The Information Technology sector ranks second out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 27 ETFs and 155 mutual funds in the Information Technology sector as of April 16, 2013. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

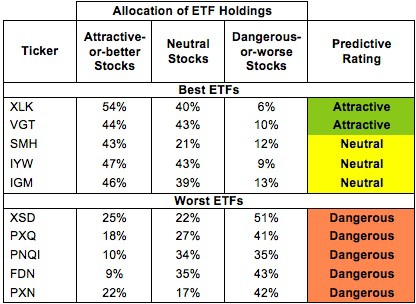

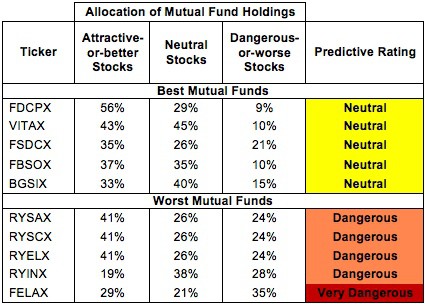

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the sector.

Not all Information Technology sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 25 to 418), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Information Technology sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expensesof each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the Information Technology sector should buy one of the Attractive-or-better rated ETFs from Figures 1. There are no mutual funds in this sector worth buying since none of them get my Attractive rating or better.

Get my ratings on all ETFs and mutual funds in this sector on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

First Trust NASDAQ Technology Dividend Index Fund (TDIV) is excluded from Figure 1 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

ROGSX, PGTYX, ICTEX, STPIX, HEGMX, FDMIX are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Technology Select Sector SPDR (XLK) is my top-rated Information Technology ETF and Fidelity Select Portfolios: Computers Portfolio (FDCPX) is my top-rated Information Technology mutual fund. XLK earns my Attractive rating and FDCPX earns my Neutral rating.

PowerShares Lux Nanotech Portfolio (PXN) is my worst-rated Information Technology ETF and Fidelity Advisor Electronics Funds (FELAX) is my worst-rated Information Technology mutual fund. PXN earns my Dangerous rating and FELAX earns my Very Dangerous rating.

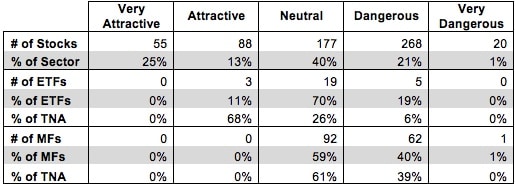

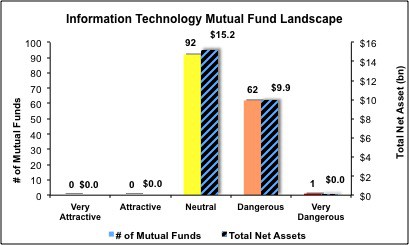

Figure 3 shows that 143 out of the 608 stocks (over 38% of the market value) in Information Technology ETFs and mutual funds get an Attractive-or-better rating. 68% of the assets in Information Technology ETFs are allocated to Attractive rated ETFs. No mutual funds in the sector earn an Attractive rating.

Figure 3: Information Technology Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

The takeaway is: mutual fund managers in this sector do not deserve their fees.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Information Technology ETFs and mutual funds, as only three ETFs and zero mutual funds in the Information Technology sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating.

Accenture PLC (ACN) is one of my favorite stocks held by Information Technology ETFs and mutual funds and earns my Very Attractive rating. ACN consistently achieves a high return on invested capital, and its current ROIC of 65% puts it easily in the top quintile of all the companies I cover. In addition, the company’s excess cash far exceeds its debt and pension liabilities, putting the company on a solid financial footing. One would expect such a profitable, well-funded company to have a high valuation, but that is not the case for ACN. At its current valuation of ~$75.24/share, ACN has a price to economic book value ratio of 1.0, implying zero future growth in after-tax profits (NOPAT). Such low expectations mean great risk/reward for investors.

Aspen Technology (AZPN) is one of my least favorite stocks held by Information Technology ETFs and mutual funds and earns my Dangerous rating. AZPN’s NOPAT has been negative for the past three years. It has written down $173 million in assets, nearly 95% of its total net assets. No company can succeed when its investments fail at such a high rate. Despite these negatives, AZPN’s valuation has steadily increased over the past few years, so that it is now valued at ~$29.28/share. This valuation implies that over 23 years AZPN will grow its NOPAT from its current negative level to $824 million. For a company that has not earned NOPAT above $50 million in any year going back to at least 1998, such an expectation is far out of line with results. The valuation of AZPN is writing checks the company can’t cash.

508 stocks of the 3000+ I cover are classified as Information Technology stocks, but due to style drift, Information Technology ETFs and mutual funds hold 608 stocks.

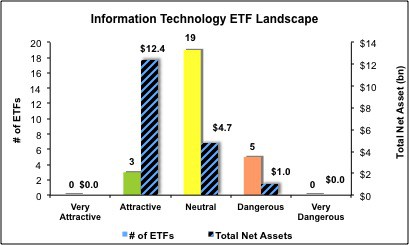

Figures 4 and 5 show the rating landscape of all Information Technology ETFs and mutual funds.

My Sector Rankings for ETFs and Mutual Funds report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filing

Sources: New Constructs, LLC and company filing

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with reports on all 27 ETFs and 155 mutual funds in the Information Technology sector.

Sam McBride contributed to this report

Disclosure: David Trainer owns ACN. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.