There’s a lot of shuffling going on in the variable annuity space. As some insurance carriers have bowed out of the VA business or scaled back their distribution, those firms that are still in the business are increasing their market share. But many advisors and investors believe annuities are still the only game in town when it comes to guaranteed income, so who gets that business? The only ones left standing…

“Carriers are being financially prudent, in the low interest rate environment,” said Meredith Lloyd Rice, senior project director at Cogent Research and co-author of Cogent’s new report on VA providers. “They’re trying to scale back their benefits and balance the risk to their balance sheet. But what we’ve seen in our research among advisors and also with affluent investors is there’s really a strong demand for the product or at least some sort of protection of principle and guaranteed income.”

Since the beginning of 2011, Sun Life Financial, Genworth Financial and, most recently, The Hartford have exited the annuity business altogether. In 2010, ING abandoned its annuity business. John Hancock, owned by Canadian-based Manulife Financial, significantly scaled back its annuity business last year, and even MetLife says it expects to sell 35 percent fewer variable annuities in 2012 versus the prior year as it shifts its marketing focus elsewhere.

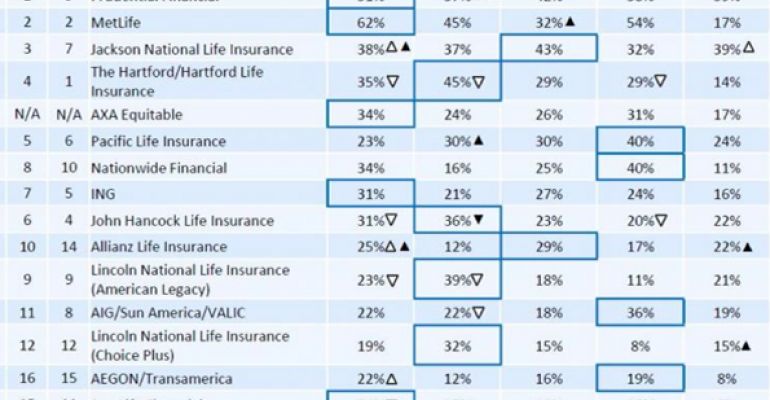

And the numbers are starting to reflect that. According to the Cogent report, The Hartford went from being No. 1 in terms of VA penetration in 2010 to No. 4 this year. Also since 2010, ING fell from fifth to eighth, John Hancock slipped from fourth to ninth, and Sun Life went from 11th to 15th. Metlife has consistently stayed in second place on the list, but Lloyd Rice says the Cogent report doesn’t reflect the firm’s announcement in May to focus more on their life and health businesses, and less on annuities. She expects their penetration to drop as a result.

Meanwhile, those still standing are upping their market share. Prudential moved up to No. 1 from No. 3 in 2010, boosting its penetration in the regional channel in particular. Jackson National jumped to third from seventh, gaining market share in the national brokerage and RIA channels. Nationwide moved up to No. 7 from No. 10 on the list.

“It does correlate to what’s been going on in the marketplace, and at the same time I see Prudential and Jackson National moving up because we’ve really seen they’re consolidating their stronghold on the industry,” Lloyd Rice said.

Source: Cogent Research