit on key Senate panels that shape financial and tax policy, and decide who is appointed to crucial posts at the Treasury Department and Securities and Exchange Commission.

Regardless of whether Donald Trump or Hillary Clinton wins the presidency, the party that controls the Senate will likely have a slim majority. That makes every lawmaker’s vote consequential in determining regulatory jobs. Wall Street is laser focused on regulators because government agencies have been where most big battles over the Dodd-Frank Act have been fought in recent years. With Congress gridlocked, few major bills have been passed that impacted the finance industry since Dodd-Frank’s 2010 approval.

Here’s a snapshot of some of the candidates who could have big consequences for Wall Street.

Pennsylvania -- Pat Toomey

The most expensive U.S. Senate race in history is unfolding in Pennsylvania, where at least $139 million has been spent by Wall Street, unions, billionaires and other contributors. Toomey, a former derivatives trader, sits on both the Senate Banking Committee and Senate Finance Committee, which oversee banks and tax policy, respectively. If he fails to beat Democrat Katie McGinty, the industry will lose someone it considers an ally in vetting Treasury and SEC appointments.

Toomey has a track record of advocating for policies aligned with financial firms’ interests. He sponsored legislation passed in 2014 that eased some rules for the derivatives industry, also known as swaps-pushout. He also introduced a bill that seeks to overturn tougher requirements for the money-market fund industry intended to curb risks that contributed to the 2008 financial crisis. The money-market rule is one that some firms have spent years and millions of dollars lobbying to reverse.

Employees from banks, hedge funds and private equity firms have given about $4.6 million to Toomey’s campaign and two allied committees, making him one of the top Senate recipients of funds from the finance industry this year.

Pennsylvania -- Katie McGinty

The Pennsylvania race could serve as a double whammy to Wall Street if Toomey loses, because it would mean gaining a lawmaker who appears to be part of Elizabeth Warren’s growing political posse. Warren has aggressively campaigned and raised money for McGinty. At political events, they regularly discuss their shared desire to strengthen financial reforms.

Attacking Toomey’s ties to Wall Street has been one of McGinty’s main lines of attack. She has continuously lambasted him for his campaign contributions, his past finance career and how a bank he invested in allegedly forced small business owners out of their homes.

