Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

Salesforce.com (CRM) is in the Danger Zone this week. The cloud-based customer relationship management (CRM) provider has helped pioneer the software as a service (SaaS) model, but the first-mover advantage can be short lived. CRM differentiated its services by delivering them through the cloud, but as other companies develop their own cloud platforms, CRM will be hard pressed to continue its spectacular growth. CRM’s strategy of acquisitions to grow revenue at the expense of profits raises questions over whether the company can achieve the profit margins necessary to support its expensive valuation.

Acquisition Strategy Hurts Profits And Strains the Balance Sheet

CRM has spent aggressively on acquisitions in recent years, including a $2.6 billion purchase of ExactTarget, a provider of digital marketing software, this past July. These acquisitions have kept the top line growing at the expense of profitability.

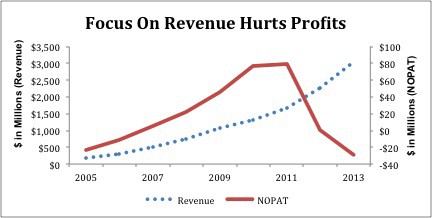

CRM’s cash operating profits (NOPAT) had been growing at an accelerating rate until 2011, when the company’s growth strategy shifted its focus to acquisitions and revenue growth. Over the next three years, the company spent (in millions) approximately $400, $420, and $580 respectively. As Figure 1 shows, these acquisitions have been good for revenue but bad for NOPAT.

Figure 1: Revenue vs. NOPAT

The ExactTarget acquisition appears to continue this pattern. In 3Q13, ExactTarget added roughly $81 million to revenue (accounting for 28% of CRM’s year over year revenue growth) and lost about $68 million (accounting for 55% of CRM’s reported pre-tax loss for the quarter).

While CRM has managed these acquisitions without overly straining its finances so far, the balance sheet is beginning to swell. At the end of its most recent fiscal year CRM had over $2.3 billion in adjusted total debt, which includes $1.1 billion inoff-balance sheet debt due to operating leases. That number has increased significantly in 2013, as CRM took on an additional $1.9 billion in debt and capital lease obligations. At the end of 2010, the company had under $780 million in total debt.

Salesforce is competing with giant companies like Oracle (ORCL), Microsoft (MSFT) and SAP (SAP) in the CRM industry. If it tries to outspend those companies it will have to run up even more serious debt or dilute equity holders. Oracle recently bought Big Machines, a company that Salesforce had previously invested in.

Buying up smaller companies to hit revenue targets and keep the stock price up is nothing new. Recent Danger Zone callsTangoe (TNGO) and InnerWorkings (INWK) followed the same strategy. Those two stocks are down 37% and 29% since I put them in the Danger Zone.

Competition Limits Growth

CRM helped pioneer the SaaS model, which allowed it to deliver business applications and software to customers in a new, more efficient manner. In many ways, CRM has a great deal in common with Netflix (NFLX). NFLX pioneered a new way of delivering content to consumers, but the barriers to entry were not enough to keep Amazon (AMZN), Hulu, and others from following in their footsteps. To protect its market share, NFLX has had to keep its margins low and attempt to differentiate with original content, which threatens to further erode its already thin margins because it is so much more expensive than the used content NFLX peddles now.

Similarly, CRM helped popularize the SaaS model both through its own software and its mobile app development platform. Long term, I don’t see any more value in the cloud platform for CRM than I do the streaming delivery system for NFLX. Once competitors can replicate the delivery system, the only differentiation becomes the content being delivered. CRM now has to rely on offering superior quality products, and while its current offerings still beat the competition, there’s no guarantee that it will hold on to that top spot in the future. Companies like ORCL or SAP could leverage their existing franchises and large installed bases of customers to create a competitive product, or smaller companies like SugarCRM could succeed through the open source software development model.

As of 2012 Salesforce had a 14% market share in the global CRM industry, which made it the industry leader. However, SAP and Oracle still have double-digit market shares, and small, fast growing companies like Sugar CRM and Zoho make up almost 40% of the market. As the market leader, Salesforce is in an enviable position, but there are too many competitors for it to achieve the market domination that its stock price implies.

Priced For Perfection

Salesforce could absolutely grow into a profitable company in the future. After all, it does have the largest market share and most advanced set of products in a rapidly growing industry. However, the massive revenue growth and margin expansion that its stock price predicts seems unlikely.

CRM’s current valuation of ~$51/share implies 30% compounded annual growth in revenue for 13 years with an average pre-tax margin of 7.5%. Under that scenario, CRM would have $95 billion in revenue in 13 years, which is about how much IBM generates today.

Even if we give CRM credit for more significant margin expansion, the required revenue growth is still staggering. If CRM’s pre-tax margin expands to 15 percent, the company would still need to grow revenue by 20% compounded annually for 15 years, at which point its annual revenue would be $55 billion, or around what Intel generates today.

Simply put, a $30 billion market cap for a company with negative profits does not make sense. There are too many competitors out there for CRM to grow revenue and expand margins simultaneously to the extent that the market valuation already implies. Too much downside risk is in this stock.

Insiders Selling

Over the past six months insiders have sold roughly 900,000 shares and bought a grand total of 200. Large portions of these insider transactions have been sales by management. Perhaps management is not as confident in the future of CRM as it would have us believe.

900,000 shares only represents 0.5% of the shares held by insiders, but the trend is still clearly towards selling rather than buying. Additionally, the amount of options exercised doubled from 2012 to 2013, with 5 million shares being exercised in 2013. Insiders don’t appear to see much more upside to the stock at its current valuation.

Avoid These Funds

Investors should avoid the following ETFs and mutual funds due to their 6+% allocation to CRM and Dangerous-or-worse rating.

- iShares iShares North American Tech-Software ETF (IGV): 8.4% allocation to CRM and a Dangerous rating.

- Berkshire Funds: Berkshire Focus Fund (BFOCX): 6.8%% allocation to CRM and a Dangerous rating.

- Touchstone Funds Group Trust: Touchstone Sands Capital Select Growth Fund (CFSIX): 6.2% allocation to CRM and a Dangerous rating.

Sam McBride contributed to this article.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.