Sometimes when I analyze a stock, I am reminded of the marvels that investment bankers can do for their valuations, especially if the company is a good client. With its recent $3.7 billion acquisition of Gen-Probe, I would bet that Hologic (HOLX) made its investment bankers quite happy.

Investors, on the contrary, should sell the stock and not be happy with that deal.

As usual, Hologic management lauds the acquisition because of (1) its positive earnings accretion and (2) synergies, which are never quantified or specified.

Sounds great, right? The problem is much of what management says is misleading. Per the well-documented high-low fallacy, one of the biggest misconceptions in the investing world is that the merit of an acquisition should be judged by whether or not it is “earnings accretive”. The impact of an acquisition on a company’s accounting earnings is not indicative of its value to shareholders.

From HOLX’s 8/1/2012 press release announcing the close of the Gen-Probe deal: “the transaction delivers a strong growth profile with attractive economics and is expected to be $0.20 accretive to Hologic’s non-GAAP adjusted earnings per share in fiscal 2013 and significantly more accretive on a non-GAAP basis thereafter.”

Now for the economics of the deal. HOLX paid $3.7 billion for roughly $90 million in annual after-tax cash flow (based on Gen-Probe management’s guidance for 2012 earnings). That equals a return on investment of about 2.4%. In other words, HOLX just allocated capital that, without synergy, earns somewhere between a 10yr and 30yr treasury bond, which is far below the company’s weighted-average cost of capital of about 7.2%. Not so good for investors. And it is a sign that more write-downs are in the company’s future.

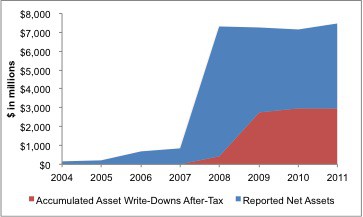

Figure 1: Write-Downs Are Already Huge for HOLX

The synergies required to make the Gen-Probe deal truly accretive to shareholders equal around $400 million in annual cost savings or incremental profits. I could not find any specific comments on cost savings or incremental revenues in management’s discussion of the “attractive economics” of the deal. Maybe that’s because the economics are not attractive.

Making bad investments is not new to management of HOLX. Figure 1 (above) compares Hologic’s reported net assets to the accumulated write-downs (after-tax) that the company has made since 2004. As of FYE 2011, accumulated write-downs equals over 60% of the reported net assets. That means HOLX’s management has written down over 60 cents for every dollar of stakeholder investment in the company.

Write-downs represent the failure of management to allocate capital successfully. In my opinion, management’s most important responsibility is to be good stewards of investors’ capital. Nearly $3 billion in write-offs over the last several years does not inspire me to trust this management team with any of my capital.

Even if we do not add back the write-downs, the return on invested capital (ROIC) of this business is on the decline. See Figure 2. Removing the $3 billion in write-downs from invested capital raises the ROIC from 2.4% in 2011 to 4.5%, still well below the firm’s WACC of 7.2%.

Figure 2: Profitability Is On the Decline

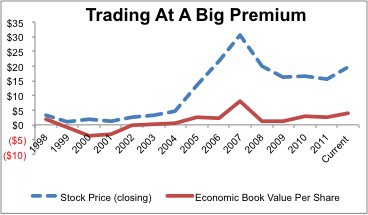

Despite the poor track record of this management team, the valuation of the stock is very expensive. That is why I am marveling at, what I speculate to be, HOLX’s investment bankers’ influence on the stock’s price.

To be sure, the valuations premium will not last. But for now, it is impressive. How impressive? To justify the current price of the stock (~$20/share), the company has to grow profits (NOPAT) at 20% compounded annually for 10 years. That is a high hurdle especially when compared to the last three years when NOPAT growth averaged -10%.

HOLX’s poor profits and high valuation earn it my Very Dangerous rating. HOLX was also added to my Most Dangerous Stocks list in August.

As Figure 3 shows, the recent rise in HOLX makes the stock about as expensive as it was during the last stock market bubble. The current economic book value of the stock is under $4/share. That is the no-growth value of the stock so it is probably not the stock’s fair value. The point is that $16 of the $20 value of the stock is justified only by future profit growth, and a lot of it.

I respect the company’s product line and think they serve an important role in the health care of women. There is an important difference, however, between a good company and a good stock. Hologic may be a good company, but it’s stock is not good.

When this stock’s valuation reconciles with its true profits, it could drop a long ways…bad risk/reward.

As my regular readers know, I also cover 7400+ ETFs and mutual funds. My predictive fund ratings leverage the deep research I do on all of the 3000+ stocks covered by my firm, New Constructs.

The ETFs and funds that allocate 2% or more to HOLX and get a Dangerous or worse rating are:

- Forum Funds: Fountainhead Special Value Fund (KINGX)

- Advisors’ Inner Circle Fund: Rice Hall James Mid Cap Portfolio (RHJVX)

- Allianz Funds: RCM Wellness Fund (RAG, RBGHX, RCG)

- BlackRock Funds: BlackRock Small Cap Growth Equity Portfolio (CSGEX, PCGEX, PSGIX, CSGBX, CGICX)

- SPDR S&P Health Care Equipment ETF (XHE)

New Constructs’ free fund screener provides free reports on 7400+ mutual funds and ETFs, including all of the funds mentioned in this article.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.