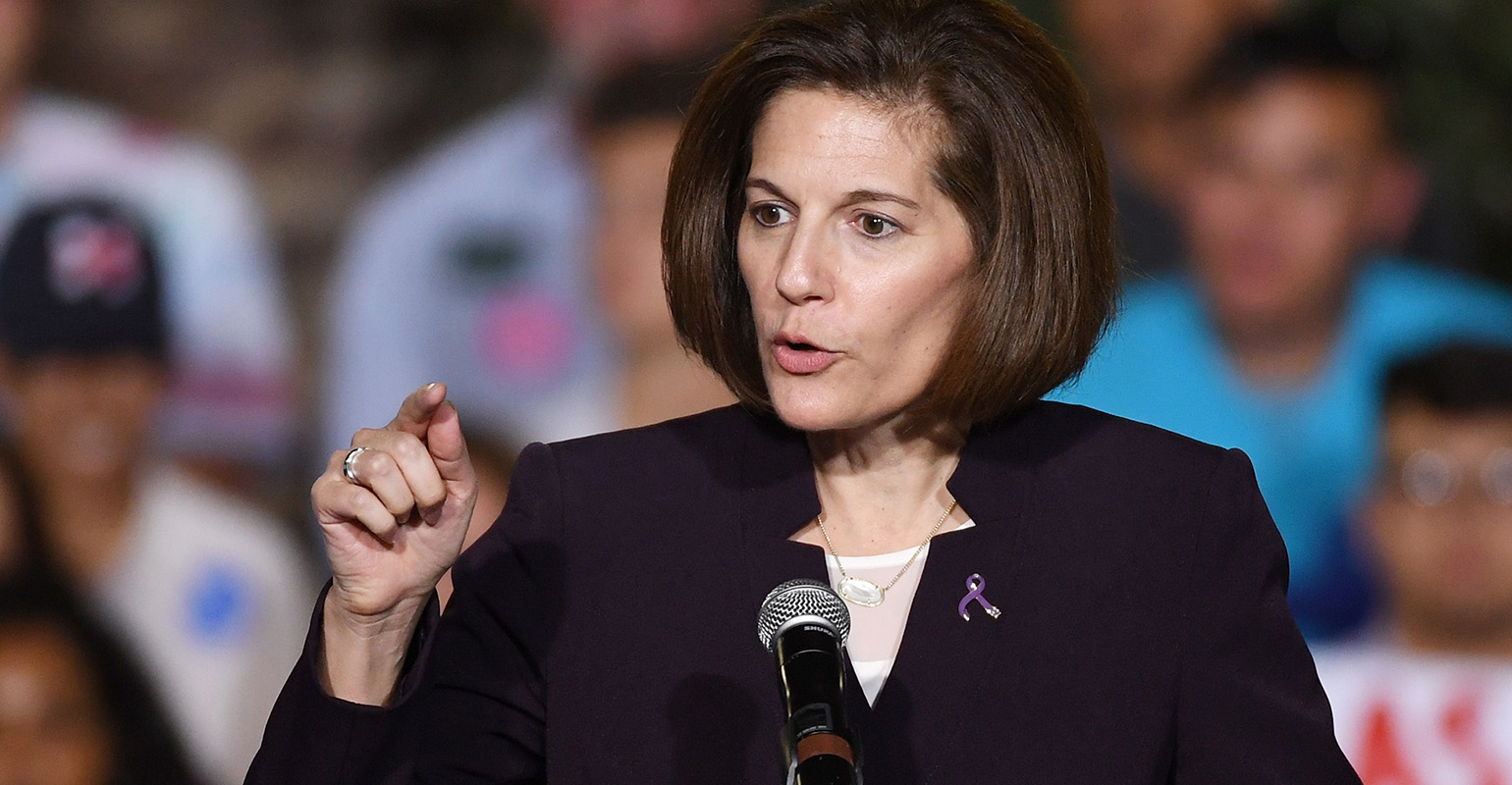

Nevada -- Catherine Cortez Masto

Democrat Catherine Cortez Masto in Nevada is another candidate that stands out as a potential ally of Warren’s. Throughout her campaign, she frequently cites how during her tenure as the state’s attorney general, she held Wall Street banks accountable. She sued Bank of America Corp. over deceptive foreclosure practices during the financial crisis and her office investigated more than 200 companies for mortgage fraud. Wall Street lobbyists fear her background could make her a contender to join the Senate Banking Committee.

Masto is running against Republican Joe Heck, currently a U.S. representative from the state’s third congressional district.

Indiana -- Evan Bayh

Should Democrats take control of the Senate, bank lobbyists will be looking to moderates to help blunt Warren’s clout and provide balance on the banking panel, which is expected to be chaired by Sherrod Brown, a progressive Democrat from Ohio.

Democrat Bayh, who is running in Indiana, fits the mold. Bayh, considered a centrist, is looking to reclaim his seat after retiring from Congress in 2010. Since he left office, he’s been a lobbyist in Washington, an adviser to the private equity giant Apollo Global Management and sits on the board of Fifth Third Bancorp.

Should he win and return to the banking committee, lobbyists expect he’d be more likely to work across the aisle and be receptive to Wall Street’s issues. He’s currently leading in polls against Republican Todd Young.

Illinois -- Mark Kirk Versus Tammy Duckworth

Mark Kirk, the Republican candidate in Illinois, sits on the banking panel. He’s been trailing in polls.

Tammy Duckworth, the Democrat running against him, has been championed by Warren. While her record on financial services issues is thin, Duckworth has been outspoken about tougher rules the Department of Labor imposed this year on brokers who manage retirement accounts. While the Obama administration has said the rule will help protect millions of savers from conflicted investment advice, the finance industry argues it will hurt less-affluent investors, because firms facing steeper compliance costs will drop smaller accounts.

