Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

Financials sector ETFs and Mutual Funds are in the Danger Zone this week. The Financials sector ranks last out of the ten sectors in my Sector Rankings for ETFs and Mutual Funds Report. The funds in this sector consistently hold poor stocks and charge investors high fees.

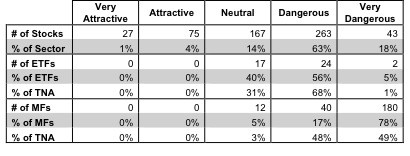

A big part of the reason for this problem is that there are just not many good stocks in the Financials sector. Only 5% of Financials stocks by market cap earn an Attractive-or-better rating. Dangerous-or-worse rated stocks make up 81% of the value in the sector. Figure 1 shows the breakdown of Financials sector stocks, ETFs, and mutual funds.

Figure 1: Financials Sector Landscape For ETFs, Mutual Funds & Stocks

A quick look at Figure 1 reveals that the problem in this sector goes beyond the slim pickings for quality stocks. Over 78% of Financials mutual funds earn a Very Dangerous rating, despite the fact that only 18% of Financials stocks by market cap are rated Very Dangerous.

Mutual fund managers are allocating heavily to the very worst stocks in the sector. By contrast, only 5% of ETFs in the Financials sector are rated Very Dangerous. Active management is performing far worse than passive management in this sector. This statistic is more of a comment on the poor holdings of mutual funds than a sign that Financials ETFs are doing well.

Over 68% of assets in Financials ETFs are in Dangerous rated ETFs, while only 63% of stocks by market cap earn a Dangerous rating. Not only do Financials ETFs hold poor quality stocks, but investors appear to be putting their money disproportionately in the worst-rated ETFs.

As detailed in “Cheap Funds Dupe Investors”, investors appear to choose between funds primarily based on costs, with little analysis of holdings. A closer look at the funds in the Financials sector supports this hypothesis. Vanguard REIT Index Fund (VGRSX) has low cost funds and poor holdings—0.13% total annual costs and a Dangerous portfolio management rating—and has nearly $35 billion in assets. Meanwhile, the higher rated, more expensive ICON Financial Fund (ICFSX)—1.75% % total annual costsand a Neutral portfolio management rating—has only $42 million in assets.

Investors are good at choosing cheap funds, but that alone is not enough. Low fees cannot drive positive performance. Only quality holdings can create value for investors, which is why our ratings of ETFs and mutual funds are driven by our stock rating of their holdings.

iShares FTSE NAREIT Industrial/Office Capped Index Fund (FNIO) is my worst-rated Financials ETF and earns my Very Dangerous rating. One of my least favorite stocks in FNIO is Prologis Inc. (PLD). PLD earns my Very Dangerous rating and a place on April’s Most Dangerous Stocks list. PLD has not earned positive economic earnings in any year going back to 1998. PLD’s after tax profit (NOPAT) was actually about 8% lower last year than it was a decade earlier in 2002. In addition to this declining income, PLD has some issues on the balance sheet. It has accumulated asset write-downs of nearly $2.5 billion, or roughly 10% of net assets. It also has over $13 billion in adjusted total debt, a significant issue for a company that has had a negative free cash flow for three consecutive years.

At almost any price PLD would be a risk. However, due to the recovery in the housing market, PLD is currently trading at an inflated price. The no-growth (economic book) value of the company is $-22.74/share. The gap between that value and the market valuation of ~$41.45/share is incredible. For PLD to justify its market valuation, it would need to grow NOPAT by 24% compounded annually for 12 years. No reasonable expectation of growth in the housing market could translate to that kind of profit growth for PLD. Investors are being fooled by the sector hype and ignoring the dangerous fundamentals of this company.

FNIO’s nearly 20% allocation to PLD helps to explain why it is my worst-rated Financials ETF. Fortunately, investors seem to recognize that FNIO is a poor ETF, as it has only $13 million in assets. However, other Very Dangerous rated funds appear to be fooling investors. Nuveen Real Estate Securities Fund (FREAX) has nearly $4.6 billion in assets despite its Very Dangerous rating.

The ability of mutual funds to attract investors even when they hold poor stocks is a problem for investors. There is a reason active management has a long history of not paying off: they can get away with it. Fund managers continue to be rewarded, even as most of them are doing a poor job of picking stocks. There are so few good funds out there because there is no incentive for funds to work hard at putting together quality portfolios. If investors are willing to pay fees for poor performance, then why bother to improve?

ETFs appear to be a possible solution to this conflict. By offering a low cost alternative to mutual funds, they put pressure on active managers to add value to justify their fees. The passively managed ETFs also hold higher quality stocks in the Financials sector. Still, the lack of any Attractive rated Financials ETFs shows that they are not doing well enough.

Compared to mutual funds, ETFs offer better management at a lower price. However, investors buying individual stocks can put together a much better portfolio with no fees at all. In the Financials sector, neither the active management of mutual funds nor the passive management of ETFs does a good job of identifying the best stocks the sector has to offer.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.