The mid-cap value style ranks eleventh out of the twelve fund styles as detailed in my style roadmap. It gets my Dangerous rating, which is based on an aggregation of the ratings of 12 ETFs and 206 mutual funds in the mid-cap value style as of July 19, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are here.

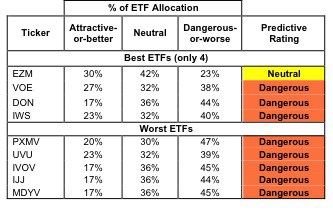

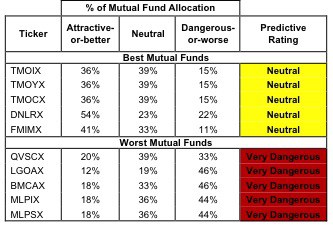

Figure 1 ranks from best to worst the nine mid-cap value ETFs that meet our liquidity standards and Figure 2 shows the five best- and worst-rated mid-cap value mutual funds. Not all mid-cap value style ETFs and mutual funds are created the same. The number of holdings varies widely (from 21 to 617), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the mid-cap value style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors should not buy any mid-cap value ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this style, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

See ratings and reports on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5 (where available)

* Best ETFs exclude ETFs with less NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

First Trust Mid Cap Value AlphaDEX Fund (FNK) and iShares Morningstar Mid Value Index Fund (JKI) are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Seven mutual funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

WisdomTree MidCap Earnings Fund (EZM) is my top-rated mid-cap value ETF and Touchstone Strategic Trust: Touchstone Mid Cap Value Opportunities Fund (TMOIX) is my top-rated mid-cap value mutual fund. Both earn my Neutral rating.

SPDR S&P 400 Mid Cap Value ETF (MDYV) is my worst-rated mid-cap value ETF and ProFunds: Mid-Cap Value ProFund (MLPSX) is my worst-rated mid-cap value mutual fund. MDYV earns my Dangerous rating and MLPSX earns my Very Dangerous rating.

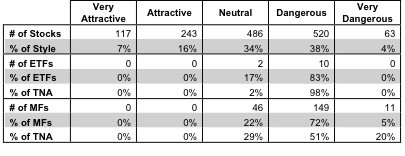

Figure 3 shows that 360 out of the 1429 stocks (over 23% of the total net assets) held by mid-cap value ETFs and mutual funds earn an Attractive-or-better rating. However, there are not any mid-cap value ETFs or mutual funds that earn an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to poor quality stocks and mid-cap value ETFs offer exposure to poor quality stocks.

Figure 3: Mid-cap Value Style Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

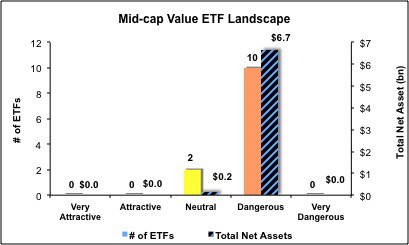

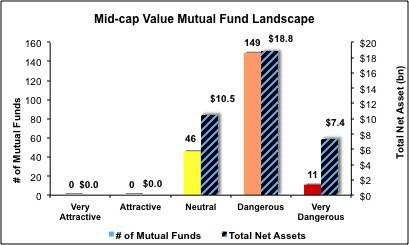

Investors need to tread carefully when considering mid-cap value ETFs and mutual funds, because 83% of ETFs are rated Dangerous and 77% of mutual funds are rated Dangerous-or-worse. No mid-cap value ETFs or mutual funds earn an Attractive-or-better rating. Investors desiring exposure to the mid-cap value category should buy a basket of Attractive-or-better-rated mid-cap value stocks. Review my free stock screener for individual stock investments.

TRW Automotive Holdings (TRW) is one of my favorite stocks held by mid-cap value ETFs and mutual funds and earns my Attractive rating. Sometimes when a company institutes a restructuring plan, it’s a dying gasp and a desperate move to squeeze out a few more years of life. TRW Automotive, however, is a great example of a company that has been able to benefit dramatically from restructuring. The financial crisis and recession were hard on the auto industry, but TRW took advantage of the downtown by tightening their belts and improving their operating efficiency. They emerged from the recession stronger than ever.

Over the past two years, pre-tax operating margins were about double the margins of the two prior years, up to 8.5% in 2010 and 7.7% in 2011 (up from 3.4% and 3.7% in 2008 and 2009). Keep in mind that our calculation of pre-tax operating income (NOPBT) excludes the 2008 and 2009 restructuring charges. So those numbers do not reflect merely the absence of restructuring charges, they are genuine improvements. With revenues up to pre-crisis levels and growing, TRW turned in their most profitable years on record in 2010 and 2011. Before restructuring, TRW never earned an ROIC higher than 6% and were eroding away shareholder value. After restructuring, however, they turned in 13.8% ROIC in 2010 and 13.7% in 2011. This is a company that has dramatically improved the profitability of its business and TRW’s focus on long-term value-creation is paying off. Best of all, the market is pricing TRW as if its after-tax profits (NOPAT) are going to permanently decline by 37%. Sometimes Mr. Market can irrationally hold a grudge, but when he does, it can create an attractive opportunity for investors who do the proper due diligence.

Lamar Advertising (LAMR) is one of my least favorite stocks held by mid-cap value ETFs and mutual funds and earns my Dangerous rating. At first glance, Lamar Advertising does not seem like an awful company. Their revenues and NOPAT have been steady over the last decade and their NOPBT margins have been hovering around 20% for several years. However, LAMR has consistently failed to generate positive economic earnings. Lamar’s ROIC has never reached above 3.5% since 1998 when my model begins. Companies that earn ROIC < WACC destroy shareholder value. The secret behind Lamar’s dismal ROIC is that they produce invested capital turns of only 0.26 to 1, placing LAMR in the 16th percentile of all Russell 3000 companies. That means every dollar invested in Lamar’s business generates a mere 26 cents in revenues. But yet, in order to justify their current stock price, Lamar needs to see profit growth of 15% compounded annually for the next 15 years. LAMR is a stagnant and inefficient company priced as it will achieve tech-start-up levels of growth.

Figures 4 and 5 show the rating landscape of all mid-cap value ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with free reports on all 12 ETFs and 206 mutual funds in the mid-cap value style.

Disclosure: I receive no compensation to write about any specific stock, sector, style or theme.