The Consumer Discretionary sector ranks seventh out of the ten sectors as detailed in my sector roadmap. It gets my Neutral rating, which is based on aggregation of ratings of 18 ETFs and 21 mutual funds in the Consumer Discretionary sector as of July 12, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are here.

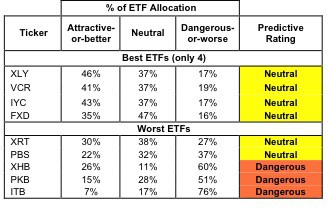

Figure 1 ranks from best to worst the nine Consumer Discretionary ETFs that meet our liquidity standards and Figure 2 shows the five best and worst-rated Consumer Discretionary mutual funds. Not all Consumer Discretionary sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 25 to 373), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Consumer Discretionary sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors should not buy any Consumer Discretionary ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this sector, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off. Review my free stock screener for the most attractive stocks in the Consumer Discretionary sector.

See ratings and reports on all ETFs and mutual funds in this sector on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5 (where available)

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

4 ETFs are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

4 mutual funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Consumer Discretionary Select Sector SPDR (XLY) is my top-rated Consumer Discretionary ETF and Fidelity Select Portfolios: Consumer Discretionary Portfolio (FSCPX) is my top-rated Consumer Discretionary mutual fund. Both earn my Neutral rating.

iShares Dow Jones U.S. Home Construction Index Fund (ITB) is my worst-rated Consumer Discretionary ETF and Rydex Series Funds: Retailing Fund (RYRTX) is my worst-rated Consumer Discretionary mutual fund. Both earn my Dangerous rating.

Figure 3 shows that 124 out of the 473 stocks (38% of the total net assets) held by Consumer Discretionary ETFs and mutual funds get an Attractive-or-better rating. However, no Consumer Discretionary ETFs or Mutual Funds get an Attractive-or-better rating.

The takeaway: Consumer Discretionary sector mutual fund managers and ETFs are picking the wrong stocks in this sector. Their fees are undeserved, no matter how low.

Figure 3: Consumer Discretionary Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Consumer Discretionary ETFs and mutual funds, because all of them are rated either Neutral or Dangerous. I recommend investors focus instead on the 124 individual stocks that are rated Very Attractive or Attractive. Use my free stock screener to find Attractive-or-better-rated Consumer Discretionary stocks.

Autozone (AZO) is one of my favorite stocks held by Consumer Discretionary ETFs and mutual funds and earns my Most Attractive rating. Autozone has grown Revenue and NOPAT every year since. More impressive is AZO’s ability to become more profitable and efficient as it grows. Over the last 14 years, AZO has boosted its NOPBT margin (Net Operating Profits before Taxes) from 12% in 1998 to 19.6% in 2011. Simultaneously, AZO has improved its capital efficiency or asset turnover. Their ROIC has steadily climbed from 10.9% in 1998 to 25.0% in 2011, placing them in the 85th percentile for highest ROIC among Consumer Discretionary companies.

Growth in operating profits while simultaneously boosting capital efficiency is a recipe for rapid value creation and indicates exceptional capital stewardship. It would be no great feat to increase operating profits by $1 if it required $100 of incremental investment (a meager 1% return on invested capital). It is extraordinarily difficult, however, to grow consistently for over a decade and earn even higher returns on new investments. Autozone has made it look easy.

AZO is a great company, but its undervalued stock price makes it a great stock as well. Today’s market price of $382.45 assumed AZO will never grow its profits beyond 2011 levels.. That is a low expectation for a company that is a value-creating machine.

MGM Resorts International (MGM) is one of my least favorite stocks held by Consumer Discretionary ETFs and mutual funds and earns my Very Dangerous rating. Like Autozone, MGM has grown revenue substantially over the last 14 years. Unlike Autozone, however, MGM’s growth has been accompanied by a steady decline in profitability. In 1998, MGM was earning an unimpressive 4.5% ROIC. That number has eroded to a big-time-value destroying 1.8% in 2011. MGM’s invested capital has ballooned by 1830% with investments that have generated consistently lower returns. MGM is a great example of a company where growth only accelerates value destruction. Furthermore, in order to justify its current stock price, MGM would need to grow NOPAT 15% compounded annually for the next 10 years. It is hard to imagine where that profitable growth is going to come from when the company’s investments in the past have consistently earned low returns. Today’s price of $9.75 translates to very high expectations for this Very Dangerous-rated stock.

373 stocks of the 3000+ I cover are classified as Consumer Discretionary stocks, but due to style drift, Consumer Discretionary ETFs and mutual funds hold 473 stocks.

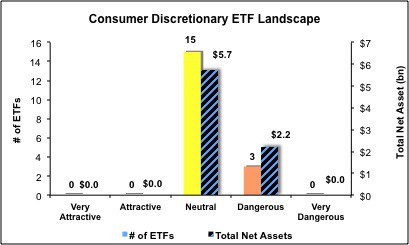

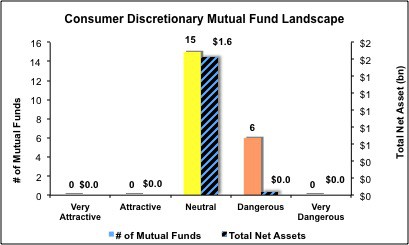

Figures 4 and 5 show the rating landscape of all Consumer Discretionary ETFs and mutual funds.

Our sector roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Review my full list of ratings and rankings along with free reports on all 18 ETFs and 21 mutual funds in the Consumer Discretionary sector.

Disclosure: I receive no compensation to write about any specific stock, sector or theme.