Some stocks are more dangerous than others. In an anemic economic environment, the most dangerous stocks are those with issues that are lurking behind the scenes or in footnotes. Too often, investors are willing to invest without much diligence when times are good. But when times get tough, more are willing to roll up their sleeves and do some old-fashioned analysis.

US Steel (X) is an example of a stock that could see significant additional downward pressure as more investors become aware of the $5.2 billion in liabilities related to its “Pension Benefits”, “Other Benefits” and “Other postemployment benefits” plans, which I will bundle under the term “pensions” for the remainder of this article.

A loophole in GAAP accounting minimizes, at least temporarily, the impact of big pension liabilities on reported earnings. Eventually, however, these issues can hurt earnings and surprise investors if the company does not take measures to get them under control.

In a challenging economic environment, taking appropriate measures is not always feasible. As Warren Buffett famously said, “when the water is drained out of the pool, you see who is not wearing trunks”.

My fear is that US Steel’s pension liabilities will eventually manifest in downward earnings revisions that will drive the stock down.

Accounting loopholes can provide a short-term boost to earnings, but they can also lead to a long-term drag or possible bankruptcy. Eastman Kodak (EKDKQ.PK) used the same trick to prop up its 2010 earnings, and now it is bankrupt just as I predicted in my March 2011 article “Dead Company Walking: Sell Eastman Kodak”.

Pension Accounting Boosts EPS

US Steel boosted its 2011 earnings by increasing its expected return on plan assets (“EROPA”) assumption for its pensions to 7.79%[1], up from 7.75% in 2010. Page F-40 in US Steel’s 2011 10-K filing has the details.

An EROPA of 7.79% is abnormally high. Out of the 1,021 companies with pensions that I cover, 90% of them have a lower EROPA. Only 96 of the 1,021 raised their EROPAs in 2012 while 525 lowered and 400 made no changes. US Steel’s EROPA assumption is not only among the highest but it is also rising when the majority is falling.

Raising its EROPA in 2012 looks worse when compared to my estimates of the company’s actual return on plan assets. I estimate 2011’s actual return on plan assets was 4.96%. I estimate the average return over the last five years is also 4.96%. Over the last ten years, it is 6.30%. These estimates are based on dividing the “Actual return on plan assets” by the “Beginning balance” of plan assets. You can replicate my analysis using data from the company’s annual reports as detailed in the model used to calculate the actual return on plan assets, which is based on data from the 2001 – 2011 10-Ks.

US Steel’s investor relations contact, Dan Lesnak, asserted that the company’s EROPA assumption was not high compared to actual historical returns. When I shared my analysis of the actual returns going back to 2001, he said that I was not looking at a long enough time horizon. When I asked for the appropriate time horizon, he would not provide one. Nevertheless, Mr. Lesnak’s assertion is consistent with this statement on page 57 of the 10-K in reference to using a 7.75% EROPA for 2012: “Actual returns since the inception of the plans have exceeded this 7.75 percent rate and while some recent annual returns have not, it is U. S. Steel’s expectation that rates will return to this level in future periods.”

In my opinion, that is a rather big expectation given that 30-40% of plan assets are in corporate bonds, Treasury bonds and government-backed mortgages, which are not offering yields anywhere near 7.75%. The remainder of plan assets are in equities, which will have to earn 9.8% for the portfolio return to be 7.75% assuming a 70/30 equity/fixed income split and a 3% yield on the fixed income.

I think most professional money managers would be happy with 9.8% return over the same long-term time frame assumed for the EROPA.

Pensions Can Have Big Impact On EPS And Cash

Since US Steel’s pensions are so large, its pension costs play a prominent role in earnings, much more so than most companies. US Steel’s net periodic benefit cost (the cost attributable to pensions with the current EROPA reported in GAAP earnings) is over 3% of revenue. We cannot analyze how large a part of net income the net periodic benefit expense is because X’s net income was negative in 2011. However, given that net income margins are at best in the high single digits, it is safe to say that, at 3% of revenue, US Steel’s net periodic benefit cost has a big impact on the company’s financial bottom line.

A high EROPA enables US Steel to lower the costs it must report in earnings for paying into its pensions. In turn, the company’s overall expenses are lower and accounting earnings are higher.

A 0.5% decrease in US Steel’s EROPA would wipe away $0.23 per basic shares outstanding. A 0.5% reduction to a 7.29% EROPA would be below the median (7.5%) EROPA for the 1,021 pensions we analyzed. It would still be significantly above my estimate of the company’s actual return on plan assets over the last ten years.

Note that US Steel has been making significant cash contributions, not reflected in EPS, to its pensions. In 2011, the company contributed $626 million to its pension obligations, compared to $534 million in 2010 and $658 million in 2009. Those are big numbers, especially to maintain over a long period, for a company whose reported cash flows were negative in 2011 and 2010. Since 2009, the company’s cash and cash equivalents declined from $1,218 million to $408 million at the end of fiscal 2011.

Pensions Are Underfunded by $5.2 billion

US Steel’s pensions were under-funded by $5.2 billion as of 12/31/2011. The sum of the “net funded status” for the “Pension Benefits” and “Other Benefits” plans on page F-38 of the company’s 2011 10-K shows $5.1 billion in underfunded status. An additional $100 million in underfunded obligations to employees is found near the bottom of page F-48. All together, $5.2 billion is about 1.5 times the company’s market cap. For comparison, American Airlines’ (AAMRQ.PK) pensions were underfunded by $8.1 billion coming out of 2010, and it filed bankruptcy about 11 months later with its pensions underfunded by about $10 billion, not a good precedent for US Steel.

