Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and MarketWatch.com.

The Energy Sector is in the Danger Zone this week due to the poor management and holdings of ETFs and mutual funds in the sector.

Investors who want exposure to this sector should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fees. Here are my top 20 Energy stocks, all of which get an Attractive-or-better rating.

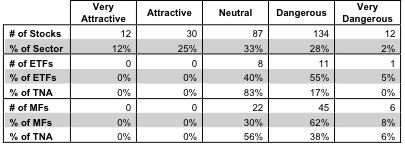

12 out of 20 ETFs and 51 out of 73 mutual funds get a Dangerous-or-worse rating. Not a single Energy Sector ETF or mutual fund allocates enough value to Attractive-or-better rated stocks to earn an Attractive rating.

It is not as if there are no good stocks for Energy Sector funds to choose from. The Energy Sector ranks fifth out of ten sectors in our sector rankings report. Sectors such as Financials, Consumer Discretionary, or Utilities are all ranked lower. Out of the 275 stocks in the Energy Sector, 42 of them get an Attractive-or-better rating. These 42 stocks represent 37% of the market cap for the sector.

I have detailed before the evidence that active management rarely justifies the fees. The data from the Energy Sector further supports this assertion.

Investors seem to have more difficulty identifying the best mutual funds compared to ETFs. Energy Sector mutual fund investors have invested 44% of total net assets to Dangerous-or-worse rated funds, compared to only 17% for ETFs. Both ETFs and mutual funds in the Energy Sector have poor holdings, but at least investors seem to be able to identify the (relatively) better ETFs.

Figure 1: Energy Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Vanguard Energy ETF (VDE) is my top-rated Energy ETF and Fidelity Select Portfolios: Natural Gas Portfolio (FSNGX) is my top-rated Energy mutual fund. Both earn my Neutral rating.

Direxion Daily Natural Gas Related Bull 3x Shares (GASL) is my worst-rated Energy ETF and BlackRock Funds: BlackRock Energy & Resources Portfolio (SSGRX) is my worst-rated Energy mutual fund. Both earn my Very Dangerous rating.

Exxon is one of my favorite stocks held by Energy ETFs and mutual funds and earns my Very Attractive rating. Exxon recently passed Apple, Inc. (AAPL) as the world’s most valuable company, but unlike Apple, Exxon looks like a good bet to keep rewarding investors. It’s grown itseconomic earnings at an impressive CAGR of 43% for the last four years, and it’s still seriously undervalued at $91/share. That price results in a price to economic book value ratio of 0.6, which mean the market expects XOM’s NOPAT to decline by 40% permanently.

I also like Chevron (CVX) and Holly Frontier Corporation (HFC). Both of those stocks have similar characteristics to XOM. They have high ROICs (13% for Chevron and 26% for HFC) and low valuations. The price to economic book value ratio for CVX is 0.6, for HFC it is 0.7. The market valuations imply a permanent 40% and 30% decline in NOPATs for each stock, respectively.

See my full report on the Energy Sector for 1Q13.

Disclosure: Sam McBride contributed to this post.

David Trainer owns XOM, CVX and HFC. David Trainer and Sam McBride receive no compensation for writing about any specific stock, sector, or theme.