Mergers and acquisitions seem to be crawling back to the top of RIA principals’ to-do lists this year, as the first quarter’s numbers show record activity. What is your practice worth?

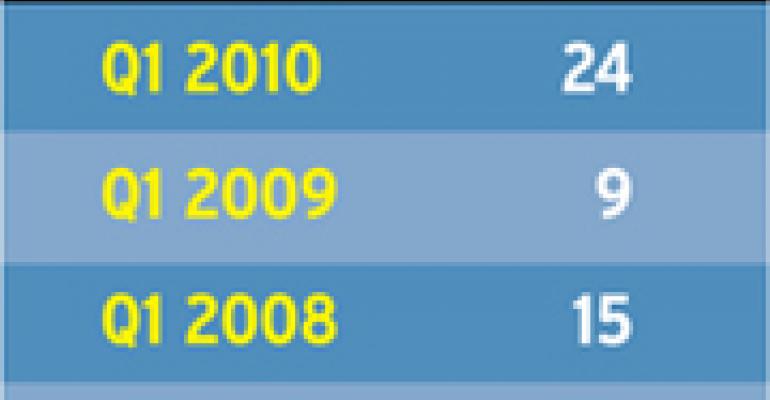

There were 24 M&A deals in the RIA space in the first quarter of 2010. That’s a record for any first quarter since as far back as 2003 when Schwab Advisor Services started tracking the data. Just nine deals were completed in the first quarter of 2009. Registered Rep. predicted the upturn early this year, but reckoned the M&A participants would be finicky indeed.

David DeVoe, managing director of the strategic business development group at Charles Schwab, says advisors are picking up where they left off back in 2008. “Many RIA principals are now re-engaging in the negotiations they’d stopped 18 months ago. M&A was put on the backburner and activity stalled as the market decline distracted advisors from deals they might have done,” he says.

Now, though, as the market continues to rally, advisors have fewer anxious clients and more time to focus on their business strategies. It’s likely that M&A activity in the RIA space will continue its upward momentum, and that more records will be broken as they were in the four successive years leading into 2009, Devoe says. “There was certainly a stall in 2009 but now the activity will continue for another five or seven years,” he predicts.

TD Ameritrade, as do other RIA platforms/custodians, offer advice and help in selling or buying advisory practices, as we recently noted online. We wrote: “Banking on a wave of mergers in 2010, the major custodian firms are in a race to offer the best M&A tools to their RIAs so that the assets of selling firms don’t walk out the door to a rival custodian. M&A in the RIA world had dried up but is starting to bounce back, say executives, as firms look for ways to cut costs and begin to grow again. Succession planning has also been a big issue in the financial advisory industry in the past few years, and will continue to be, as the average age in the industry is over 55.”

Also, as the market conditions show improvement, so do the valuations for RIAs, and that may also help increase deal activity this year. Over the last few years, valuations for a firm with $100 million in revenue have ranged somewhere between about four to six times cash flow. In 2007, when deals were at their hottest, they were on the upper end of that range, Devoe says. “In the immediate term, I think valuations are slowly returning to normal levels—somewhere between the extremes of 2007 and the lows of 2008.

The other differentiating factor in the last quarter’s figures is the significant number of small RIAs doing deals. Typically, firms with $250 million in assets or less, $250 to $1 billion and $1 billion or more make up an equal portion of the total deals. But in Q1 2010, 58 percent of deals involved firms with $250 million or less. “That’s a fairly big change,” Devoe says. But he is hesitant to make too much out of that statistic just yet. “We’ll see if that continues in the next few quarters.”

Two such deals include Bridgewater Wealth and Financial Management and Rowling, Dold & Associates. Bridgewater, a firm with about $200 million in assets, was acquired by RIA consolidator Focus Financial in January. Rowling, Dold and its $200 million in client assets was bought up by Moss Adams in the same month—the consulting firm’s first acquisition in about ten years.

In February, the mood was different, and we wrote, “Despite all the news about the decrease in M&A activity recently, the fact is, there’s still lots of action going on—and a lot of interested buyers. Still, for the seller, it’s an odd time. While a large pool of potential purchasers exists, valuations for many RIAs of all sizes have declined, thanks to market turmoil. The bottom line: It’s possible to end up with a deal that works for you, as long as you’re aware of what today’s market requires. That means everything from negotiating a valuation you can live with to persuading potentially skittish clients the sale is in their best interest.”