Part of the increase in the underfunded level of X’s pension is due to lower discount rates used to determine the value of its pension obligations. These discount rates are based on “certain corporate bond rates” according to page 57 in the 2011 10-K. The discount rate in 2011 was lowered to 4.5% from 5.0% for most of its “pension” liabilities. Accordingly, a meaningful rise in corporate bond rates would meaningfully reduce the pension obligations and the underfunded level of US Steel’s pensions.

Such a rise would be a welcome sign and would also likely correspond with a rebound in economic activity. I am not sure, however, if we can expect either anytime in the next couple of years.

Doubtful That US Steel Can Grow Its Way Out Of Its Liabilities

If US Steel were in a high growth industry with excellent prospects for future profits, one could argue that the company could eventually earn its way out of the underfunded pensions hole. That is a tough argument for a company in such a competitive and low margin business.

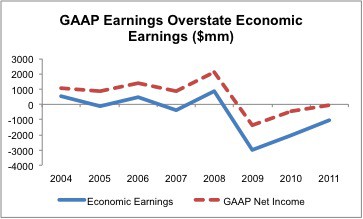

Worse yet, my financial model suggests that US Steel is more unprofitable than reported GAAP earnings suggest, even if one assumes its EROPA is fair and accurate. Figure 1 compares US Steel’s economic earnings to its accounting earnings. In 2011, US Steel reported -$53 million in accounting losses while I believe the company’s losses were closer to -$1,050 million.

Figure 1: Accounting Profits Are Not Truly Indicative Of Financial Health

Sources: New Constructs, LLC and company filings

One of the largest drivers of the differences in reported accounting and economic earnings for US Steel is $1.1 billion in off-balance sheet reserves (about 33% of the company’s market cap). In addition, US Steel is in a very capital-intensive business and generates relatively little cash compared to the amount of invested capital in the business.

From where I sit, the company is in a tough spot. It is not making much, if any, money and its liabilities are formidable: pensions at $5.2 billion plus total debt of $4.4 billion equals $9.6 billion.

Stock Valuation Could Suffocate Under Looming Liabilities

Assuming that US Steel’s liabilities do not increase, equity investors should be intimidated by the $9.6 billion in existing liabilities that have a senior claim on the company’s future profits. If US Steel does generate future profits, those profits have to be large enough to cover the $9.6 billion in senior claims plus the expectations baked into the current stock price before equity investors can make significant money in US Steel.

For those that say all of this information is already baked into the stock price, I suggest you look again. According to my discounted cash flow model, to justify the stock valuation at $18.41/share, the company has to grow its after-tax cash flow (NOPAT) by 9% compounded annually for over 15 years. That is a rather high growth rate for a long time for a commodity business. I underscore that those are the expectations baked into the current stock price. For investors to believe US Steel deserves a higher valuation/stock price, they must believe that the company’s future profit growth will be even greater than that baked into the current stock price.

I would say the odds are rather low that US Steel can meet the current expectations baked into the stock price and the odds are rather high the company’s future profits will be much lower than what the market expects.

Footnotes Diligence Pays

In summary, using the footnotes to lift the accounting veil on US Steel’s financial situation reveals some earnings and liabilities issues for a stock that is already expensive and could suffer downward pressure when investors become more aware of these issues.

Avoid ETFs and Mutual Funds That Hold US Steel

Here is a list (as of June 6, 2012 when I sent my original note to clients) of the ETFs and mutual funds that allocate the most to US Steel. Get free reports on these funds from my free mutual fund and ETF screener.

Mutual funds

- WorldCommodity Funds Inc: WorldCommodity Fund (WCOMX) – Dangerous Rating

- Thornburg Investment Trust: Thornburg Value Fund (TVIFX) – Dangerous Rating, same for TVCFX, TVBFX, TVRX, TVAFX, TVIRX, TVRRX

- Monetta Trust: Monetta Mid-Cap Equity Fund (MMCEX) – Dangerous Rating

- Professionally Managed Portfolios: Hodges Blue Chip 25 Fund (HDPBX) – Neutral Rating

- Flex-funds Trust: Quantex Fund (FLCGX) – Dangerous Rating

ETFs

- Rydex S&P Equal Weight Materials ETF (RTM) – Neutral Rating

- SPDR S&P Metals & Mining ETF (XME) – Dangerous Rating

- PowerShares S&P 500 High Beta Portfolio (SPHB) – Dangerous Rating

- First Trust Materials AlphaDEX Fund (FXZ) – Dangerous Rating

- Materials Select Sector SPDR (XLB) – Neutral Rating

This report is part of my series on stocks at risk because of abnormal accounting practices. My first article was on Delta Airlines (DAL) on 5/10/12. Only logged-in users can access Premium Picks reports under the Investment Insights section of our Reports library.

Disclosure: I am short X. I receive no compensation to write about any specific stock or theme.

[1] My contact at US Steel did not comment on how assets were divided between the US and non-US pensions plans. So, the 7.79% assumes a 50/50 split. If more assets are in the US plan then 7.79% is too low.