The large-cap blend style ranks first out of the twelve fund styles as detailed in my style roadmap. It gets my Neutral rating, which is based on aggregation of ratings of 40 ETFs and 1193 mutual funds in the large-cap blend style as of April 24, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are on my blog.

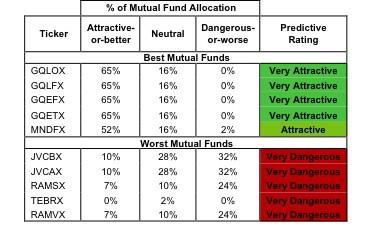

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the style. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the large-cap blend style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the large-cap blend style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

See ratings and reports on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with less NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

PowerShares S&P 500 High Quality Portfolio [s: SPHQ] is my top-rated large-cap blend ETF. GMO Trust: GMO Quality Fund [s: GQLOX] is my top-rated large-cap blend mutual fund. Both earn an Attractive-or-better rating.

Starboard Investment Trust: Roumell Opportunistic Value Fund [s: RAMVX] is my worst-rated large-cap blend mutual fund. It gets me Very Dangerous rating. Advisors Series Trust Teberg Fund [s: TEBRX] is my second worst large-cap blend fund and earns my Very Dangerous rating because it holds over 84% of its value in cash and charges investors 3.71% a year. That’s one expensive savings count.

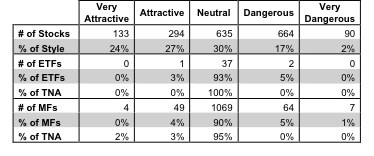

Figure 3 shows that only one out of 40 large-cap blend ETFs (less than 1% of total net assets) and 53 out of 1193 large-cap blend mutual funds (5% of total net assets) get an Attractive-or-better rating. The takeaway is: mutual fund managers allocate too much capital to low-quality stocks.

Figure 3: Large-cap Blend Style Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

Investors need to tread carefully when considering large-cap blend ETFs and mutual funds, as 97% of ETFs and 95% of mutual funds are not worth buying. Only 1 ETF and 50 mutual funds in the large-cap blend style allocate enough value to Attractive-or-better-rated stocks to be deemed investment worthy.

Ross Stores, Inc. [s: ROST] is one of my favorite stocks held by large-cap blend ETFs and mutual funds and earns my Attractive rating. In today’s trying economic times, shoppers are trying to stretch their dollars further than ever before and retailers like ROST are positioned to take full advantage. Over the past 5 years ROST has seen steady growth by increasing their store count by an average of 6% a year. Even better than steady store count growth is ROSS’ ability to increase profits by an average of 24% over the same period. Improving margins while growing stores at an aggressive pave is impressive.

Funds that overweight consumer discretionary stocks like ROST have a good chance of earning an Attractive-or-better rating because there are lots of Attractive-or-better stocks in that sector. However, I’m neutral on Consumer Discretionary sector funds so be careful which fund you choose in that sector.

Bank Of America Corp [s: BAC] is one of my least favorite stocks held by large-cap blend ETFs and mutual funds and earns my Very Dangerous rating. BAC’s reported earnings are misleading because they are positive and rising while the economic earnings are negative and declining. This poses a pitfall for investors who are not doing the diligence required to uncover the true economics of companies. I recommend Investors avoid BAC.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Figures 4 and 5 show the rating landscape of all large-cap blend ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with free reports on all 40 ETFs and 1193 mutual funds in the large-cap blend style.

Disclosure: I receive no compensation to write about any specific stock, sector, style or theme.