"Tax Freedom Day" arrives tomorrow --- that's the date, according to the non-partisan Tax Foundation, when the average American has paid off his debt to the gub'ment and begins to keep his earnings.

"Tax Freedom Day" arrives tomorrow --- that's the date, according to the non-partisan Tax Foundation, when the average American has paid off his debt to the gub'ment and begins to keep his earnings.

There is a funny (mini) debate going on between the Tax Foundation and Chris Bergin, a tax analyst and blogger for tax.com, "the tax daily for the citizen taxpayer." I excerpt the Tax Foundation's response to Bergin's all-taxes-are-good-and-necessary blog below.

What Tax Freedom Day Means to Me

By Joseph Henchman

Chris Bergin comments on Tax Freedom Day over at tax.com, calling our annual calculation meaningless, hilarious, awkward, and a great publicity stunt. Why such mixed feelings? He writes:

The truth of the matter is that, other than the chuckle I get from the whole thing, Tax Freedom Day doesn't mean a thing. As a society, we will never be free of taxes--that is unless we all want to be bathing down by the river, catching our own dinner, and freezing to death in the dark.

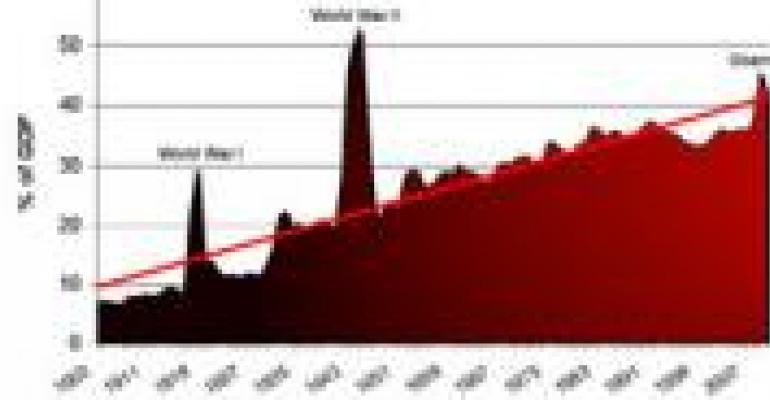

And currently as a society we don't pay enough taxes, not enough to pay for the government services we demand. A lot of Americans don't want their Medicare, Social Security or new Healthcare touched. They also don't want to pay more taxes.

I'm no anarchist but it sounds like Bergin is alluding to the opposite extreme: that every tax dollar is vital to the functioning of society. This isn't the case: the value from a well-functioning and impartial court system is different from the value from ethanol subsidies, the U.S. Institute of Peace, and the National Watermelon Promotion Board. Those may be nice programs for some people but they aren't exactly vital to keeping the lights on. We could have a smaller tax burden and not be foraging for berries and boar meat.