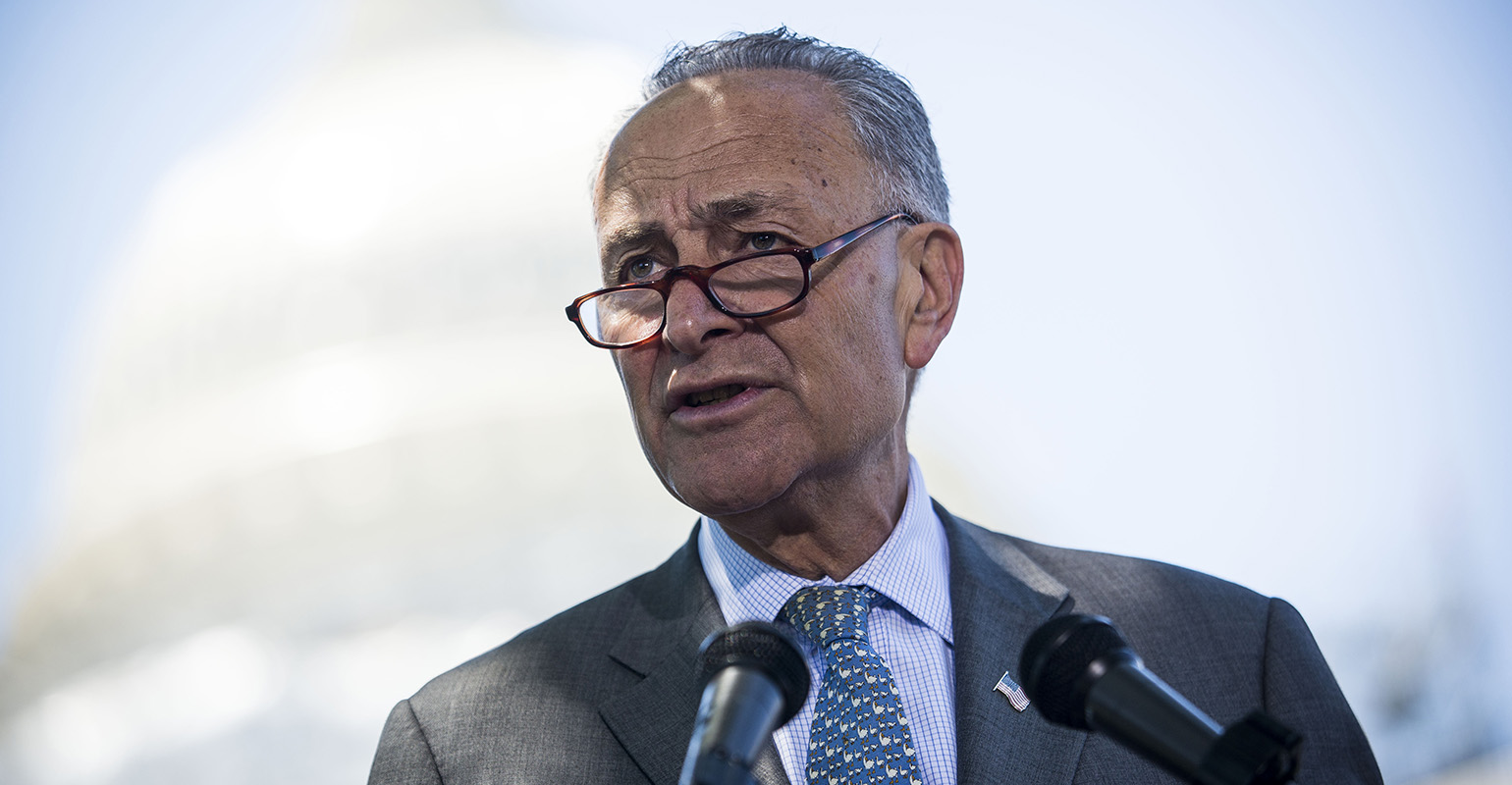

New York -- Chuck Schumer

Schumer is expected to coast to victory on Tuesday, but that hasn’t stopped Wall Street from spending money to re-elect him. That’s because he’s likely to play a crucial role as a buffer between the progressive wing of the Democratic party and Hillary Clinton, should she win the presidency. He’s also poised to be his party’s leader in the Senate. If Clinton prevails, agency appointments are expected to expose Democrat tensions between liberals and moderates. Warren and other progressives have already been trying to influence who gets on lists that Clinton’s transition team is lining up to vet for roles at Treasury and the SEC.

To contact the reporter on this story: Elizabeth Dexheimer in Washington at [email protected] To contact the editors responsible for this story: Jesse Westbrook at [email protected] Alexis Leondis